Off-Season December in Real Estate Market

House Prices Surge and Jeonse Crisis Overlap

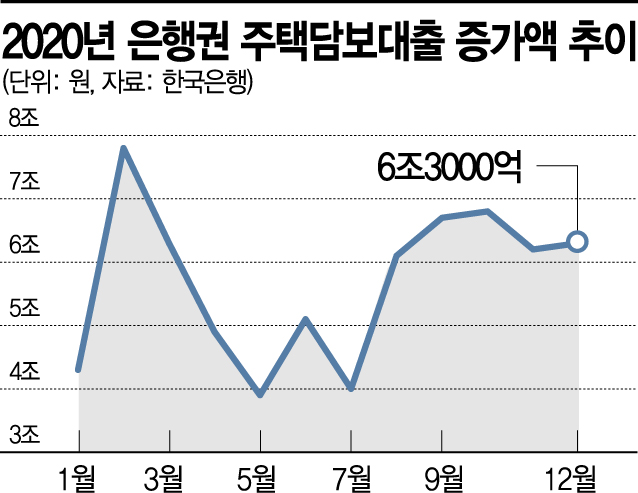

Increase of 6.3 Trillion Won Sets Record Growth Rate

[Asia Economy Reporter Jo Gang-wook] Despite the government's successive real estate regulatory measures, bank mortgage loans recorded the highest increase ever for the month of December last month. This is attributed to the nationwide surge in housing prices and the shortage of jeonse (long-term lease deposits) amid the economic downturn caused by the COVID-19 pandemic. In particular, housing-related loans among young people in their 20s and 30s are steadily increasing, and with recent rises in bank interest rates, concerns about a future 'debt bomb' are growing.

According to the Bank of Korea and financial authorities on the 15th, among the household loans that increased by more than 100 trillion won last year, the increase in mortgage loans was recorded at 68.3 trillion won. This is the second-largest increase after 70.3 trillion won in 2015.

Especially in December, the year-end month, mortgage loans increased by 6.3 trillion won. This is the highest ever for December since statistics began in 2004. The surge in mortgage loans in December, typically an off-season for the real estate market, was due to the nationwide rise in housing prices combined with the jeonse shortage. December is generally considered an off-season in the real estate market.

A financial authority official explained, "Mortgage loans increased more than usual due to expanded housing transactions and rising housing prices." Nationwide housing transactions increased from 1.62 million units in 2016 to 1.76 million units in 2017, then decreased to 1.72 million units in 2018 and 1.57 million units in 2019. However, last year, it sharply rose to 1.8 million units.

The problem is that the increase, which showed signs of slowing due to loan regulations by financial authorities, is growing again. The increase in bank mortgage loans decreased from 5.6 trillion won in December 2019 to 4.3 trillion won in January last year. However, as the COVID-19 situation intensified, it jumped to 7.8 trillion won in February last year, then slowed to 6.3 trillion won in March, 4.9 trillion won in April, and 3.9 trillion won in May. It then fluctuated with 5.1 trillion won in June, 4 trillion won in July, 6.1 trillion won in August, 6.7 trillion won in September, and 6.8 trillion won in October. It decreased to 6.2 trillion won in November but increased again to 6.3 trillion won in December.

In particular, with the loan frenzy for stock and real estate investments known as 'debt investment (debt-to-invest)' and 'all-in (pulling together everything including one's soul),' combined with the jeonse shortage, housing-related loans among young people, whose debt repayment ability is relatively low, are on the rise, raising concerns. According to the Bank of Korea's 'December 2020 Financial Stability Report,' housing-related loans such as mortgage loans and jeonse deposit loans for young people reached 260.2 trillion won at the end of the third quarter this year, a 10.6% increase compared to the same period last year.

Moreover, bank mortgage loan interest rates have been steadily rising. The COFIX (Cost of Funds Index) new transaction-based indicator, which serves as the basis for calculating variable mortgage loan interest rates at banks, rose to 0.9% in December last year, up 0.03 percentage points from the previous month, marking the highest level in six months. Accordingly, commercial banks collectively raised related loan interest rates on the 16th of last month, pushing the highest interest rate close to 4% per annum.

The Bank of Korea stated, "Despite a slowdown in group loan issuance, nationwide demand for funds related to housing sales and jeonse increased," and warned, "If the recent steep increase continues, the debt repayment ability of young people is likely to weaken significantly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.