Lotte Chemical, Kakao Acquisitions... Most Posted Strong Q4 Results Last Year, Growth Expected This Year

[Asia Economy Reporter Geum Bo-ryeong] While foreign and institutional investors have shown strong net selling for two consecutive days, the stocks they purchased are attracting market attention.

According to the Korea Exchange on the 13th, institutional investors sold a net 3.7432 trillion KRW and foreign investors sold 725.9 billion KRW in the KOSPI market on the 11th. On the 12th, institutions and foreign investors also sold 1.7239 trillion KRW and 628.4 billion KRW respectively.

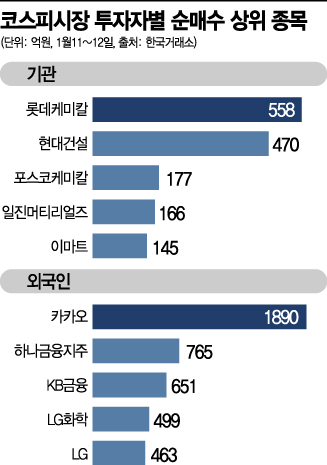

Despite the net selling streak, the stocks they net bought stand out. In the KOSPI market on the 11th and 12th, the stock most purchased by institutional investors was Lotte Chemical (55.8 billion KRW). This was followed by Hyundai Construction (47.0 billion KRW), POSCO Chemical (17.7 billion KRW), Iljin Materials (16.6 billion KRW), and E-Mart (14.5 billion KRW).

Most of these companies are expected to report strong earnings in Q4 last year or are anticipated to grow this year. Eugene Investment & Securities estimates Lotte Chemical's Q4 operating profit at 231.5 billion KRW, a 57.3% increase compared to the same period last year. Additionally, with Chinese coal prices surging about 70% from last year's low earlier this month, a windfall effect is expected for domestic companies like Lotte Chemical. Hyundai Construction is forecasted to improve overseas profitability this year as it recovers from the COVID-19 pandemic. E-Mart is strengthening its dominance in the domestic online food market through SSG.COM.

During the same period, the stock most added to foreign investors' portfolios was Kakao (189.0 billion KRW). Next were Hana Financial Group (76.5 billion KRW), KB Financial Group (65.1 billion KRW), LG Chem (49.9 billion KRW), and LG Corp (46.3 billion KRW). Kakao is expected to improve profitability as payment fees and identity verification fees expand through 'KakaoTalk Wallet' and subscription economy services launched by Kakao Pay. The 'commerce-pay-advertisement' system within KakaoTalk is expected to be further strengthened. Korea Investment & Securities reports that Hana Financial Group and KB Financial Group posted Q4 net profits of 455.5 billion KRW and 612.6 billion KRW respectively, exceeding consensus estimates by 21% and 11%.

Although the KOSPI declined over the two days, most stocks purchased by institutional and foreign investors showed an upward trend. The KOSPI, which was at 3,152.18 on the 8th, fell 0.83% to 3,125.95 the previous day, but Lotte Chemical rose 3.99% from 301,000 KRW to 313,000 KRW. Hyundai Construction rose 11.22%, E-Mart 2.23%, Kakao 5.41%, and Hana Financial Group 3.85%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)