Corona Windfall... Decline in Loss Ratios for Automobiles and Others

Foreign Companies Withdraw from Korean Market... M&A Shakeup

[Asia Economy Reporter Oh Hyung-gil] This year, insurance companies enjoyed windfall benefits by securing profitability and financial soundness despite the crisis caused by the novel coronavirus infection (COVID-19).

Due to the suspension of redemptions by private equity funds, sales of savings-type insurance increased, and the implementation of social distancing measures led to lower loss ratios for major products such as automobiles. However, concerns over losses grew due to deteriorating investment conditions.

As foreign insurance companies began to withdraw from the Korean market in earnest, the mergers and acquisitions (M&A) market heated up. Financial holding companies and private equity funds (PEF) jumped into insurance company M&A, signaling a major shift in the industry. With a series of new regulations set to be implemented in the new year, a hectic year is expected.

Securing Both Profitability and Soundness

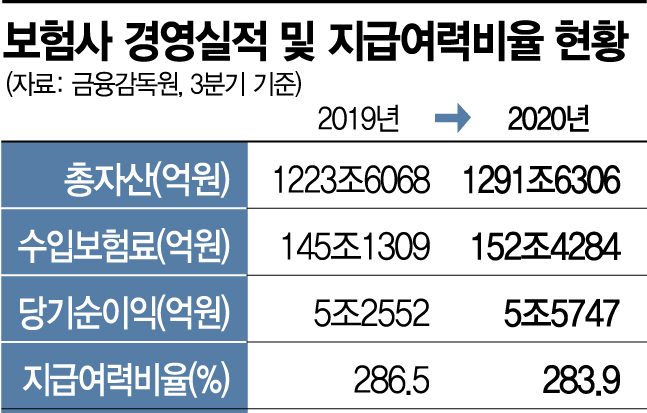

According to the Financial Supervisory Service (FSS) on the 31st, as of the end of September, the average Risk-Based Capital (RBC) ratio of insurance companies was 283.9%, up 7.5 percentage points from 276.4% at the end of June. The RBC ratio, which shows how much money an insurer can pay when policyholders claim insurance benefits, is an indicator of an insurer’s financial soundness. The Insurance Business Act requires maintaining it above 100%, and the FSS recommends maintaining it above 150%.

As of the third quarter, all insurance companies exceeded the FSS recommended level, interpreted as having secured stable financial soundness ahead of the introduction of the new international accounting standard (IFRS17) and the new solvency regime (K-ICS) in 2023.

Among life insurers, Kyobo Lifeplanet had the highest RBC ratio at 781.3%, followed by Prudential Life (486.4%), Orange Life (412.6%), and Cardiff Life (406.0%). On the other hand, IBK Pension Insurance recorded the lowest at 171.8%.

Among non-life insurers, Seoul Guarantee Insurance had 414.9%, AIG Non-Life Insurance 408.3%, and Samsung Fire & Marine Insurance 319.3%. Lotte Non-Life Insurance was the lowest at 169.4%.

Hana Non-Life Insurance, which recorded an RBC ratio of 115.7% at the end of June, rose to 252.3%, resulting in all insurance companies exceeding the RBC ratio of 150%.

During the same period, insurance companies’ profitability also improved. The cumulative net income of insurance companies for the third quarter was 5.5747 trillion won, an increase of 6.1% (319.5 billion won) compared to the same period last year. The loss ratio for automobiles and long-term insurance fell due to the impact of COVID-19, reducing insurance operating losses.

However, due to the depreciation of exchange rates and prolonged low interest rates, foreign currency translation gains and interest income decreased, leading to reduced profits in the investment sector, making future profitability improvements uncertain.

Successive M&As... Major Changes in Industry Rankings

This year, several foreign insurance companies came onto the market. Orange Life found a new owner in Shinhan Financial Group (Shinhan Holdings), and Prudential Life was acquired by KB Financial Group, becoming a successful model.

Other foreign insurers still have the potential to withdraw at any time. French-based AXA Non-Life Insurance has been negotiating a sale with Kyobo Life but the process is currently stalled, and American MetLife Life is also continuously rumored to be up for sale. AIA Life and LINA Life, which have been considered potential sale candidates, have had their CEOs directly dismiss the sale rumors.

Following Lotte Non-Life Insurance, which was acquired by a PEF, KDB Life will also be sold to JC Partners, a PEF. KDB Life, which failed to sell three times in the past decade, is expected to be reborn as a co-reinsurance company through this sale. Co-reinsurance is a system where insurers transfer not only risk premiums but also savings premiums to reinsurers to mitigate interest rate risks.

Competition for insurance company rankings is expected to intensify further. Shinhan Life, the fourth-largest life insurer, is scheduled to launch in July next year, and Meritz Fire & Marine Insurance, ranked fifth in non-life insurance, is expected to surpass higher-ranked companies in net income. Meritz Fire & Marine’s cumulative net income for the third quarter was 323.6 billion won, ranking third after Samsung Fire & Marine Insurance (628.9 billion won) and DB Insurance (442 billion won).

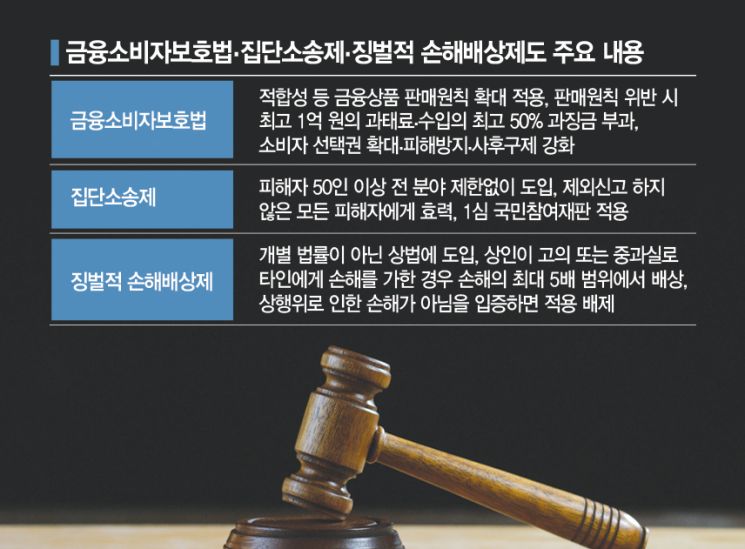

The insurance industry is on the verge of introducing new regulations next year. First, in January, the agent recruitment commission payment system will be restructured to limit first-year recruitment commissions to 1200%. In March, the Financial Consumer Protection Act will be enforced, imposing punitive fines for violations of sales principles. In July, employment insurance will become mandatory for special types of workers such as agents.

Additionally, the fourth-generation indemnity insurance product will be launched in July next year. The core of the fourth-generation indemnity insurance is to reduce premiums by separating the product structure into covered and non-covered benefits and optimizing deductibles and coverage limits. Large insurers such as Hanwha Life, Mirae Asset Life, and Hyundai Marine & Fire Insurance are expected to accelerate the 'separation of manufacturing and sales (Je-pan separation)'.

An industry insider said, "In the context of low interest rates and COVID-19, insurance companies have focused on improving product portfolios and management efficiency. Next year, it will be time for each to fend for themselves in line with the introduction of systems to strengthen consumer protection and enhance benefits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.