"Focus on Spreading Warmth of Inclusive Finance"

[Asia Economy Reporter Park Sun-mi] Financial authorities are expanding 'inclusive finance' by reviewing the interest rate reduction range for Saessal Loan 17 in line with the reduction of the maximum interest rate, and temporarily supplying refinancing products for loans exceeding 20% interest rates.

On the 14th, the Financial Services Commission announced that it will make various efforts to spread the warmth of inclusive finance by making the reduction of high-interest burdens on low-income people through follow-up measures after the maximum interest rate reduction, strengthening customized support for vulnerable groups, and setting these as key tasks for the Financial Consumer Bureau this year.

In line with the maximum interest rate reduction (from 24% to 20%, scheduled to be implemented in early July), the interest rate reduction range for Saessal Loan 17 will be reviewed in the second half of this year, and refinancing products for loans exceeding 20% interest rates will be temporarily supplied. For example, refinancing loans up to a limit of 20 million KRW will be supported only for low-income and low-credit borrowers who have been using high-interest loans exceeding 20% for more than one year before the implementation date of the maximum interest rate reduction, or whose maturity is approaching within six months and are making normal repayments.

Furthermore, moving away from the uniform supply focused on Worker Saessal Loan, support will be provided so that individual financial sectors can proactively design and supply policy financial products for low-income people, thereby diversifying policy financial products for the underprivileged. Incentive support for excellent financial companies providing loans to low-income people will also be considered. In this process, to eradicate illegal private loans, the prosecution, police, and special judicial police will conduct large-scale crackdowns, and strict punishment and handling will be enforced by confiscating tax evasion gains through tax verification and investigations. Support for appointing debtor representatives to block illegal debt collection and lawyer support for lawsuits to return interest payments exceeding the maximum interest rate will also be expanded and strengthened.

Introduction of Ultra-Long-Term Mortgage for Youth

As part of spreading the warmth of inclusive finance, customized support for vulnerable groups will also be strengthened.

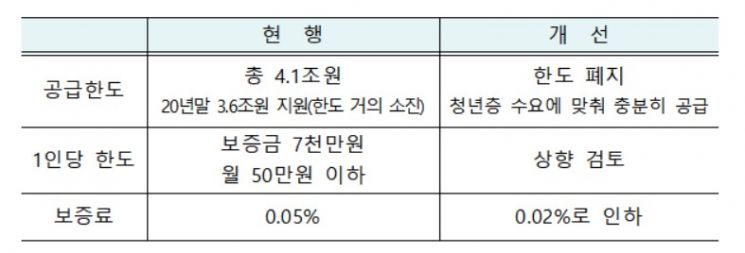

An ultra-long-term mortgage for youth will be introduced, and support for youth jeonse and monthly rent loans will be expanded to reduce housing finance costs for young people. Policy mortgages with a maximum maturity of 40 years will be prioritized for youth and newlyweds to reduce the monthly principal and interest repayment burden. In the first half of the year, products supporting deposits and monthly rent at interest rates in the 2% range will be sufficiently supplied to youth, and support for jeonse and monthly rent loans will be expanded by lowering guarantee fees from the current 0.05% to around 0.02%.

Support will also be provided to reduce excessive burdens on vulnerable debtors and enable rapid recovery.

For those who have suspended or closed businesses due to COVID-19, regardless of business duration, they will be able to apply for a special repayment deferral before debt adjustment and installment repayment (up to 2 years). Pre-debt adjustment (interest rate adjustment) for individual debtors with delinquency periods of 31 to 89 days will be improved in a way that benefits vulnerable groups. The enactment of the Consumer Credit Act will be pursued (scheduled to be submitted to the National Assembly in the first half of the year) to establish a fair debt adjustment infrastructure between creditor financial institutions and individual debtors.

Early stabilization of the Financial Consumer Protection Act will also be supported. With the Financial Consumer Protection Act (FCPA) coming into effect on March 25, the FSC plans to operate a task force intensively for three months before and after the law’s enforcement to promptly respond to field difficulties.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.