Recent Remarkable Surge in Coupang Eats Users in the Delivery App Market

"Internally, it is an emergency situation. Coupang Eats is rapidly advancing." This is a frequently heard comment recently in the delivery application (app) industry. Although there was an analysis that Coupang Eats would demonstrate strong potential in the delivery market based on Coupang's e-commerce competitiveness, the prevailing view was that the existing structure was too solid. However, since the second half of last year, its expansion has become prominent enough to pose a threat to leading companies.

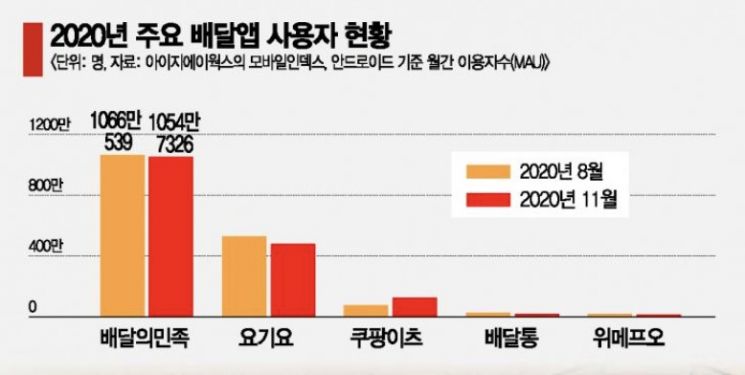

According to Mobile Index by big data company IGAWorks on the 2nd, the number of Coupang Eats users (MAU) on Android smartphones in November last year increased by 70% compared to August. The number of users rose from 748,000 in August to 1,264,000 in November, with over 500,000 new users joining Coupang Eats in the past three months. Compared to November last year, the number of users increased by over 1 million this year, and the concentration of 500,000 users in the recent three months indicates that the growth rate is accelerating.

What stands out is that during the recent three months, all major delivery apps except Coupang Eats experienced a decrease in users. Baedal Minjok (Baemin), which holds the number one position, managed to limit the decline to just over 1%, but Yogiyo saw a 10% drop, and Baedaltong experienced a 27% decrease in users. Wemakeprice O (Wemakeprice O), which had been steadily increasing its users as a latecomer, also showed a 28% decline in the past three months. Despite the increase in delivery orders due to the resurgence of COVID-19, users of major delivery apps decreased while only Coupang Eats saw a significant increase. An industry insider explained, "During this period, 'multi-homing' users who selectively use delivery apps depending on coupon issuance and marketing events concentrated on Coupang Eats."

Coupang Eats' aggressively executed marketing strategy is being evaluated as effective. Coupang Eats promotes a system where one delivery rider is assigned to one order, rather than the 'combined delivery' method that handles 3 to 4 orders at once. The industry analyzes that consumer satisfaction with the 'one delivery rider per one delivery' system is high, allowing Coupang Eats to quickly secure market share. To guarantee the income of riders who cannot perform combined deliveries, delivery fees have also been raised. This indicates significant investment is being made.

Moreover, Coupang Eats expanded its service to the entire Seoul area in June last year and began targeting the Gyeonggi region in the second half of the year. Following that, starting from Busan Metropolitan City on the 8th of last month, the service area has been expanding sequentially to Daejeon Metropolitan City, Ulsan Metropolitan City, and Daegu Metropolitan City. In terms of securing franchise stores, Coupang Eats has acquired many competitive restaurants through aggressive promotional fee operations and fast payment of settlement funds. An industry insider said, "Coupang Eats is recording explosive growth centered on the metropolitan area and is expanding its service nationwide," adding, "By leveraging Coupang's logistics experience and technological capabilities to expand the business, the user growth trend is expected to continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)