Some Similar Investment Advisory Firms and Stock Leading Rooms Promote via SNS

Inducing Paid Memberships to Collect Money

Number of Cyber Illegal Financial Activity Reports Last Year Tripled Compared to Previous Year

Experts Say "Financial Supervisory Authorities Must Strengthen Oversight"

Reference photo. The photo is not related to any specific expression in the article. [Image source=Yonhap News]

Reference photo. The photo is not related to any specific expression in the article. [Image source=Yonhap News]

[Asia Economy Reporter Lim Juhyung] #Office worker Choi Mo (28) is fully immersed in studying the KOSPI and other securities markets. Recently, after opening an account for stock investment, his interest in listed companies has significantly increased. In particular, Choi mainly collects information about promising investment companies from online communities and social networking services (SNS). Choi explained, "On SNS and YouTube, it is easy to get advice from people who have actually worked as experts in the financial industry. While you shouldn't blindly trust them, it is useful as a reference when studying stocks."

As young people in their 20s and 30s emerge as major players in the stock market, the investment culture is gradually changing. Since young people obtain investment information from SNS, YouTube, and other platforms, so-called quasi-investment advisory services such as 'stock leading rooms' and 'stock YouTube channels' are gaining popularity. However, some of these advisory firms deceive investors with exaggerated or false information, causing related damages. Experts have called for stronger supervision by financial authorities and consumer protection.

Quasi-investment advisory services refer to companies that provide investment advisory services through the internet, such as SNS and YouTube.

Originally, investment advisory firms are regulated financial institutions that must meet several conditions, including securing at least one professional investment recommendation personnel and having capital of at least 250 million KRW, and must go through registration procedures with financial authorities to provide services.

However, quasi-investment advisory firms are unregulated financial institutions that can operate simply by notifying the Financial Services Commission. According to the current Capital Markets Act, these firms are defined as "those who provide advice on investment decisions or investment value of financial investment products through publications, emails, etc., issued to an unspecified large number of people, and receive certain compensation."

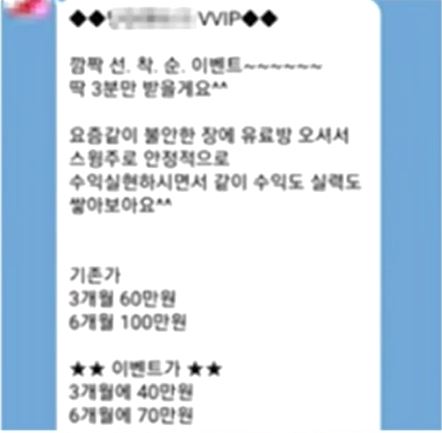

Some stock reading rooms also encourage investors to subscribe as paid members through social networking services (SNS) such as KakaoTalk. / Photo by Online Community Capture

Some stock reading rooms also encourage investors to subscribe as paid members through social networking services (SNS) such as KakaoTalk. / Photo by Online Community Capture

The problem is that some of these quasi-investment advisory firms collect money from investors through exaggerated or false advertisements.

For example, in 'stock leading rooms,' which are SNS messenger groups sharing stock-related information, they demand paid membership by claiming to provide premium investment information.

In particular, it has been found that relatively less knowledgeable young people in their 20s and 30s are exposed to advertisements from these quasi-investment advisory firms.

A 20-something office worker, Mr. A, said, "Recently, I receive advertising messages with links to stock leading rooms claiming to pick 'jackpot stocks' for me. Since it looks like a blatant advertisement, I just ignored it, but I think some people might be tempted to join."

Another office worker, Mr. B, said, "I joined a stock leading room where beginners share information, but then I received advertisements urging me to sign up for paid membership to get 'premium' information only available to paid members. It seemed very suspicious, and the membership fee was expensive, so I didn't join, but hearing that such scams are common recently makes me anxious."

In fact, the number of illegal reports related to financial investment firms has recently surged.

According to the Financial Supervisory Service, the number of cyber illegal financial activity reports related to financial investment firms reached 495 last year, nearly tripling compared to 139 cases the previous year.

Financial Services Commission / Photo by Yonhap News

Financial Services Commission / Photo by Yonhap News

Given this situation, experts have urged financial authorities to strengthen supervision of quasi-investment advisory firms. The 'Financial Consumers Federation' pointed out in a press release on December 18 last year, "Quasi-investment advisory firms are spreading the mistaken belief that one can make a fortune overnight in the capital market."

They added, "However, unlike investment advisory firms, these are not financial companies subject to the Capital Markets Act, nor are they supervised by financial authorities, so it is practically impossible for consumers to receive relief even if damages occur."

They emphasized, "Financial supervisory authorities should abolish these firms or strengthen supervision to prevent consumer damages."

Meanwhile, financial authorities plan to tighten regulations on quasi-investment advisory businesses. On October 28 last year, the Financial Services Commission held the 27th Financial Risk Response Team meeting chaired by Secretary-General Kim Taehyun to discuss management plans for quasi-investment advisory businesses.

In particular, the Financial Services Commission intends to review the status and functions of quasi-investment advisory firms, which anyone can register through the current notification system, and consider effective regulatory measures to protect consumers.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)