Suji Seongbok Station Lotte Castle Gold Town Sold for 1.495 Billion KRW

Ilsan Kintex One City Block 2 Sold for 1.45 Billion KRW

Seoul Jeonse Drops Sharply, Gyeonggi Benefits from GTX Boom

Rapid Rise in Mid-Sized Apartments in the Capital Area

[Asia Economy Reporter Onyu Lim] Since the beginning of the new year, the rise in housing prices across the Gyeonggi area has accelerated, leading to a surge in sales transactions of mid-sized apartments nearing the 1.5 billion KRW loan prohibition threshold. Due to the soaring jeonse prices in Seoul and overlapping transportation benefits such as the Metropolitan Area Express Train (GTX), areas like Ilsan in Goyang and Suji in Yongin are on track to surpass the market prices of many outer Seoul regions.

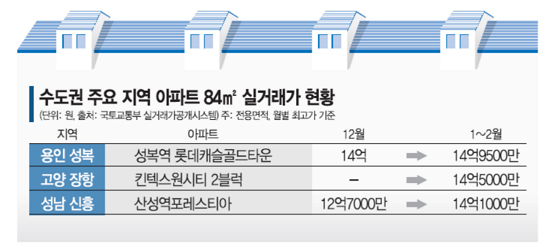

According to the Ministry of Land, Infrastructure and Transport's Real Transaction Price Disclosure System on the 17th, an 84㎡ (exclusive area) apartment in Seongbok Station Lotte Castle Gold Town, Seongbok-dong, Suji-gu, Yongin, was sold for 1.495 billion KRW on the 1st of this month. This complex recorded a real transaction price of 1.172 billion KRW in January last year. After consecutively surpassing 1.2 billion KRW in September, 1.3 billion KRW in October, and 1.4 billion KRW in December, prices have now surged close to 1.5 billion KRW this year. A representative from real estate agency A in the area stated, "Royal units on high floors, occupied by owners themselves, are listed even at 1.55 billion KRW."

1.5 billion KRW is considered a resistance price level for housing prices. In speculative overheated zones, homes priced above this threshold are completely prohibited from receiving mortgage loans. Until now, cases exceeding 1.5 billion KRW for 84㎡ units in Gyeonggi were limited to popular areas such as Gwacheon, Bundang, Wirye, and Gwanggyo New Town.

However, with the sharp rise in housing prices in Gyeonggi this year, the spread of high-priced apartment areas is becoming a trend. According to the Korea Real Estate Board's weekly apartment trend report, the apartment price increase rate in Gyeonggi has recorded the highest nationwide level for five consecutive weeks from the second week of January to the second week of this month (0.36% to 0.47%).

Accordingly, besides Suji-gu in Yongin, complexes with 84㎡ prices approaching 1.5 billion KRW are appearing one after another in Ilsan New Town, Sujeong in Seongnam, Dongan in Anyang, and Seongbok in Yongin.

For example, an 84.65㎡ unit in Kintex One City Block 2, Janghang-dong, Goyang, located near the GTX-A line scheduled to open in 2023, changed hands for 1.45 billion KRW on the 23rd of last month. Considering a similar-sized 84.44㎡ unit in the same complex was traded for 1.155 billion KRW in October last year, this represents a rapid price increase. Apartments of similar size in Sanseong Station Forestia, Sinheung-dong, Seongnam, and Pyeongchon The Sharp Central City, Gwanyang-dong, Anyang, have also surpassed 1.4 billion KRW in actual transaction prices since the new year.

Experts predict that as the rise in housing prices in Gyeonggi continues due to factors such as matching Seoul's housing prices and demand shifting from jeonse to sales amid Seoul's jeonse shortage, the number of apartments exceeding the loan prohibition threshold will increase. In particular, areas expected to improve accessibility to Seoul with the upcoming GTX opening are likely to see steep price increases. Kim Hak-ryeol, head of Smart Tube Real Estate Research Institute, said, "The new lease protection law has drastically reduced jeonse supply in Seoul, turning the real estate market into chaos," adding, "With nationwide regulations becoming standardized, the rise in housing prices in the metropolitan speculative overheated zones is expected to continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)