Miyauchi Prefecture CTO Appointed SoftBank General

Chairman Son Focuses on Group Investment Business... Likely to Restructure into Investment Specialist Group

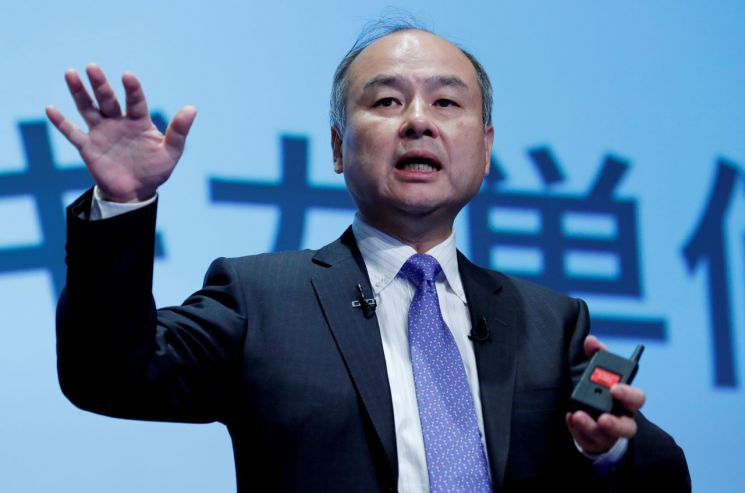

[Asia Economy Reporter Kim Suhwan] Masayoshi Son, chairman of SoftBank Group, has stepped down from his position as chairman of SoftBank, the mobile carrier subsidiary within the group. Chairman Son is expected to reorganize SoftBank Group into an investment-focused group and concentrate more on investment business.

According to foreign media including Nihon Keizai Shimbun on the 26th (local time), SoftBank announced personnel changes on the same day, stating that Chairman Masayoshi Son will step down from his position as chairman of SoftBank, the mobile carrier within the group, to become a founding director, and Ken Miyauchi, president and CEO, will take over as the new chairman. The position of president and CEO will be taken by Junichi Miyakawa, vice president who has been serving as Chief Technology Officer (CTO). These personnel changes will take effect from April 1.

In a press release distributed on the same day, SoftBank stated, "The selection process for the successor chairman began two years ago," and added, "In particular, Vice President Miyakawa was promoted to president in recognition of his expertise in advanced technology and management capabilities."

Ken Miyauchi, the new chairman of SoftBank, joined SoftBank in its early startup phase in 1984 and has been by Chairman Son’s side as the company transformed from a software distribution company into a mobile carrier. After the company was listed on the stock market, he took on the role of overseeing domestic business operations, was promoted to president in 2015, and is also known to have been involved in the merger process with Line, Naver’s Japanese subsidiary, recently.

Junichi Miyakawa, the new CEO, joined SoftBank in 2003 and has been responsible for technical tasks related to the mobile communication business. Until recently, he served as Chief Technology Officer (CTO), overseeing advanced technology research and development and related operations within SoftBank Group.

This personnel change is analyzed as Chairman Son stepping away from the mobile communication sector to focus more on investment. Previously, Chairman Son had attempted to reorganize SoftBank from a mobile communication company into a technology investment specialist company focusing on artificial intelligence and other technologies. In 2017, under Chairman Son’s leadership, the SoftBank Vision Fund was established with $100 billion (approximately 110 trillion KRW), making massive investments in major global venture companies.

The reason Chairman Son is focusing more on investment is interpreted as being due to the growing deficits of IT venture companies he invested in following the recent COVID-19 pandemic, which resulted in a loss of 1.4381 trillion yen (approximately 15 trillion KRW) in the first quarter of last year. In response, Chairman Son acknowledged that "excessive venture investment was a factor in the deterioration of performance" and significantly reduced the scale of new investments in venture companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)