Hyundai Oilbank to Produce 850,000 Tons of Ethylene Annually from August

GS Caltex Also Establishes 700,000 Tons Annual Production System

Expanding Profitability Through Chemical Business Instead of Refining

[Asia Economy Reporter Hwang Yoon-joo] The domestic ethylene production map, once dominated by the chemical industry, is changing. Refinery companies GS Caltex and Hyundai Oilbank are gearing up to expand their ethylene business through new and expanded production lines starting in the second half of this year. In particular, Hyundai Oilbank has a strategy to generate half of its operating profit from the chemical business going forward.

According to industry sources on the 18th, Hyundai Oilbank will officially begin ethylene production at the end of August. The annual production capacity is 850,000 tons, about 100,000 tons more than previously known. This is part of the Heavy Naphtha Petrochemical Complex (HPC) project, with production handled by Hyundai Chemical, a joint venture with Lotte Chemical. Once mass production begins, it is expected to generate at least 500 billion KRW in operating profit. A Hyundai Oilbank official said, "The ultimate goal is to create 50% of operating profit from the chemical business."

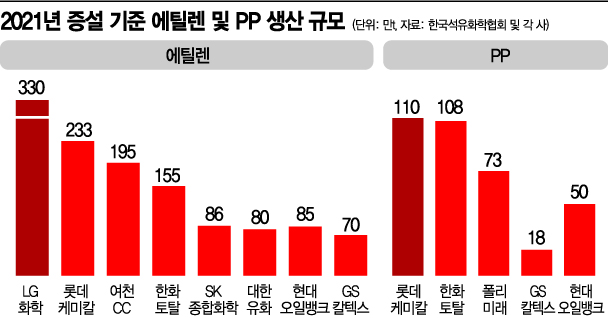

GS Caltex is also completing its Olefin Manufacturing Facility (MFC) project and plans to establish an annual ethylene production capacity of 700,000 tons starting in the second half of the year. Accordingly, domestic ethylene production is expected to be reorganized from the existing six companies into a 'Top 4 and Middle 4' structure. Based on this year's expansions, LG Chem (3.3 million tons), Lotte Chemical (2.33 million tons), Yeochun CC (1.95 million tons), Hanwha Total (1.55 million tons), SK General Chemical (860,000 tons), and Daehan Petrochemical (800,000 tons) will be joined by new entrants Hyundai Oilbank (850,000 tons) and GS Caltex (700,000 tons).

In the case of polypropylene (PP), in addition to existing producers Lotte Chemical (1.1 million tons), Hanwha Total (1.08 million tons), PolyMirae (730,000 tons), and GS Caltex (180,000 tons), Hyundai Oilbank (500,000 tons) will newly start production.

The two refineries' full-scale entry into the chemical business is based on the judgment that while oil demand has structurally contracted due to the impact of the COVID-19 pandemic, the chemical business has entered a boom period. Although winter is generally considered an off-season, demand for chemical products has significantly increased since the second half of last year.

As of last week, the price of ethylene was $851 per ton, up 15.2% year-on-year, and the price of PP was $1,071, up 20.2%. Although there are concerns about oversupply of ethylene, causing a slight decline from the peak in January, demand for chemical products is rapidly increasing. Hwang Kyu-won, a researcher at Yuanta Securities, explained, "The sharp rise in petrochemical product prices occurring in the U.S. is expected to lead to increased exports from Asian companies to Latin America in March and April. The price uptrend of petrochemical products is expected to continue for the time being."

An industry insider also said, "When supply increases during a period of rising product demand, profit margins may decrease somewhat, but operating profit and sales will increase, so it is not a cause for major concern. Since last year, the industry has entered an upcycle (boom), and this trend is expected to continue for some time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)