Financial Services Commission Announces 2021 Financial Policy Directions

Market Response Positive... "Not Likely to Be Bad for Bank Profitability and Soundness"

[Asia Economy Reporter Kiho Sung] As the Financial Services Commission announced its financial policy direction for this year, the market evaluated the policy as not unfavorable in terms of the banking sector's profitability and soundness.

However, there is also an analysis that if the loan growth rate is maintained at 4-5%, which is 2-3 times higher than the annual GDP growth rate, and principal and interest installment repayments are limited only to large loans, the regulatory effect will be limited to certain groups and the effect will inevitably appear gradually.

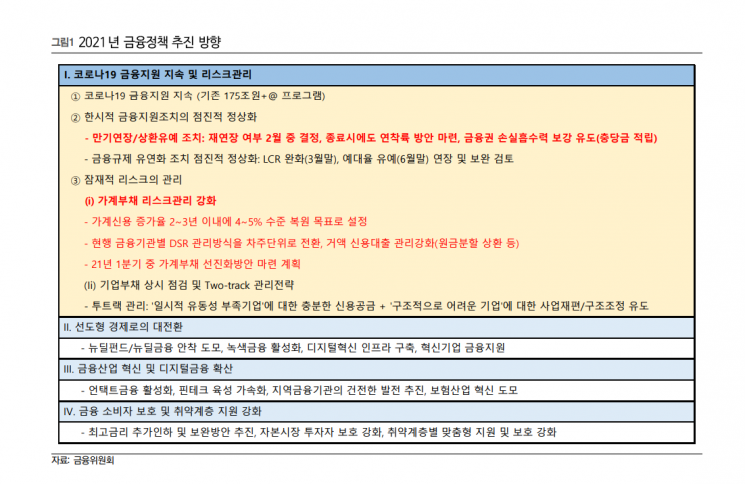

According to the financial sector on the 20th, the 2021 financial policy direction announced the previous day focused on promoting a smooth transition of loan maturity extensions and interest payment deferrals related to the novel coronavirus infection (COVID-19) and strengthening household debt risk management policies.

Regarding financial support, a final decision on whether to extend the maturity extension and repayment deferral measures for loans to small business owners and self-employed persons affected by COVID-19 will be made in February, and regulatory relaxation measures for financial institutions (LCR, easing of loan-to-deposit ratio) will be gradually normalized.

For household debt risk management, the target for household debt growth rate is set at 4-5%. In addition, an advanced household debt plan including a transition to a borrower-level total debt service ratio (DSR) management system and mandatory separate repayment of large credit loans will be prepared in the first quarter.

In this regard, the market evaluates the policy as not significantly burdensome to banks' profitability and soundness. Baeseung Jeon, a researcher at eBest Investment & Securities, predicted, "The gradual normalization of financial support measures and household loan regulations will act as factors slowing loan growth in the banking sector, but will have an effect of reducing uncertainty in terms of profitability and soundness."

Researcher Jeon noted that regarding the re-extension of maturity extension and interest payment deferral measures, the financial authorities recognize the need to normalize excessive financial support, and regardless of extension, banks are expected to recognize provisions, which will reduce related uncertainties.

He also judged that household loan regulations set a target growth rate of 4-5% over the next 2-3 years, so the possibility of sudden growth restrictions is low. He forecasted, "In the loan suppression process, imposing additional interest rates will work favorably for securing profitability."

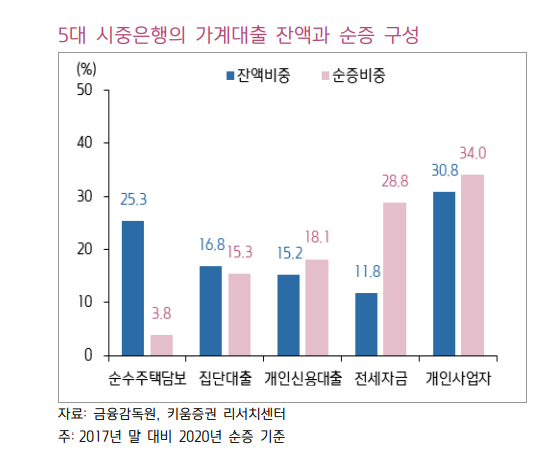

Youngsoo Seo, a researcher at Kiwoom Securities, predicted, "If the loan growth rate is maintained at 4-5%, which is 2-3 times higher than the annual GDP growth rate, and principal and interest installment repayments are limited only to large loans, the regulatory effect will be limited to certain groups and the effect will appear gradually."

Researcher Seo added, "Appropriate regulation can contribute to improving banks' net interest margin under stable loan growth conditions, which can have a considerable positive impact on profitability," and "If profitability improves this year with normal dividends, the significance will be even greater."

Furthermore, he judged that the government's policy to strengthen regulations on large loans and loans to the elderly will further suppress the inflow of funds into the real estate market, likely accelerating the money move phenomenon from real estate to stocks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.