Ruling Party Mentions 'Interest Stop Rule'

Pressure Including Store Closures and Dividend Cuts

[Asia Economy Reporter Kiho Sung] As the ruling party strongly pushes for a profit-sharing system related to the novel coronavirus infection (COVID-19), tension is rising in the financial sector. The scope of the profit-sharing system has expanded from the initially mentioned platform companies to include the financial sector, putting it at risk of forced mobilization. Although the ruling party claims it is a 'voluntary participation,' it is not easy to refuse when the government and ruling party, who hold the regulatory power, apply pressure. Moreover, financial authorities have intensified management pressure by raising the threshold for bank branch closures and even recommending dividend reductions. There is also criticism that this is not the first time political pressure has been applied, turning it from 'government-controlled finance' into 'political finance.'

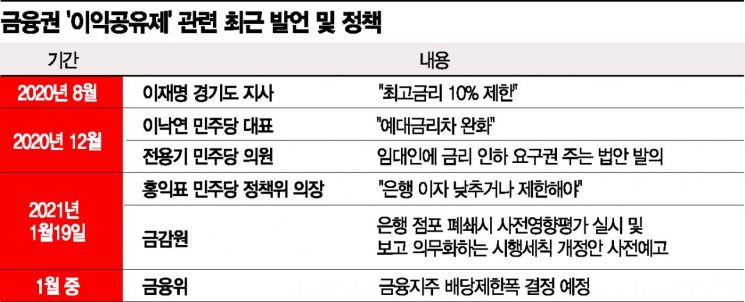

According to political and financial circles on the 20th, Hong Ik-pyo, chairman of the Democratic Party Policy Committee, appeared on a radio broadcast the day before and argued, "The biggest industry profiting even during the COVID-19 situation is the financial industry, so instead of just reducing rent and stopping, the interest from banks should also be stopped or limited." Hong reiterated the 'Interest Stop Act,' saying, "If necessary, it should be considered even through a temporary special law."

The ruling party's discussions have accelerated since Representative Lee Nak-yeon mentioned the 'profit-sharing system' earlier this year. Furthermore, when President Moon Jae-in responded at a press conference on the 18th, saying, "There are winners who are doing well and making money during COVID-19. It is a very good thing for such companies to contribute and create a fund," the momentum increased.

The profit-sharing system initially targeted platform companies such as online shopping and food delivery, which saw a surge in demand due to COVID-19. However, at the first meeting of the Post-COVID Inequality Resolution Task Force on the 15th, the Democratic Party raised the issue, "Did credit card companies also benefit from fees due to COVID-19 disaster relief funds?" expanding the scope to include the financial sector.

This is not the first time the political sphere has twisted the arms of the financial sector citing COVID-19. Last month, at a 'Financial Industry Video Conference for COVID-19 Bed Securing Cooperation' held at the National Assembly, Representative Lee Nak-yeon requested commercial banks to "pay attention to easing the interest rate spread," which sparked controversy over government control. In the same month, Democratic Party lawmaker Jeon Yong-gi also introduced bills to amend the Bank Act and Specialized Credit Finance Business Act to grant landlords who reduced rent the right to request interest rate reductions. Gyeonggi Province Governor Lee Jae-myung advocated last August to cap the maximum interest rate at 10%.

The pressure from financial authorities on the banking sector is also increasing. Eun Sung-soo, chairman of the Financial Services Commission, said at an online pre-briefing on the financial commission's work plan for this year held at the Seoul Government Complex in Gwanghwamun the day before, "Considering all temporary financial support measures such as maturity extensions, repayment deferrals, and financial regulation relaxations across the financial sector, it seems inevitable to extend them." Commercial banks have opposed interest repayment deferrals due to concerns about the proliferation of marginal companies and credit risks. However, with the extension of interest repayment deferrals being finalized, banks have no choice but to bear the bad debts.

Closing bank branches, one of the important business strategies for banks, is also becoming difficult. The Financial Supervisory Service, through a prior notice of the 'Banking Supervision Implementation Rules Amendment,' stipulated that banks must report the results of impact assessments involving external experts to financial authorities every three months if they intend to close branches. The threshold for branch closures, which previously only required internal impact assessments under bank self-regulation, has been significantly raised. While banks agree with concerns that financial accessibility for the elderly and vulnerable groups may decrease, there is widespread dissatisfaction that the authorities' intervention is excessive. Additionally, the authorities are recommending financial holding companies lower their year-end dividend payout ratios. Although the intention is to reduce dividends and accumulate cash in preparation for the COVID-19 impact, it has become a controversial issue over shareholder value erosion.

The financial sector is concerned that the continuous regulatory pressure from authorities and politicians may actually lead to policy implementation. There is also dissatisfaction that the government's and ruling party's arm-twisting is excessive, given that after COVID-19, the securities and bond market stabilization funds, green finance, and New Deal funds were forcibly mobilized, and repayment deferrals for self-employed and small businesses were implemented.

A bank official said, "It is difficult to openly oppose government policies," adding, "Especially in the case of the profit-sharing system, there is a risk of managerial breach of duty, so it is not easy to comply." Another financial sector official expressed concern, saying, "While it is the role of financial companies to support and participate in various policies when a crisis occurs, recently it has been excessive," and "There is considerable risk associated with forced mobilization."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.