Record High with Daily Average Trading Value of 42 Trillion Won Last Month... Approaching 65 Trillion on the 11th

Stock Market Boom Causes Frequent System Overloads and Outages Due to Surge in Concurrent Users

Kiwoom Securities and DB Financial Investment Most Affected... Accelerating IT System Improvements

[Asia Economy Reporter Lee Seon-ae] The securities industry is actively working to stabilize IT systems such as Home Trading Service (HTS) and Mobile Trading System (MTS). As the domestic stock market continues to boom, system errors caused by IT overload frequently occur, causing inconvenience to investors.

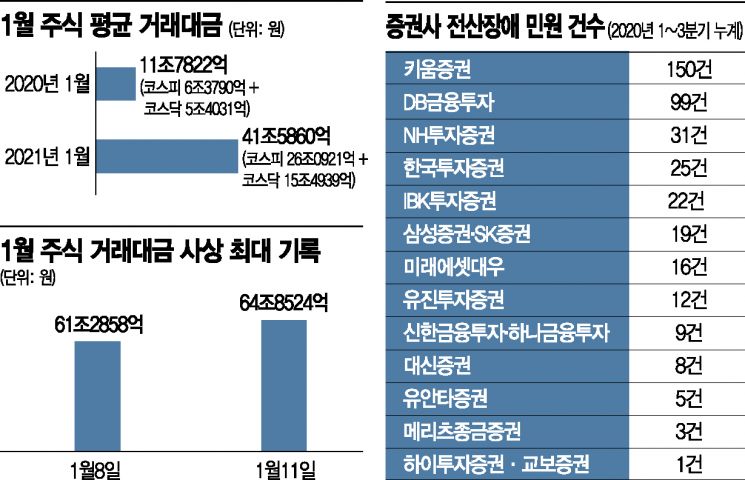

According to the Korea Exchange on the 5th, the average daily trading value of domestic stocks last month was 42 trillion won. Compared to the average daily trading value of 12 trillion won in January last year, this is more than three times higher, and it is about 8 trillion won more than December last year (33.3026 trillion won), which recorded the highest trading value. On January 8, it surpassed 60 trillion won, and on the 11th, it nearly reached 65 trillion won, setting an all-time record. In particular, the KOSPI trading value exceeded 20 trillion won every day last month. Last year, storm trading also occurred in August (30.7364 trillion won), September (28.2234 trillion won), and November (27.3181 trillion won), when the stock market was strong.

As a result, various IT failures such as connection failures to HTS and MTS, delays in balance inquiries, and trading transaction failures occurred. According to the Korea Financial Investment Association, the securities company with the highest number of IT failure complaints from the first to third quarter last year was Kiwoom Securities (150 cases). This was followed by DB Financial Investment (99 cases), NH Investment & Securities (31 cases), Korea Investment & Securities (25 cases), IBK Investment & Securities (22 cases), Samsung Securities and SK Securities (19 cases), Mirae Asset Daewoo (16 cases), Eugene Investment & Securities (12 cases), Shinhan Financial Investment and Hana Financial Investment (9 cases), Daishin Securities (8 cases), Yuanta Securities (5 cases), Meritz Securities (3 cases), and Hi Investment & Securities and Kyobo Securities (1 case each). The securities industry collectively stated, "Due to the impact of COVID-19 last year, the KOSPI volatility increased significantly, and the number of simultaneous users rose sharply, causing the platform to be unable to handle the overload, resulting in connection delays and errors."

This year, such IT failures have continued. On the first trading day of the new year, January 4, and on the 11th, when the KOSPI surpassed 3200 during trading hours, problems occurred at Kiwoom Securities, Shinhan Financial Investment, NH Investment & Securities, KB Securities, and others. On securities companies' bulletin boards, investors' demands for stabilization of IT failures are posted daily.

NH Investment & Securities stated that it is continuously expanding and improving its IT system capacity to provide stable services to customers. To accommodate the continuously increasing number of customers, they are configuring a system capable of handling more than twice the current number of users. In the short term, they plan to expand and rebuild the 'main IT server' and 'MTS server.'

DB Financial Investment completed the expansion of its MTS server in the second half of last year and plans to fully replace both HTS and MTS systems with the latest server equipment within the first half of this year. In addition, to improve overall system performance beyond just online channel systems, they are aiming to complete the replacement of network communication equipment, database servers, and storage within the first quarter.

KB Securities relocated its data center last year and is currently applying additional spare equipment such as servers. Previously, Kiwoom Securities and Shinhan Financial Investment also partially completed server expansions and additional data center construction and are continuously working on improvements.

Meanwhile, investors are also raising their voices demanding institutional measures such as compensation for damages caused by securities companies' system errors. A representative from the Financial Consumer Federation said, "It is true that there needs to be a mutually agreeable standard so that compensation can be provided to users when IT failures last for a long time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.