Better-than-expected performance last year... TokBiz and paid content sailing smoothly

High growth expected to continue this year... Subsidiary listings highlight corporate value

"PER was 228 times based on last year's performance, but still upward this year"

KakaoTalk/Photo by KakaoTalk Blog Capture

KakaoTalk/Photo by KakaoTalk Blog Capture

[Asia Economy Reporter Minwoo Lee] Kakao, which experienced high growth last year due to the non-face-to-face (untact) culture brought about by COVID-19, is expected to continue growth accompanied by profitability improvement this year as well.

According to the industry on the 13th, multiple securities firms recently raised their target prices for Kakao. Hi Investment & Securities proposed the highest at 630,000 KRW, while NH Investment & Securities and Samsung Securities both set it at 600,000 KRW. Additionally, Shinhan Investment Corp. raised it to 585,000 KRW, followed by Korea Investment & Securities and Cape Investment & Securities at 560,000 KRW, and Hana Financial Investment and Daishin Securities at 550,000 KRW, with most target prices lifted to the mid-500,000 KRW range. On the 10th, Kakao’s closing price was 489,500 KRW, having risen 6.18% in a single day.

Kakao Surpasses Expectations in 4Q... Sustained High Growth

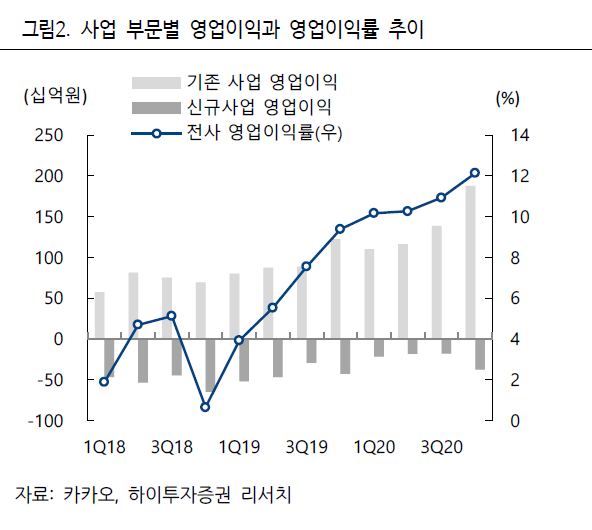

It is analyzed that Kakao’s smooth growth exceeding market consensus in the fourth quarter of last year stimulated investor sentiment. Kakao recorded sales of 1.2351 trillion KRW and operating profit of 149.8 billion KRW in 4Q last year. Compared to the same period the previous year, sales increased by 45.71% and operating profit by 88.24%. These were strong results exceeding consensus by 2.38% and 5.14%, respectively.

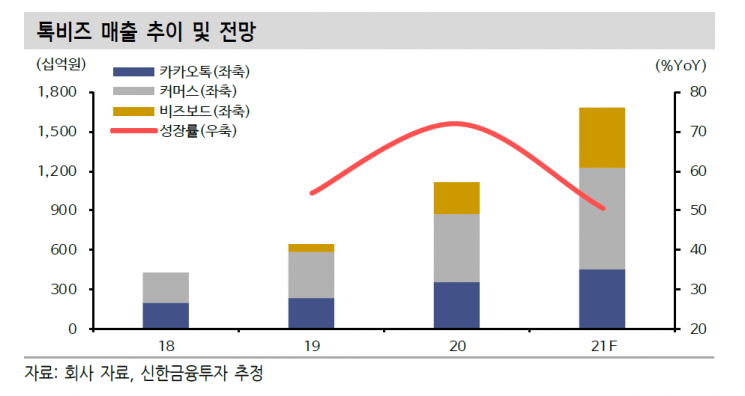

TalkBiz sales based on KakaoTalk reached 360.3 billion KRW, up 62.6% year-on-year. Total commerce transaction volume grew 71% compared to the same period last year, with all sectors showing high growth year-on-year: Gift (61%), Talk Store (216%), and Makers (69%). Biz Board, which displays ads in KakaoTalk chat room lists, achieved its year-end daily sales target of 1 billion KRW, more than doubling compared to the previous year.

Content segment sales also rose about 43% year-on-year to 578.1 billion KRW. Due to a base effect from accounting standard changes, paid content sales from KakaoPage, Daum Webtoon, and Piccoma (Japanese webtoon) reached 163.6 billion KRW, a 233% increase year-on-year. KakaoM’s video production sales growth and strong music distribution led the IP business and other segments to record sales of 118.6 billion KRW, a 24.7% increase year-on-year. Costs were similar to estimates, but personnel expenses rose 10.9% quarter-on-quarter to 265.5 billion KRW due to incentive reflection.

Soaring 'TalkBiz'... "Year of Profitability for New Businesses"

TalkBiz’s high growth is expected to continue this year. Shinhan Investment Corp. forecasts Kakao’s TalkBiz sales to reach 1.6813 trillion KRW this year, a 50.4% increase compared to last year. Senior researcher Moonjong Lee of Shinhan Investment said, "With KakaoT and ShopTab, Biz Board’s ad space expansion will continue, leading to price increases. The inventory usage rate of the core ad space in the chat list window will also keep rising, and commerce will expand its ecosystem into general commerce through growth in Gift’s delivery products, luxury goods, as well as Talk Store and Makers," he analyzed.

New businesses such as mobility and Pay are also expected to turn profitable. Lee said, "In mobility, annual profitability is achievable this year due to the expansion of T Blue franchises, and in Pay, topline growth is expected from payment volume growth and expanded financial product sales." Paid content, which is performing well in the Japanese market, is also expected to grow significantly. Additionally, attention is focused on changes in equity value following KakaoPay’s IPO and the launch of Kakao Enterprise.

According to financial information provider FnGuide, Kakao’s consensus for this year’s performance is sales of 5.4928 trillion KRW and operating profit of 774.4 billion KRW, expected to rise 32.14% and 69.81% year-on-year, respectively. Hyeonjun Hwang, a researcher at DB Financial Investment, said, "Due to the stock price rise since last year, the current price-to-earnings ratio (PER) based on last year’s results is 228 times, and the expected PER for this year is 70 times, indicating valuation pressure. However, given the remarkable performance growth and the continued increase in the value of held shares this year, the upward trend in the stock price is likely to continue," he forecasted.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)