"Job-Centered Policies... Less Focus on Financial Market Liberalization"

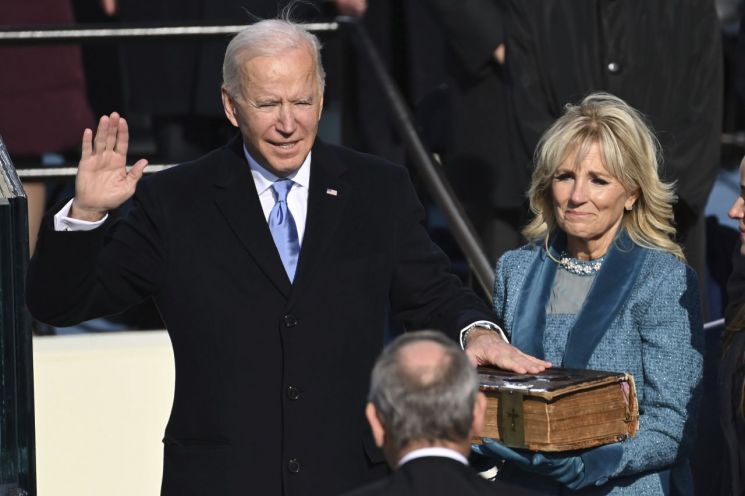

[Asia Economy Reporter Yujin Cho] It has been revealed that major U.S. financial firms donated a huge sum of $200 million to Joe Biden's campaign during the last presidential election.

According to the Center for Responsive Politics (CRP), a private organization tracking political funds, financial services companies contributed $200 million in campaign funds to Biden's camp in the recent U.S. presidential election. This amount is about four times the donations made by the industry during former President Donald Trump's 2017 election.

The U.S. financial services industry’s push to strengthen lobbying power is closely related to uncertainties in trade benefits. As the Biden administration prioritizes trade policies aimed at protecting domestic industries and workers, concerns are growing over the financial services sector, which is not directly linked to job creation.

In the past, the Trump administration pressured China to expand the opening of its financial services market and secured broad investment agreements. The two countries completed a Phase 1 agreement to remove barriers so that U.S. banks, insurance companies, and other financial service firms could enter the Chinese market.

However, it is uncertain whether this approach will continue under the Biden administration. Jake Sullivan, the designated National Security Advisor, pointed out during his time as Biden’s senior policy advisor that "the focus should be on raising wages and creating high-paying jobs in the U.S. rather than on trade measures to strengthen corporate competitiveness."

He explicitly emphasized that "pressuring China to open its financial system for Goldman Sachs will not be a priority in government negotiations."

The rapid growth of China’s financial market and forecasts that it will threaten the U.S.'s position in the global financial industry further fuel these concerns. According to data from the United Nations Conference on Trade and Development (UNCTAD), China’s foreign direct investment (FDI) increased by 4% last year, while FDI into the U.S. decreased by 49% compared to the previous year. The U.S., which had held the undisputed top position for decades, failed to block the spread of COVID-19 and could not prevent global capital from moving from the U.S. to China.

Meanwhile, the Wall Street Journal (WSJ) identified the financial services and pharmaceutical sectors as representative industries that fail to increase domestic jobs despite overseas investments in the Biden era. According to WSJ, Robert Lighthizer, U.S. Trade Representative (USTR) who designed protectionist trade policies under the Trump administration, advised the Biden administration that pharmaceutical companies with production bases in tax havens are the main culprits causing the U.S. trade deficit.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.