Next Month, 20 New Residential Sites in the Seoul Metropolitan Area Announced

Reflecting Expectations from the 2·4 Measures

Apartment Sale Price Increase Slows

Experts Say "It's Just a Transaction Cliff Phenomenon"

Reconstruction and Redevelopment Transactions Disappear

New Apartment Owners Withdraw Listings

[Asia Economy Reporter Kangwook Cho] Real estate market stability or transaction cliff.

As the government announced that it will reveal 20 new housing sites with a scale of about 260,000 households starting next month as a follow-up measure to the February 4 supply plan, market attention is focused on the housing price trend after the Lunar New Year holiday.

While the rise in Seoul apartment prices has slowed since the announcement of the measures, the government confidently states that housing prices will stabilize once the follow-up measures are announced. However, in the market, voices are rising expressing concerns that the recent moderation in the rate of increase is only temporary and that a transaction cliff phenomenon is emerging due to a decrease in listings.

According to the Ministry of Land, Infrastructure and Transport (MOLIT) and the real estate industry on the 15th, MOLIT Minister Byeon Chang-heum recently appeared on TV and radio broadcasts around the Lunar New Year and said, "The 20 new housing sites in the metropolitan area, which can supply about 260,000 households, are almost finalized," adding, "There was housing price instability caused by panic buying due to the belief that housing supply would be difficult, but we have shown that sufficient supply is possible."

Minister Byeon further expressed strong confidence in 'controlling housing prices,' saying, "Housing prices may even fall below the current level beyond stabilization." MOLIT plans to disclose about 20 newly selected housing sites sequentially after completing consultations with local governments.

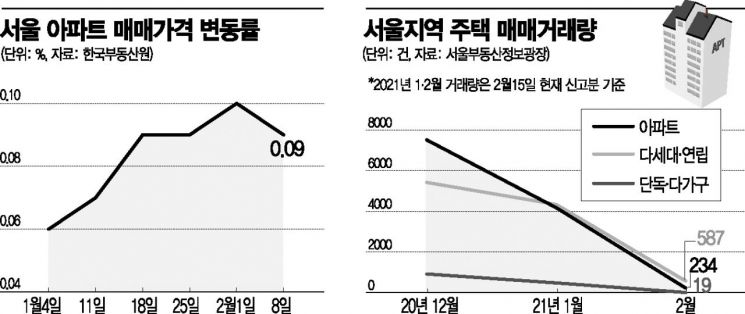

Following the government's announcement, the nationwide apartment sales price increase has also temporarily slowed. According to the Korea Real Estate Board, the nationwide apartment sales price increase rate for the second week of February (as of the 8th) was 0.27%, down 0.01 percentage points from the previous week. In particular, the rate of increase has decreased by 0.01 percentage points for two consecutive weeks this month. Seoul apartment prices also saw a reduction in the rate of increase from 0.10% last week to 0.09% this week. On the surface, this appears to reflect market expectations for stabilization due to the February 4 measures.

However, experts point out that this slowdown in the rate of increase is merely a transaction cliff phenomenon caused by the disappearance of listings. After the supply measures, transactions of reconstruction and redevelopment properties have disappeared due to fears of cash settlements at appraisal prices less than half of market prices. The apartment market is also showing signs of a balloon effect centered on new apartments, with owners withdrawing their listings, according to industry sources.

Ko Jong-wan, head of the Korea Asset Management Research Institute, expressed concern, saying, "The follow-up measures could be a variable, but if there is no change as it is, it will be difficult for housing prices to fall."

According to the Seoul Real Estate Information Plaza, the volume of apartment sales transactions in Seoul (as of the 15th) has sharply declined from 7,511 cases in December last year to 4,181 in January this year, and 234 in February. During the same period, single-family and multi-family houses decreased from 927 to 488 and then to 19 cases, and multi-unit and row houses shrank from 5,426 to 4,347 and then to 587 cases. Listings are also decreasing. According to 'Apartment Real Transaction Price' (Asil), a real estate information company, the number of apartment listings in Seoul as of the 14th was 38,667, down 4.4% from 40,440 ten days earlier. Listings decreased in all 25 districts of Seoul.

Kwon Dae-jung, professor of real estate at Myongji University, said, "As the government's anti-speculation measures suppress demand, transaction volumes have decreased, but waiting demand has increased, raising concerns about simultaneous rises in jeonse (long-term deposit lease) and sales prices in the future. However, because government regulations are strong, the number of sales transactions will not increase significantly, but the traded volumes are likely to set new record prices," he predicted.

There is also a forecast that apartment prices in the metropolitan area will rise by up to 8% this year.

Ham Young-jin, head of the Zigbang Big Data Lab, explained, "Concerns about supply may decrease, but price increases will continue, with Seoul rising about 3-5% and the metropolitan area 5-8%. In particular, Gyeonggi-do is showing a trend of both high transaction volumes and rising prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.