[2021 Industry Outlook] ① Electric and Electronics Entering a Supercycle

Record Highs of 70,000 and 120,000 Won This Year... Semiconductor Boom Expected Next Year

Exports Increase Driving Earnings Growth... Target Prices Raised to 90,000 and 150,000 Won

[Asia Economy Reporter Song Hwajeong] The electrical and electronics sector, which has played a leading role in the second half of this year, is seeing growing expectations for performance as the semiconductor supercycle is anticipated next year. Samsung Electronics and SK Hynix, which both hit record highs this year, are expected to see their stock prices exceed 90,000 KRW and 150,000 KRW respectively next year.

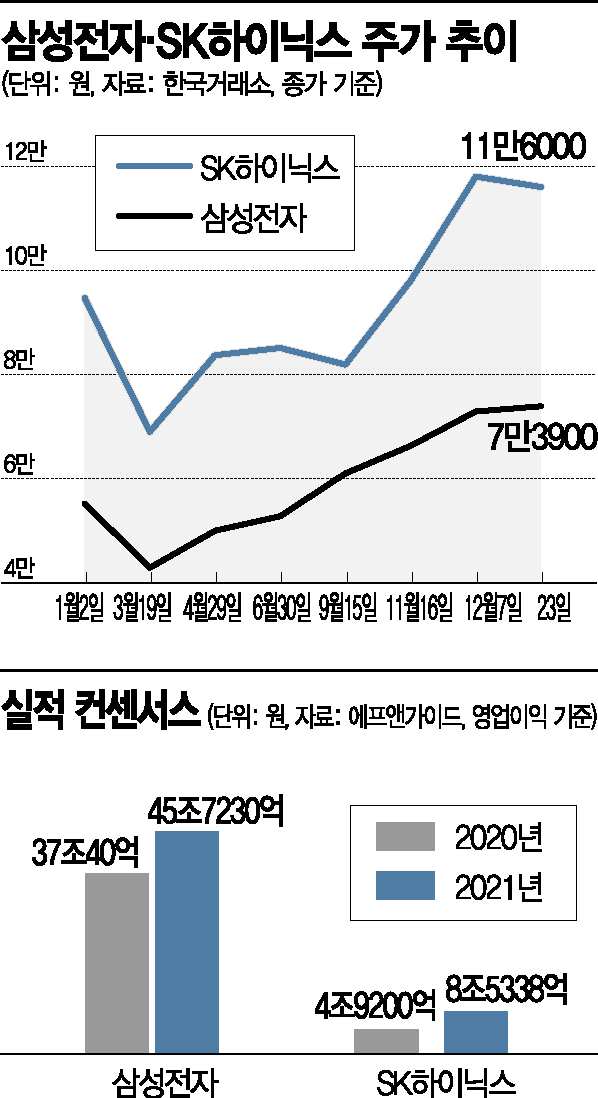

According to the Korea Exchange on the 24th, the KOSPI electrical and electronics sector index has risen 34.27% so far this year. The index increase was driven by the sharp rise in stock prices of the leading companies Samsung Electronics and SK Hynix, both of which recorded all-time highs. During the same period, Samsung Electronics rose 30.8%, and SK Hynix increased by 20.83%. Samsung Electronics recently surpassed 70,000 KRW, reaching new highs. On the 14th, it even climbed to an intraday high of 74,500 KRW, setting a new record. SK Hynix's stock price also rose into the 110,000 KRW range and is attempting to break through 120,000 KRW. On the 9th, it reached an intraday high of 121,000 KRW, also setting a new record.

In the first half of this year, due to the impact of COVID-19, foreign investors sold off heavily, causing Samsung Electronics and SK Hynix to lose their leading stock positions to BBIG (Battery, Bio, Internet, Game) and show relatively sluggish performance. However, in the second half, they reclaimed their leading roles and drove the KOSPI to new all-time highs.

Expectations are particularly high as the semiconductor industry is forecasted to enter a supercycle next year. Semiconductor exports surged 26.4% year-on-year this month, and export growth is expected to continue next year. According to KOTRA, the semiconductor market is expected to enter a supercycle next year, with DRAM demand increasing by 19% and NAND by 34% compared to this year.

No Geun-chang, a researcher at Hyundai Motor Securities, said, "The DRAM market in 2021 will see new and replacement investments in data centers starting in the second half of the second quarter. Server DRAM prices are expected to form a bottom at around $108 in the first quarter and rise to the $152 range by the fourth quarter, while NAND prices will decline until the first half and then rebound in the second half."

Choi Doyeon, a researcher at Shinhan Financial Investment, analyzed, "DRAM prices will rise from the first quarter next year. Huawei's rush orders accelerated inventory depletion, and recent mobile semiconductor orders for Oppo, Vivo, and Xiaomi are expanding. Server semiconductor orders for data centers have also resumed as server companies reduce inventories."

With export growth and industry improvement, expectations for next year's performance are also increasing. According to financial information provider FnGuide, Samsung Electronics' operating profit consensus for this year is 37.004 trillion KRW, up 32.86% from the previous year. The forecast for next year is 45.723 trillion KRW. SK Hynix's operating profit is estimated to increase by 81.31% to 4.92 trillion KRW this year and is expected to reach 8.5338 trillion KRW next year. The performance growth of these two leading companies is expected to lead to an increase in KOSPI earnings. Shinhan Financial Investment researcher Bae Han-ju said, "The KOSPI's net profit consensus for next year is 129.5 trillion KRW. The KOSPI net profit has only exceeded 100 trillion KRW twice, in 2017 (142.7 trillion KRW) and 2018 (130.2 trillion KRW), during the semiconductor boom. With the improvement in the semiconductor industry next year and recovery from the COVID-19 impact, expectations for profit normalization are high."

Given the favorable industry conditions and performance growth outlook, further stock price increases are expected. Securities firms are raising their target prices for Samsung Electronics and SK Hynix, with Samsung Electronics' target price rising to 90,000 KRW and SK Hynix's to the 150,000 KRW range.

Lee Sunhak, a researcher at Hanwha Investment & Securities, said about Samsung Electronics, "The rebound in memory prices will contribute to overall performance improvement, and growth in the foundry business will bring mid- to long-term valuation rerating. Compared to the KOSPI and competitor TSMC, Samsung Electronics has relative valuation merits, so the upside is open." Hanwha Investment & Securities raised Samsung Electronics' target price from 76,000 KRW to 92,000 KRW.

Park Yuak, a researcher at Kiwoom Securities, said, "Reflecting the DRAM price outlook, we raised SK Hynix's earnings per share (EPS) forecasts for 2021-2022 and increased the target price to 150,000 KRW. Since the memory supercycle is just beginning, positive momentum will be concentrated from the fourth quarter of this year through the first quarter of next year, and stock prices are expected to record the strongest gains during this period."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.