Warnings from Economists on Political Money Distribution

Paper by Professor Jang Yongseong of Seoul National University Presented at Academic Conference on 5th

Basic Income Funding Scenarios

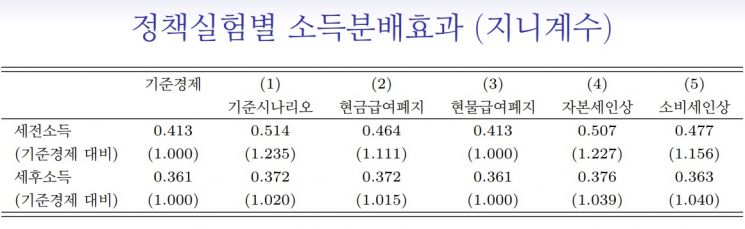

All Five Plans Show Increased Gini Coefficient

Confirmed Worsening Income Distribution Inequality

*Source: 'Economic Impact Analysis of Basic Income Implementation' (Kim Seonbin, Jang Yongsung, Han Jongsuk)

*Source: 'Economic Impact Analysis of Basic Income Implementation' (Kim Seonbin, Jang Yongsung, Han Jongsuk)

[Asia Economy Reporter Eunbyeol Kim] The economics community has raised warnings about the political sphere's money printing. As the likelihood increases that deficit bonds will need to be issued again to provide the fourth round of disaster relief funds, concerns are being voiced that this could exacerbate inequality.

Professor Jang Yongseong of Seoul National University's Department of Economics will present a paper titled "An Economic Analysis of the Effects of Introducing Basic Income" at the upcoming 'Joint Economics Academic Conference' on the 5th. The paper includes the assessment that "basic income not only lacks economic benefits as universal welfare but may also increase the national burden and widen inequality among low-income groups." Previously, Professor Jang prepared this paper together with Professor Kim Seonbin of Yonsei University's Department of Economics and Research Fellow Han Jongseok of the Korea Institute of Public Finance.

Basic income is the idea that the government provides all citizens with a monthly living allowance sufficient for basic subsistence, regardless of property ownership or employment status. However, in reality, funding basic income would require raising taxes, which could reduce labor and savings, potentially widening income gaps between working-age individuals and the elderly. To avoid increasing the tax burden, existing welfare benefits for low-income groups would have to be eliminated, resulting in a scenario where "basic income is given, but welfare programs disappear."

According to the paper, providing a monthly basic income of 300,000 won to 39.19 million adults aged 25 and over in South Korea would require an annual total of 141.1 trillion won (equivalent to 7.35% of the Gross Domestic Product (GDP)). To secure this funding, it is essential to either raise tax rates or reduce existing welfare programs, according to Professor Jang and colleagues. The paper analyzes five scenarios for securing funds: ▲fully covering costs by raising earned income tax (hereafter income tax) ▲abolishing cash benefits and raising income tax ▲abolishing in-kind benefits ▲raising capital income tax and income tax ▲raising consumption tax rates entirely.

Analysis shows that the pre-tax income Gini coefficient, which measures income inequality, was 0.413 in the 2019 economy before COVID-19. However, when applying the scenarios for introducing basic income, the Gini coefficient increased in most of the five scenarios. It is estimated that the Gini coefficient could rise to between 0.464 and 0.514 upon the introduction of basic income. A higher Gini coefficient indicates worsening income distribution inequality.

If the entire basic income funding is covered by raising income tax rates, the income tax rate would increase from the current 6.8% by 17.6 percentage points to 24.4%. While taxes on earned income would rise, basic income would be provided regardless of work, leading to a reduction in labor supply and potentially increasing inequality depending on existing assets.

Without raising taxes, the only way to secure funding is to abolish the originally provided welfare programs. Since this is essentially just renaming welfare benefits for low-income groups as basic income, it is also ineffective for low-income groups. Basic income also appears to have significant negative impacts on the overall economy. If funding is secured by raising income tax, total production (-19%), total capital (-22%), and total labor (-16%) are expected to decline substantially. Raising capital income tax from 30% to 50% would still be insufficient, requiring an additional 14.2 percentage point increase in earned income tax. In this case, total production is expected to decrease by as much as 23%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.