[Asia Economy Reporter Seulgina Jo] "The way to survive is 'original content.'"

As the domestic OTT market enters the Warring States period, local OTT platforms are actively securing so-called 'Net-eopX-it (content not on Netflix but available on their own platforms).' With the influx of OTT platforms such as Disney Plus, which is set to launch in Korea this year, and Coupang Play, which emphasizes the lowest price, it is judged that differentiated original content is essential to survive. The moves of OTT giant Netflix, which has enjoyed great success with Korean original content such as 'Kingdom' and 'Sweet Home,' have also served as a backdrop.

◆ Domestic OTTs Increasing Original Content

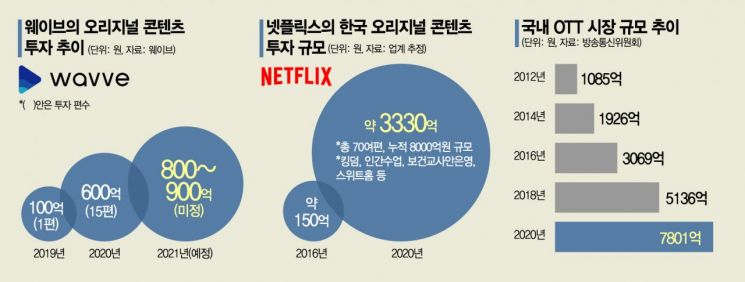

According to industry sources on the 4th, Wavve, which is based on terrestrial broadcasting content, plans to expand its investment in original content to 90 billion KRW this year. Wavve, which received favorable reviews for its first original content 'The Nokdu Flower' launched in September 2019, has been aggressively investing in original content since May last year. Over the past year alone, it has released as many as 15 original contents including terrestrial dramas. The genres are diverse, ranging from dramas like 'SF8' and 'Zombie Detective' to variety shows like 'The Witches.' The investment scale has also increased from 10 billion KRW in its first year to 60 billion KRW last year, and is expected to reach 80 to 90 billion KRW this year.

Seezn, operated by telecom company KT, also established a dedicated 'Original' section during its December revamp last year, focusing on enhancing content competitiveness. The number of self-produced contents (including short-form) released since the days of Olleh TV Mobile to the present reaches about 130 titles. Especially this year, Seezn plans to shift its focus from short-form content of around 10 minutes to high-quality mid-form content. Seezn is differentiating itself from other companies with a cross-media strategy that includes producing original films like 'Double Patty' and pre-selling them overseas, not limiting releases to Seezn only.

Domestic OTTs that are starting full-scale original content production are also lining up. Watcha, which completed a Series D investment of 36 billion KRW, will begin producing original content this year. Last year, Watcha gained good responses by leading with exclusive content known as 'Net-eopWatch-it (content not on Netflix but on Watcha)' such as 'Kidding,' 'Why Women Kill,' and 'Mrs. America.' They plan to add self-production to this.

Tving, a joint venture between CJ ENM and JTBC, will also release its first original content 'High School Mystery Club' this month. Since CJ ENM has formed a content production alliance with Naver, future moves are highly anticipated. Coupang, which recently officially entered the OTT market, has also announced plans to produce original content in the future.

◆ Catching Up with Netflix: Will It Become a Chicken Game?

Original content that can only be viewed on a specific platform is one of the representative strategies for OTTs to strengthen content competitiveness and increase new users. According to mobile research firm Open Survey, among the top domestic OTT platform Netflix's paid subscribers, 4 to 5 out of 10 chose Netflix because 'there is specific content that can only be used here (45.3%).' A Seezn official stated, "Currently, the number of original content titles among the VOD content provided by Seezn is less than 1%, but it was found that 3 out of 10 VOD users watched original content."

In particular, domestic OTTs are paying close attention to Netflix's moves, which have enjoyed great success by leading with original content for several years. The hot popularity of K-content such as 'Kingdom' and 'The School Nurse Files' is considered one of Netflix's main growth drivers in the global market. 'Sweet Home,' released by Netflix at the end of last year, ranked third worldwide in traffic as of the 25th of last month, surpassing 'Kingdom.'

The reason why Netflix's investment in Korean content, which was only 15 billion KRW in its first year of entry in 2016, has expanded more than 20 times to the 300 billion KRW level annually is also related to this. SK Management & Economic Research Institute previously evaluated in an OTT-related report, "The challenge is to provide something differentiated from competitors while defending against high cancellation rates, and the answer to this is original content."

However, there are also repeated criticisms that domestic OTTs face significant limitations in competing against financially powerful companies like Netflix and Disney Plus. Although enormous funds are required in the production process, immediate profit is not secured, which could lead to a chicken game in the future. Some suggest that active government support measures such as tax credits for producing 'pilot programs' are necessary to revitalize domestic platforms.

Ultimately, domestic OTTs seem to need to find answers in global market expansion led by K-content. The achievements brought by overseas format exports of original content from terrestrial and general programming channels also have significant implications for future OTT strategies. An industry insider emphasized, "It is practically difficult to fight Netflix alone," adding, "Since Korean content is also accepted overseas, an OTT content alliance looking at overseas markets rather than the domestic market is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.