Record High Individual Net Buying... Focused Shopping on Top Market Cap Stocks

Unbroken Market Trend... Attention on Semiconductor, Secondary Battery Earnings and Exports

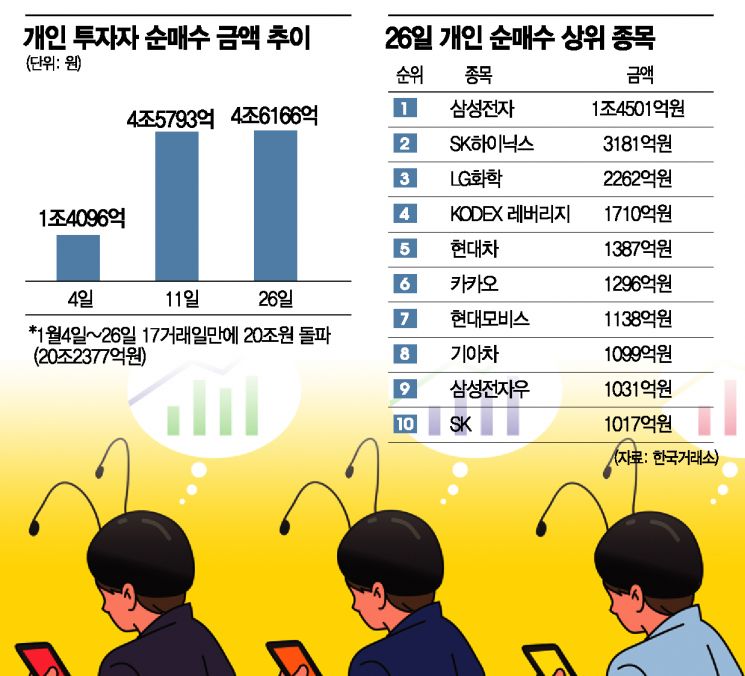

[Asia Economy Reporters Seon-ae Lee and Min-woo Lee] 4.6 trillion KRW. On the 26th, individual investors recorded a net purchase amount of 4.776 trillion KRW to defend the index decline by absorbing the massive sell-off of 4.776 trillion KRW from foreigners and institutions. This is the largest ever. On that day, individual investors made a net purchase of 4.205 trillion KRW in the KOSPI market and 411.3 billion KRW in the KOSDAQ market, totaling 4.6166 trillion KRW across both markets, breaking the record for the largest net purchase. The previous record was 4.5793 trillion KRW, consisting of 4.4921 trillion KRW in the KOSPI market and 86 billion KRW in the KOSDAQ market, recorded on the 11th. The total net purchase amount by individual investors reached 20.2377 trillion KRW, surpassing the 20 trillion KRW mark. Last year, it took 53 trading days to exceed 20 trillion KRW, but this year, thanks to unprecedented liquidity, it was achieved in just 17 trading days.

Individual investors focused their shopping baskets on ultra-large blue-chip stocks. Despite the KOSPI falling more than 2.14% that day, they judged it to be a good opportunity to buy market-leading blue-chip stocks and concentrated on 'large-cap shopping.' The top net purchased stock by individuals was Samsung Electronics, with a net purchase of 1.4501 trillion KRW. This is the second-largest single-day net purchase ever. This year alone, they have exceeded 1 trillion KRW in net purchases in a single day three times: on the 6th (1.0132 trillion KRW), the 11th (1.749 trillion KRW), and now.

SK Hynix, ranked second in market capitalization, was also bought with 318.1 billion KRW. This is the largest single-day net purchase since January 10, 2018 (335.4 billion KRW). LG Chem, the leader in secondary batteries, was net purchased by 226.2 billion KRW, marking the second-largest single-day net purchase ever. Other top market capitalization stocks such as Hyundai Motor (138.7 billion KRW) and Kakao (129.6 billion KRW) were also heavily bought.

The exchange-traded fund (ETF) product 'KODEX Leverage,' which rises in price as the index rises, was also accumulated in large quantities. A total of 171 billion KRW was purchased, ranking third in individual net purchases. This product tracks the KOSPI 200 index at twice the rate, and individual investors seem to believe that large-cap stocks in sectors leading the recent market, such as automobiles, semiconductors, secondary batteries, and internet, can continue to rise.

On the 27th, although the KOSPI and KOSDAQ indices started higher, they turned downward during the session and showed mixed trends, individual investors' net purchase streak continued. As of 9:30 AM, individuals bought 106.2 billion KRW in the KOSPI market and 111.9 billion KRW in the KOSDAQ market. The net purchased stocks were also centered on top market capitalization stocks, including Samsung Electronics, SK Hynix, LG Chem, KODEX Leverage, Hyundai Motor, and Kakao.

The market volatility is increasing due to the sharp rise in the index over a short period and profit-taking desires. However, considering expectations for economic recovery, earnings recovery, and liquidity, the general outlook in the securities industry is that the trend will not be broken. Accordingly, experts emphasize the need for cautious approaches when selecting stocks to add to the portfolio in the future.

Kim Dae-jun, a researcher at Korea Investment & Securities, said, "If the U.S. stimulus package proves effective, the U.S. economy will recover, and the Korean economy will benefit directly and indirectly, so the stock market will show a gentle upward trend after a short correction." He added, "Especially if the steep rise in interest rates and the resumption of domestic short selling can be avoided, the trend will not be broken." He further advised, "With the start of the Q4 earnings season, attention to profits has increased, and valuation burdens also make investors focus on fundamentals. The larger the consensus upward revision, the higher the probability of earnings surprises, and the expected returns increase accordingly. Therefore, I continue to recommend increasing the weighting of cyclical sectors such as displays, which have a steep earnings upward trend, and materials, which have relatively favorable earnings momentum."

Kim Yong-gu, a researcher at Samsung Securities, said, "When earnings expectations are valid and the market shows characteristics led by individuals, earnings momentum is strong, so I suggest an investment strategy focused on earnings momentum stocks." He added, "It is necessary to continue a concentrated response in export consumer goods sectors such as semiconductors, secondary batteries, automobiles, and vaccines." The priority order he suggested is semiconductors > secondary batteries > vaccine CMO > automobiles.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.