Intensified Conflict Between Iljin and SKC Over Malaysia Copper Foil Factory Construction

SKC Decides to Invest 1000km Away from Iljin Factory, Temporarily Settling Dispute

Iljin Anxious About Potential Core Talent Drain

Copper Foil, a Key Material for Electric Vehicle Batteries... Annual Growth Rate Around 30%

[Asia Economy Reporter Lee Jun-hyung] The 'copper foil conflict' between Iljin Materials and SK Nexilis, a subsidiary of SKC, over the construction of a factory in Malaysia has been resolved for now. SK Nexilis, which was considering investing in the area where Iljin Materials' copper foil factory is located, has decided to establish its overseas production base in a different region of Malaysia. Iljin Group, which was concerned about the outflow of key personnel, is relieved.

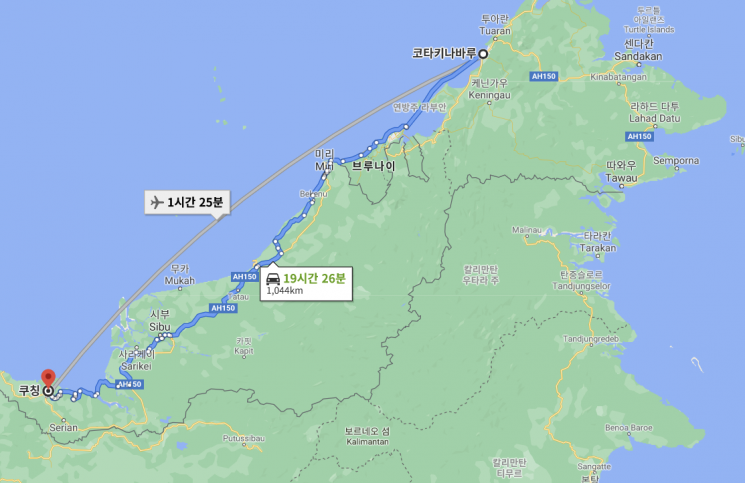

SK Nexilis, a copper foil manufacturer, selected the KKIP Industrial Park in Kota Kinabalu, Sabah, Malaysia, as its first overseas production plant at a board meeting held on the 26th. This location is about 1,050 km away from Kuching City, Sarawak, Malaysia, where Iljin Materials' copper foil production plant is located, a distance that takes about 19 to 20 hours by car. The areas of Kota Kinabalu and Kuching City are similar in size, at 394 km² and 431 km² respectively.

Iljin Group welcomed SK Nexilis' decision. A representative of Iljin Group stated, "We did not oppose SK Nexilis' entry into Malaysia, but opposed their entry into Kuching City," adding, "Concerns about the outflow of local personnel, which could affect SK Group's image, may have been considered." He added, "It is fortunate that Kota Kinabalu was confirmed as the location," and said, "The two companies will engage in healthy competition for the development of the secondary battery industry."

Iljin Materials and SK Nexilis are competing companies ranked second and third in the global copper foil manufacturing industry. Copper foil is a thin copper sheet about 1/15 the thickness of a human hair and is a key material used in the anode of lithium-ion batteries for electric vehicles. Approximately 40 kg of copper foil is used per electric vehicle.

SK Nexilis initially considered Kuching City as a strong candidate. According to industry sources, the factory site SK Nexilis considered investing in last year was very close, separated by only a road, to Iljin Materials' local factory. In response, Iljin Group opposed, saying, "Coming to Kuching City obviously means poaching local key skilled workers." An Iljin Group official explained, "Since copper foil is a material sensitive to climate, it takes about two years of research and development (R&D) to mass-produce it according to local temperature and humidity," adding, "If a large corporation's factory is established nearby, there is a risk of losing key local technicians in Malaysia." This was why Iljin Group was closely monitoring SK Nexilis' decision.

The distance between Kuching City, Malaysia, where Iljin Materials' copper foil factory is located, and Kota Kinabalu City, where SK Nexilis decided to invest [Photo by Google Maps capture]

The distance between Kuching City, Malaysia, where Iljin Materials' copper foil factory is located, and Kota Kinabalu City, where SK Nexilis decided to invest [Photo by Google Maps capture]

Iljin Materials' concerns are also influenced by a personnel outflow incident experienced in the 1990s. Iljin Group succeeded in developing copper foil manufacturing technology for the first time in Korea and built a copper foil production plant in Iksan, Jeonbuk, in 1989. However, in 1996, LG Metal, which built a copper foil factory on a nearby site, poached 15 key skilled workers. LG Metal is the predecessor of SK Nexilis.

Both companies plan to expand their overseas factory production capacity to increase copper foil production capacity to an annual scale of 100,000 tons, two to three times the current level. This is due to the rapid increase in demand for electric vehicles and the copper foil market. According to the Small and Medium Business Corporation, the electric vehicle battery pack market size, which was only 4.6 trillion won in 2015, is expected to reach 263 trillion won next year. According to Hana Financial Investment, the demand for copper foil for electric vehicle batteries will increase about twofold from 305,856 tons last year to 610,399 tons next year. Market research firm SNE Research analyzed the annual growth rate of the copper foil market for electric vehicle batteries to be in the 30% range.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)