Illegal Private Loan Average Interest Rate at 401%... 16.7 Times the Legal Maximum Interest Rate

Average Loan Amount 9.92 Million Won, Usage Period 64 Days

Most Victims Are Emergency Loan Borrowers... Illegal Private Loans Likely to Increase This Year as Legal Maximum Interest Rate Is Lowered

[Asia Economy Reporter Song Seung-seop] Last year, the average interest rate on illegal private loans reached 401% per annum. This figure exceeds 16 times the legal maximum interest rate of 24% per annum. Reports of illegal private loan damages also surged sharply.

Some experts express concerns that if the legal maximum interest rate is further lowered starting in the second half of this year, low-credit borrowers may be driven to illegal private financing, potentially causing illegal private loan interest rates to rise even higher.

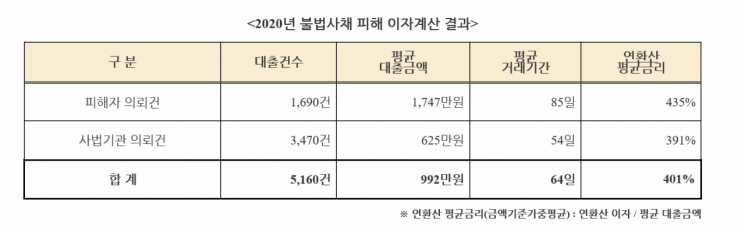

The Korea Credit Finance Association announced on the 20th that an analysis of 5,160 high-interest loan transactions conducted last year showed an annualized average interest rate of 401%. This is about three times higher than the 145% recorded in 2019, before the outbreak of the novel coronavirus disease (COVID-19). The average loan amount for victims was 9.92 million KRW, and the average transaction period was 64 days.

Users of quick cash loans accounted for the largest share at 93% (4,830 cases) of the total. Daily loans numbered 285 cases, followed by secured loans at 45 cases.

This is attributed to the rapid economic downturn caused by the spread of COVID-19 combined with the impact of the legal maximum interest rate reduction, which increased demand for borrowing from illegal private lenders. The government has amended the Enforcement Decrees of the Interest Limitation Act and the Loan Business Act to lower the legal maximum interest rate from the current 24% to 20%, a 4 percentage point reduction, effective from the second half of this year. Accordingly, borrowers with poor credit or delinquencies are highly likely to be driven to illegal private financing. Professor Choi Cheol of the Department of Consumer Economics at Sookmyung Women’s University recently estimated in a report that 570,000 borrowers may want loans but be unable to obtain them due to the legal maximum interest rate reduction.

Low-Credit Borrowers Driven to Illegal Private Loans

Interest Rates May Rise Further with Legal Maximum Interest Rate Reduction in Second Half

Under current law, unregistered lending businesses face imprisonment of up to five years or fines up to 50 million KRW, and violations of the legal maximum interest rate regulations are subject to aggravated penalties of up to three years imprisonment or fines up to 30 million KRW.

Nevertheless, unlike regular financial transactions, illegal private loans involve irregular and non-fixed repayment of principal and interest, making it difficult for victims to calculate the amount of interest damage. Law enforcement agencies also require interest rate calculations to prosecute illegal lenders for violating interest rate limits.

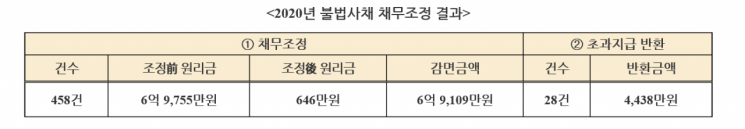

Accordingly, since 2015, the Association has continuously supported law enforcement agencies and victims in calculating interest rates. Last year, for 458 cases of illegal private loan damages, interest rates were readjusted within the legal limit, or 44.38 million KRW of interest already paid was refunded to debtors.

The Association stated, “Recently, illegal private lenders have been enticing self-employed and low-income individuals who cannot use formal financial institutions through false and exaggerated advertisements on internet and direct loan transaction sites, leading them to take high-interest private loans.” They added, “As cases of damage are rapidly increasing, special caution is required.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.