Emphasizing the Role of Policy Finance in Areas such as Korean-style (K) New Deal, Green Finance, and Small Business Support

[Asia Economy Reporter Park Sun-mi] Since the beginning of the year, as the government and financial authorities emphasize the role of policy finance in areas such as the Korean-style (K) New Deal, green finance, and support for small business owners, the pace of the three policy banks?KDB Industrial Bank, Korea Eximbank, and IBK Industrial Bank of Korea?is also accelerating. These banks have focused their business direction this year on strengthening policy finance and have begun establishing and implementing detailed plans as well as organizational restructuring.

According to the financial sector on the 28th, KDB Industrial Bank invested 510 billion KRW to form a policy-type New Deal mother fund, taking the first step toward creating a K-New Deal fund that will inject a total of 20 trillion KRW over the next five years. The bank plans to match the 510 billion KRW investment with private funds to establish the policy-type New Deal fund. The submission of proposals from asset management companies has already closed, and the selection process will be completed by the end of next month. Subsequently, sub-funds will be formed and invested sequentially to support the successful promotion of the K-New Deal.

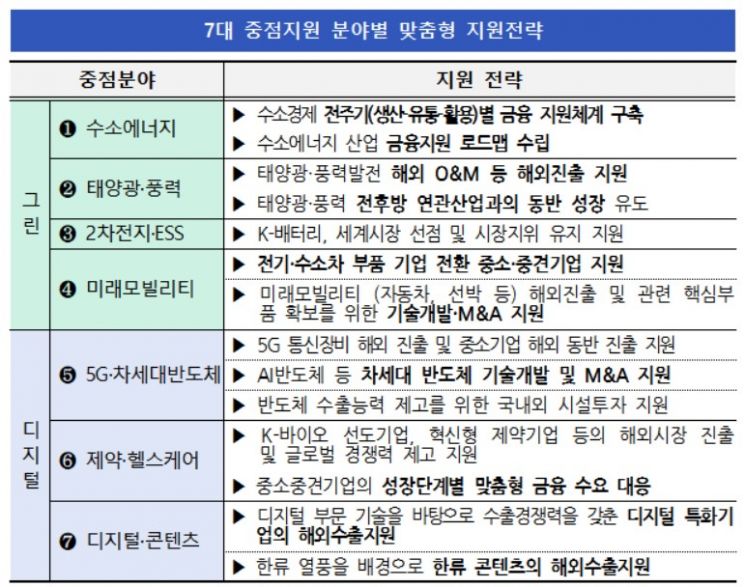

Korea Eximbank has designated this year as the inaugural year for achieving global results in the K-New Deal. Centered on seven key support areas selected by the bank?hydrogen energy, wind and solar power, secondary batteries and ESS, future mobility, 5G and next-generation semiconductors, pharmaceuticals and healthcare, and digital content?it plans to provide 80 trillion KRW in support over ten years until 2030.

IBK Industrial Bank of Korea is establishing the ‘IBK New Deal Fund’ to discover and nurture New Deal innovative companies, investing a total of 1 trillion KRW over five years with an annual contribution of 200 billion KRW. Through this fund, the bank plans to focus investments on companies carrying out the five core New Deal tasks selected by the bank: strengthening the D.N.A (Data, Network, Artificial Intelligence) ecosystem, spreading low-carbon and distributed energy, and building an innovative green industry ecosystem.

The financial authorities are emphasizing the role of policy finance not only in the K-New Deal but also in green finance. At the 3rd Green Finance Promotion Task Force (TF) plenary meeting held earlier this week, Do Gyu-sang, Vice Chairman of the Financial Services Commission, reinforced the importance of strengthening the role of policy finance. The authorities plan to prepare investment strategies for each institution within the first half of the year to increase the share of green sector support by policy finance institutions from the current 6.5% to about 13% by 2030. To maximize synergy in policy finance support, they will also establish and operate a consultative body among policy finance institutions.

The three policy banks have already formed dedicated green finance organizations to this end. KDB Industrial Bank expanded its policy planning division into a policy and green planning division and newly established an ‘Environmental, Social, and Governance (ESG)’ and New Deal planning department under it. Korea Eximbank created a dedicated green industry finance support organization, including a renewable energy industry team, through an industry-specific organizational restructuring. IBK Industrial Bank of Korea also formed an ESG management team within the strategic planning department of the management strategy group to oversee green management.

A representative from one of the policy banks said, "All policy banks have commonly set their business direction and plans this year with the goal of expanding their roles as policy finance institutions," adding, "We are prepared to promptly follow the government and financial authorities’ detailed plans as soon as they are announced."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.