New Securities Firms' All-Out Battle to Target 'Joorini' Next Year

Fierce Competition for the Top Stock Trading App Among Beginner Investors

Toss Securities to Launch MTS in February Next Year... Kakao Pay Expected by Year-End

[Asia Economy Reporter Minwoo Lee] Competition among emerging securities firms targeting novice investors in their 20s and 30s, known as 'Joorini (stock + child),' is expected to intensify. While KakaoPay Securities' mobile trading system (MTS) launch is only possible by the end of next year, Toss Securities is set to release its MTS first, focusing all efforts on capturing the Joorini market.

According to industry sources on the 23rd, Toss Securities plans to launch its MTS around February next year. A Toss Securities representative said, "Most of the development is already complete, and we are currently in the final inspection phase," adding, "It will be officially launched in February next year." It is expected to actively attract novice investors through integration with the 'Toss' application, which has established itself as Korea's leading simple remittance service. To this end, instead of creating a separate PC home trading system (HTS) with somewhat diverse and complex functions, the trading screen and item names have been simplified and minimized. Initially, the service will start with domestic stock brokerage and plans to expand into overseas stock brokerage and collective investment securities (funds) sales in the future.

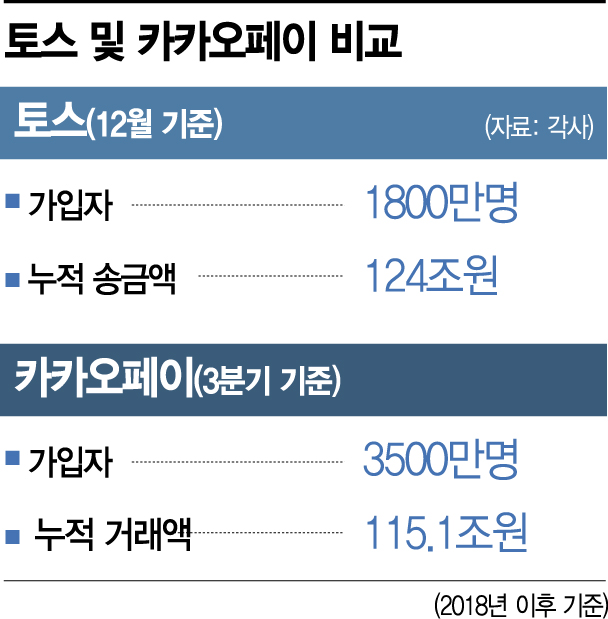

In particular, since the launch will be somewhat earlier than the MTS release of KakaoPay Securities, considered its biggest competitor, Toss Securities aims to secure Joorini customers as much as possible. Among the existing 18 million Toss members, 10 million (60%) are in their 20s and 30s. A Toss Securities official explained, "Many personnel who contributed to increasing Toss's market share by accurately identifying user needs and responding quickly have been deployed to Toss Securities," adding, "We will rapidly implement an aggressive expansion strategy starting next year."

KakaoPay Securities' MTS is expected to be launched only by the end of next year. KakaoPay Securities signed a contract with Koscom last month to develop a ledger management system. The ledger management system is a program that manages customer accounts and transaction histories. Since trading system development typically takes about a year, KakaoPay Securities will start about a year later than Toss Securities. Until now, KakaoPay Securities has taken a cautious approach to entering the brokerage market, focusing on small-amount fund investment services such as 'Almoeugi' and 'Dongjeonmoeugi,' but hurried to develop the MTS in response to Toss Securities' moves. A KakaoPay Securities representative explained, "We decided it would be efficient for Koscom to develop the ledger management system while KakaoPay Securities develops the user interface (UI) and user experience (UX) that leverage Kakao's characteristics."

However, since KakaoPay Securities' users are rapidly increasing based on KakaoPay subscribers, it is expected to quickly increase its market share despite the late start. As of the 9th, KakaoPay Securities' comprehensive accounts surpassed 3 million cumulative accounts, just nine months after the official service launch. After exceeding 2 million accounts in early September, the number increased by 1 million in two months. This represents an average monthly growth rate of 36% over the past nine months. The user age and gender distribution have also diversified. While those in their 20s (29%) and 30s (29%) account for more than half, those in their 40s and 50s account for 24% and 12%, respectively. The gender ratio is roughly equal at 50:50. Moreover, since it can leverage not only financial affiliates such as KakaoBank but also users of its parent company Kakao, it is expected to fiercely catch up despite being a latecomer.

Therefore, the industry predicts that the period until the latter half of next year could be Toss's 'golden time.' Although Toss and KakaoPay are both emerging securities firms targeting new investors, their conditions and competitiveness differ significantly. A representative from a major securities firm pointed out, "KakaoPay has abundant funds and versatility, linking from KakaoBank to KakaoTalk gifticons, and can generate profits through various channels such as repurchase agreement (RP) transactions using funds accumulated in Pay. In contrast, Toss will have to operate like existing securities firms, and many businesses require capital soundness, such as credit and unsettled transactions, so there will be many challenges."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.