Three Major Issues in the Amendment of the Electronic Financial Transactions Act

Financial Services Commission raises

need for internal transaction management amid big tech growth

If the Electronic Financial Transactions Act is amended as per the Political Affairs Committee's original proposal,

it would infringe on the Bank of Korea's exclusive payment settlement authority

Conflicts also arise with the Bank of Korea Act amendment proposed by the Planning and Finance Committee

Potential clashes between standing committees in the Legislation and Judiciary Committee

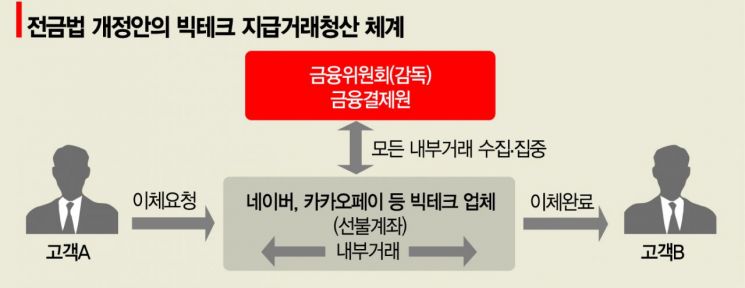

[Asia Economy, Reporter Kim Eunbyeol] It has been confirmed that the Korea Financial Telecommunications & Clearings Institute (KFTC), at the center of the conflict between the Bank of Korea (BOK) and the Financial Services Commission (FSC), has already established an organization capable of monitoring transaction details of big tech companies’ customers such as Naver and KakaoPay. According to the amendment to the Electronic Financial Transactions Act (EFTA) being discussed in the National Assembly’s Political Affairs Committee, the KFTC is to monitor customer transaction details of big tech companies, while the FSC is to manage this information. This means that even before the law is passed, an organization to handle these tasks has already been formed. Following the Bank of Korea’s unusually strong warning to the FSC, which proposed the EFTA amendment, calling it a ‘Big Brother,’ the controversy is expected to intensify as the issue of the KFTC’s organizational structure arises.

According to the KFTC on the 18th, the institute established a new ‘Clearing Management Office’ through an organizational restructuring on the 28th of last month. Four personnel were pre-assigned starting from the 1st of this month. The KFTC currently performs clearing operations for banks and other financial institutions, so there is no particular need for a separate organization. For this reason, insiders both inside and outside the KFTC predict that the newly established office will be responsible for concentrating and managing big tech transaction details. A KFTC official said, “Please do not assign any special meaning,” but added, “If the EFTA amendment passes, there may be additional tasks, so we decided to establish the organization.” As the conflict between the BOK and FSC deepens, attention is also focused on the background of their clash over the EFTA amendment.

◆Q1. Is internal transaction management necessary due to big tech growth?

The issue began with the government’s intention to deregulate big tech companies to foster new financial businesses. According to the EFTA amendment proposed by the FSC and Representative Yoon Kwan-seok of the Political Affairs Committee, customers will be able to open accounts directly with Naver, KakaoPay, etc., without financial sector partnerships, and perform salary transfers, card payments, remittances, and more. Account limits will also increase, but the problem is that as companies grow, risks increase as well. The payment volume of Naver and KakaoPay reached about 100 trillion won last year. The FSC argues for collecting customer transaction information to prevent companies from going bankrupt or misusing prepaid funds elsewhere. However, the BOK says concentrating transaction information is an excessive regulation intended to protect consumers. A BOK official stated, “Consumer protection can be ensured through deposit protection provisions (Article 26) and record-keeping and supervision provisions (Articles 22 and 39) of the EFTA amendment. Financial institutions only report interbank transactions to the KFTC; transactions within the same bank cannot be viewed without customer consent.”

◆Q2. Why does the Bank of Korea oppose this?

This relates to the central bank’s exclusive authority and the establishment process of the KFTC. The KFTC officially launched in 1986 by integrating the National Bill Clearing House and Bank Giro Clearing House. During its establishment, the authority for consultation was granted to the BOK Governor, and the BOK took charge of system operations. Article 81 of the Bank of Korea Act already specifies ‘payment settlement operations,’ and the BOK has managed bank settlements since then. After 35 years, as big tech companies grow and are granted powers equivalent to banks, the argument is that it is more efficient for the BOK, which has been in charge since the beginning, to handle this. Central banks in other countries also manage related entities. If problems arise during inter-agency clearing, only the central bank with the ‘lender of last resort’ function can inject funds and stabilize the system.

◆Q3. What are the next steps?

The ball is now in the National Assembly’s court. Twelve years ago, in 2009, the BOK and FSC clashed over payment settlement system supervision rights, but the issue fizzled out in the Assembly. This time, with big tech companies involved, the Assembly is expected to reach a conclusion one way or another. The immediate focus is the Political Affairs Committee’s judgment on the EFTA amendment, with the BOK hoping for the removal of problematic provisions. Separately, the Planning and Finance Committee has proposed an amendment to the Bank of Korea Act emphasizing that payment settlement authority is the BOK’s exclusive duty. Since this conflicts with the EFTA amendment, the matter will be referred to the Legislation and Judiciary Committee, where the Political Affairs and Planning and Finance Committees will compete. Kim Ju-young, a member of the Planning and Finance Committee from the Democratic Party who proposed the Bank of Korea Act amendment, said, “The BOK already operates the payment settlement clearing system, so it is better to utilize the existing system.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.