Bank of Korea 'Overseas Economic Focus'

[Asia Economy Reporter Kim Eun-byeol] The prices of raw materials, which rose on expectations that COVID-19 vaccines and various countries' stimulus measures would revive the global economy, are expected to continue their upward trend for the time being this year.

On the 17th, the Bank of Korea stated in its 'Overseas Economic Focus' report, "International raw material prices are likely to maintain the upward trend that has continued since the second half of last year, supported by global economic recovery and sustained preference for risk assets," adding, "Crude oil prices, which have recently shown a clear upward trend, are expected to lead the price increases, while prices of grains and non-ferrous metals, having surged sharply in a short period, will likely see a somewhat moderated steep rise in the second half of the year."

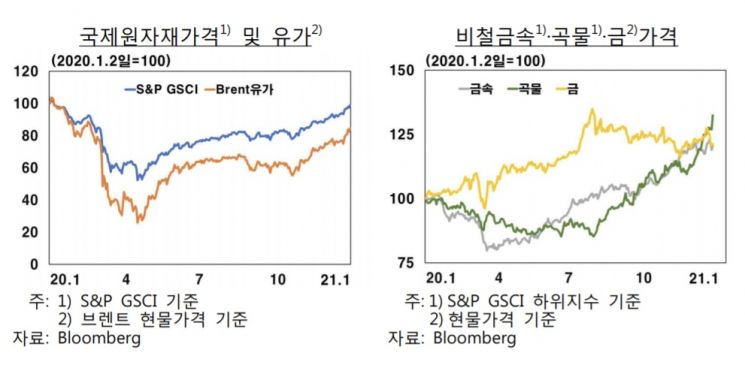

Recently, prices of non-ferrous metals and grains have shown a strong upward trend since the second half of last year, and crude oil prices are also clearly rising.

By item, copper prices are currently around $8,000 per ton as of mid-January, the highest level since February 2013, and soybean prices have shown a steep rise since August, currently exceeding $14 per bushel, marking the highest level since June 2014. International crude oil prices have turned upward since November last year, recently reaching the mid-$50 range. Gold prices, after hitting an all-time high in early August last year, have slightly declined and are hovering around $1,900.

The Bank of Korea explained, "These price increases are mainly due to China driving global raw material demand based on solid growth, along with accommodative monetary policies and large-scale economic stimulus measures strengthening the preference for risk assets, which has increased the inflow of global investment funds into the raw material market."

International raw material prices have also been partially influenced by individual factors such as OPEC+ (the Organization of the Petroleum Exporting Countries (OPEC) and a coalition of major non-OPEC oil-producing countries including Russia) production quota adjustments and weather anomalies.

The Bank of Korea said, "Both common and individual factors are likely to act as price-increasing pressures," and added, "As the global economy improves and investment sentiment recovers due to vaccine rollouts and other factors, global demand conditions for raw materials are expected to steadily improve."

As for individual factors, the resolution of accumulated oversupply in crude oil, tight supply-demand conditions for non-ferrous metals due to China's solid growth and production disruptions, and grains affected by poor harvests from weather anomalies and increased feed import demand from China are expected to exert upward pressure. Despite a weakening preference for safe-haven assets, gold prices are still expected to face strong upward pressure due to negative real interest rates and rising inflation expectations.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.