After the Enforcement of the On-to-Law, 41 P2P Companies Closed... Average Delinquency Rate Soars to 20.99%, Twice That of Last Year

Recovery of Loan Claims May Be Difficult When Small P2P Companies Close... Concerns Over Investor Defaults

Since the implementation of the Online Investment Trading Act on August 27, the number of closures among P2P companies has been increasing.

Since the implementation of the Online Investment Trading Act on August 27, the number of closures among P2P companies has been increasing.

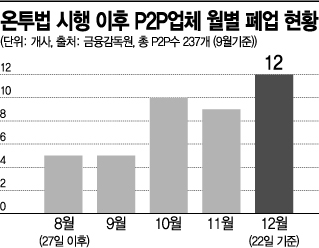

[Asia Economy Reporter Gong Byung-sun] Since the Online Investment-Linked Finance Act (OnTu Act) was enforced last August, a total of 41 P2P (peer-to-peer) companies have closed down. In particular, 12 companies have shut down just this month. Experts predict that the number of closures will inevitably increase as financial authorities have set a policy to induce unqualified companies to close. Concerns are rising over the damage to financial consumers who invested in P2P companies, highlighting the urgent need for investor protection measures.

According to financial authorities and related industries on the 22nd, since the enforcement of the OnTu Act on August 27, a total of 41 companies have ceased operations as of this date. During the first comprehensive survey by financial authorities in September, 17% of the 237 companies had closed. P2P refers to services that mediate between investors and borrowers without going through traditional financial institutions. P2P companies operate by collecting investment funds from an unspecified number of people and lending them to those who want loans, earning interest in return.

12 P2P Companies Closed This Month... "More P2P Companies Will Be Forced Out"

The closure of P2P companies has accelerated this month, with 12 companies already shutting down. Experts forecast that more companies will close in the future. So-young Lee, a researcher in the Risk Management Division at the Korea Deposit Insurance Corporation, said, "There are P2P companies ceasing operations due to management fraud, embezzlement, and poor loan screening," adding, "Authorities plan to induce unqualified companies to either convert to lending businesses or close, so the number of P2P companies being forced out will increase." She also expressed concern, saying, "If operating P2P companies close, loan recovery procedures may be halted, potentially transferring damages to investors."

Additionally, the possibility of loan defaults is increasing. According to P2P information provider Midrate, the average delinquency rate of P2P companies reached 20.99% as of this date, nearly double the 11.4% recorded at the end of last year. Since P2P loans are not yet part of the formal financial system, there are no specific standards for delinquency rates, but the increase is steep.

There is also analysis that the prolonged COVID-19 pandemic has driven up delinquency rates. Researcher Lee explained, "Although the stock market is booming due to COVID-19, the real economy is not doing well," adding, "Many borrowers from P2P companies are medium- to low-credit individuals who typically cannot obtain loans from formal financial institutions, so they have been more severely affected by the economic downturn caused by COVID-19."

Urgent Need for Investor Protection... Loan Recovery May Be Difficult for Small P2P Companies

Accordingly, there are calls for urgent measures to protect investors. Although the Financial Services Commission’s guidelines and the OnTu Act include measures such as entrusting loan recovery tasks to law firms when P2P companies cease operations, most P2P companies at risk of closure are small-scale, and loan recovery may not be systematically conducted. In fact, victims of Nekpun, which closed in July and failed to return 25.1 billion KRW in outstanding loans, still complain that their investments have not been recovered.

A Financial Supervisory Service official said, "There are no specific measures yet regarding the closure of small-scale P2P companies and investor protection," adding, "We recognize potential problems and will work on developing concrete solutions going forward."

Meanwhile, a significant number of P2P companies have not yet completed the registration process under the OnTu Act. Only three companies?8Percent, Rendit, and PeopleFund?have officially submitted P2P company registration applications to the Financial Services Commission.

Reporter Gong Byung-sun mydillon@asiae.co.kr

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.