[Asia Economy Reporter Lee Seon-ae] This year, the securities industry is expected to achieve high profitability due to strong performance in brokerage and corporate finance (IB). On the other hand, the asset management industry is forecasted to continue experiencing contraction in public and private funds. However, with growing investor interest in corporate sustainability driven by climate change and COVID-19, the expansion of the ESG (Environmental, Social, and Governance) fund market within the asset management industry is expected to accelerate.

On the 28th, the Korea Capital Market Institute presented this analysis through an online broadcast of the seminar titled "2021 Capital Market Outlook and Key Issues."

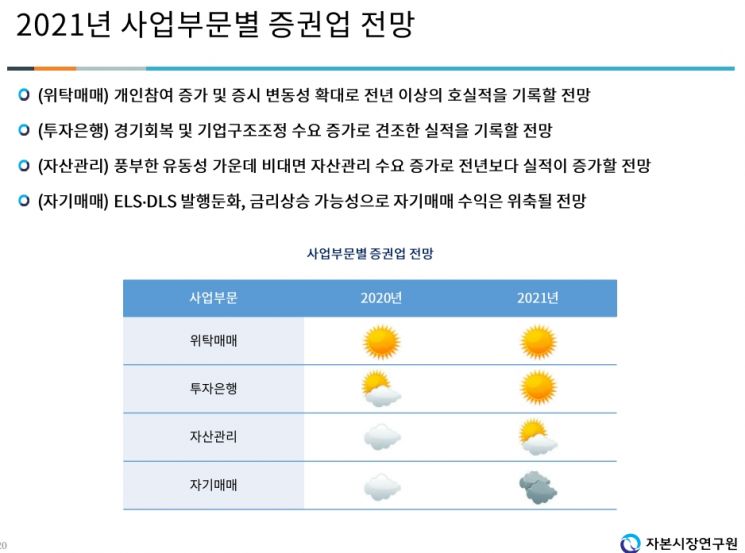

The securities industry is anticipated to realize high profitability due to increased individual participation in the stock market and expectations of economic recovery. Lee Hyo-seop, Head of the Financial Industry Division at the Korea Capital Market Institute, analyzed, "Brokerage revenues are expected to maintain an upward trend due to increased individual participation and stock market volatility," adding, "With rising corporate funding demand and restructuring needs driven by economic recovery expectations, IPOs, rights offerings, and mergers and acquisitions (M&A) are all expected to grow steadily."

In the asset management sector, while the low-interest-rate environment will continue to increase demand for customized asset management, issuance of derivative-linked securities and fund sales are expected to slow down due to regulations on direct investments and complex financial products.

Additionally, in the proprietary trading sector, profitability is expected to decline due to contraction in the derivative-linked securities market and the possibility of rising market interest rates.

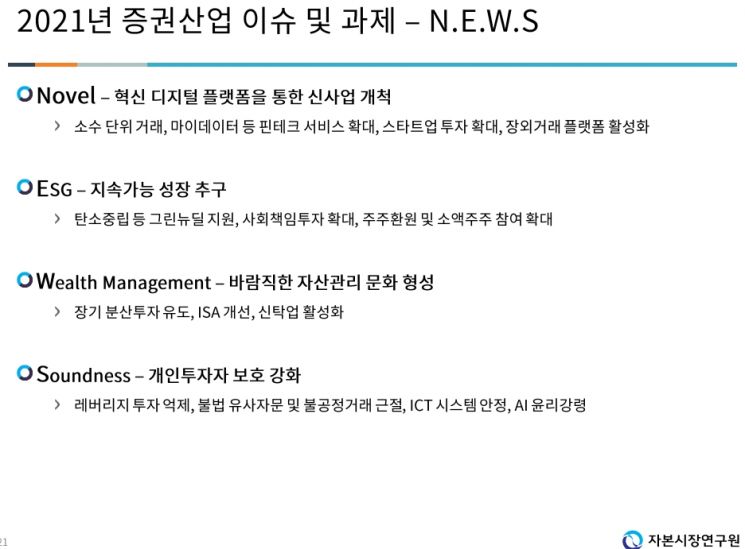

Lee identified the key issues for the securities industry as ▲ pioneering new businesses through innovative platforms ▲ ESG-based management strategies for sustainable management ▲ fostering a household asset management culture ▲ and strengthening protection for individual investors.

In the asset management industry, analysis suggests that fund contraction will continue.

Nam Jae-woo, Head of the Fund and Pension Division at the Korea Capital Market Institute, explained, "Although public funds have expanded in size, they are contracting in substance," adding, "The growth of Exchange-Traded Funds (ETFs) has slowed, and the expansion of direct investments acts as a negative factor for the public fund market."

Regarding the private fund market, he said, "Capital inflows into real estate and special assets have driven overall private fund market growth," but also noted, "Investor sentiment has weakened due to private fund incidents, leading to decreases in both the number of funds and assets under management."

The major issues for the asset management industry this year include ▲ institutional reforms to strengthen post-supervision from the perspective of protecting private fund investors ▲ expansion of the ESG investment market ▲ institutional reforms to improve the efficiency of retirement pension fund management ▲ and expansion of the fully discretionary Outsourced Chief Investment Officer (OCIO) market.

Nam stated, "With the global Green New Deal policy momentum, the growth of ESG investments is expected to accelerate further," and explained, "Regarding retirement pension system reforms, the introduction of various forms of fund-type governance structures is being pursued."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.