Revision of Joint Store Closure Procedures

Effective from Next Month but Not Significantly Different from Before

Effectiveness Likely to Vary Depending on Authorities' Management Level

[Asia Economy Reporter Park Sun-mi] To minimize the side effects of bank branch closures, the revised "Joint Procedures Related to Bank Branch Closures" will be implemented starting next month. However, doubts about its effectiveness are already being raised. Since banks select the external experts and host the evaluation, concerns have emerged that the independence of the pre-impact assessment, which must be reported to financial authorities, could be compromised. The industry expects that even with the implementation of the joint procedures amid a surge in non-face-to-face transactions, it will be difficult to slow down the pace of branch closures.

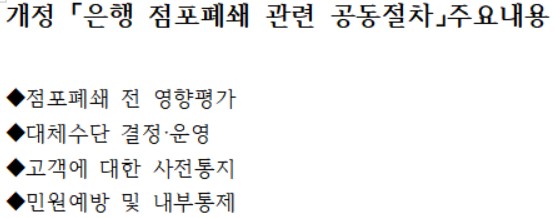

According to the financial sector on the 10th, major domestic banks evaluate that the revised joint procedures, effective from March 1, are not significantly different from those voluntarily established by the banking sector in June 2019. Banks already conduct internal analyses and impact assessments on the potential effects on customers and the availability of alternative means before closing branches. They have also been notifying the public in advance about branch consolidations or closures via their websites and branch bulletin boards. The changes from the existing joint procedures include the timing of notifications related to branch closures (from 1 month to 3 months in advance) and the participation of the bank’s consumer protection department and external experts in the pre-impact assessment process to enhance the independence and objectivity of the evaluation. Banks maintain that these changes do not pose a significant obstacle to reconsidering branch closure decisions.

A bank official said, "Since banks already conduct impact assessments before closing branches, the trend of closing inefficient branches will not change even after the revised joint procedures are implemented," adding, "The reduction in the number of branches is an unavoidable reality as non-face-to-face transactions increase."

Another bank official explained, "Notifying about branch closures three months in advance and operating alternatives like ATMs are not particularly difficult," adding, "The key issue is how objectively the inconvenience to financially vulnerable groups is evaluated in the pre-impact assessment related to branch closures." The official further noted, "However, since the bank hosts the evaluation and selects the external experts participating in the process to strengthen independence and objectivity, there are doubts about how effective it will be."

Banking Sector "Ready to Comply... Selecting External Experts"

Effectiveness Depends on Financial Authorities' Monitoring

Since there are no significant amendments, the banking sector has mostly completed preparations to implement the revised "Joint Procedures." Shinhan Bank, which announced the consolidation of Samseongyo Branch and Hyehwa-ro Branch into Daehak-ro Branch effective February 29, stated that it conducted internal analyses and impact assessments on the effects on customers and the availability of alternatives prior to the branch closure. Other banks such as Kookmin, Hana, and Woori are also preparing to comply with the revised joint procedures starting in March and are currently in the process of selecting external experts to participate in the pre-impact assessment.

There are also calls for financial authorities to strengthen monitoring and management to ensure that the revised joint procedures effectively protect financially vulnerable groups affected by bank branch closures. Since the revised joint procedures are voluntary regulations, their effectiveness may vary depending on how authorities enforce compliance.

Currently, the Financial Supervisory Service (FSS) is in the process of improving the "Enforcement Rules of the Banking Supervision Regulations" to enable banks to attach pre-impact assessment results of closed branches in their quarterly business reports and to strengthen disclosure on branch operation status. An FSS official said, "The rule improvement has already been decided and is awaiting final approval," adding, "The rules will be improved and applied within the first quarter, and the operation status of branches and sub-branches (new openings, closures, etc.) will be analyzed and regularly announced externally."

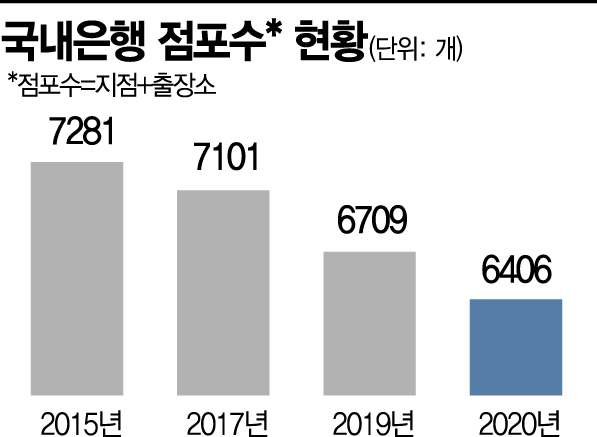

Meanwhile, the number of bank branches disappearing is steadily increasing due to the rise in non-face-to-face transactions such as internet and mobile banking amid COVID-19 and the expansion of redundant branch consolidations. The number of domestic bank branches has been continuously decreasing from 7,281 in 2015 to 7,101 in 2017, 6,709 in 2019, and 6,406 in 2020. Last year alone, 303 bank branches were closed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.