2019 562.2 Billion → 2020 519.3 Billion

"Considering Additional Provisions, Performance is Favorable"

Dividend Payout Ratio Set at 20% Following Authorities' Guidelines

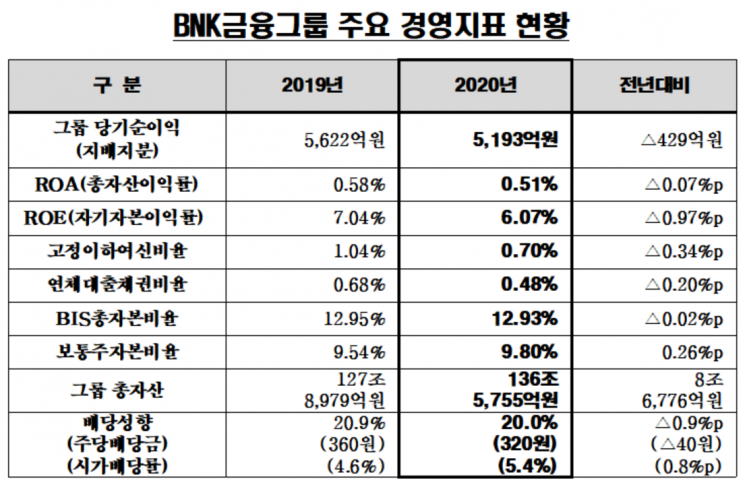

[Asia Economy Reporter Kim Hyo-jin] BNK Financial Group announced on the 9th that its net profit for the previous year was 519.3 billion KRW, a decrease of 42.9 billion KRW (7.6%) from the previous year (562.2 billion KRW).

Although the banking sector's performance declined due to a decrease in interest income caused by a drop in net interest margin, BNK Financial explained that considering additional provisions made in response to COVID-19 and increased costs from voluntary retirement, the results were favorable.

Profits from non-banking sectors such as BNK Investment & Securities and asset management increased by 21.9% compared to the previous year, offsetting the group's net profit decline.

In particular, the group's fee income rose by 47.6% year-on-year, driven by increased project financing (PF) fees from major affiliates and higher stock and derivatives fees from BNK Investment & Securities due to a favorable stock market, indicating a gradual improvement in the group's revenue structure, which had been heavily reliant on banking and interest income.

Accordingly, the proportion of net profit from non-banking sectors expanded from 18.3% in 2019 to 24.4% last year.

The group's asset soundness indicators showed an NPL ratio of 0.70%, down 34 basis points from the previous year, and a delinquency ratio of 0.48%, down 20 basis points year-on-year.

"Sound Asset Quality Indicators Despite COVID-19"

Despite the impact of COVID-19, the credit portfolio improvement and thorough asset quality management have maintained sound asset quality indicators. The group's coverage ratio for non-performing loans also improved by 24.46 percentage points from the previous year to 123.58%.

The group's capital adequacy indicator, the common equity tier 1 (CET1) ratio, rose by 0.26 percentage points year-on-year to 9.8%, influenced by the early adoption of the Basel III final rules. A significant increase in the capital ratio is expected when the group applies the internal ratings-based approach, currently awaiting approval from the Financial Supervisory Service in the first half of this year.

BNK Financial resolved at the board meeting to pay a cash dividend of 320 KRW per share. Referring to the Financial Services Commission's recommendation, the dividend payout ratio (total dividends to net profit) was set at 20%, and the dividend yield (dividends relative to stock price) was disclosed as 5.4%.

Myung Hyung-guk, head of BNK Financial Group’s Strategic Finance Division, stated, "This year, we have set a net profit target in the 600 billion KRW range by continuing to expand non-banking and non-interest income and reducing provision expenses through improved asset quality. We also expect a significant profit increase with the added role of non-banking affiliates."

He added, "This year, we will strengthen shareholder return policies, including a significant additional increase in capital ratios, upward adjustment of dividend payout ratio, and consideration of share buybacks. We will do our best to raise the undervalued stock price to a level that reflects the company's value."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.