[Asia Economy Reporter Kwangho Lee] The year-end tax settlement for earned income attributable to this year has officially begun. Approximately 18 million workers and 1.6 million withholding agents (companies) must prepare for the year-end settlement of earned income tax on this year's salaries. This year, due to the COVID-19 pandemic, the income deduction for credit card usage has been significantly expanded. Tax benefits for pension accounts have also been increased, which can help reduce taxes if used well. Additionally, a medical expense tax credit for postpartum care center expenses has been added for workers with total annual salaries of 70 million KRW or less.

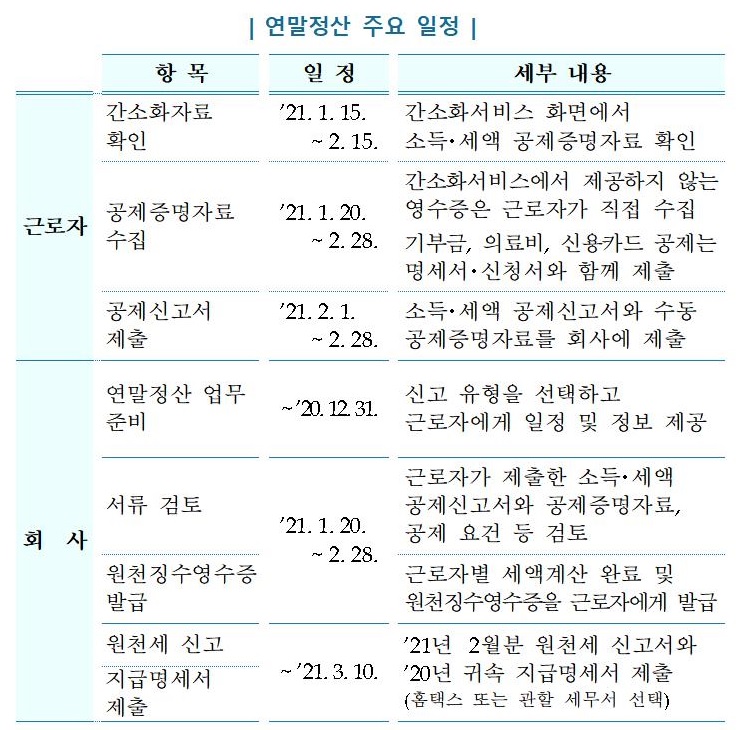

According to the National Tax Service on the 23rd, those who earned income this year must complete the year-end settlement before receiving their February salary next year. Workers should carefully check income and tax deduction items in advance, gather supporting documents meticulously, and submit them to the withholding agents. Withholding agents must accurately calculate the year-end settlement tax amount and ensure no deduction amounts are omitted.

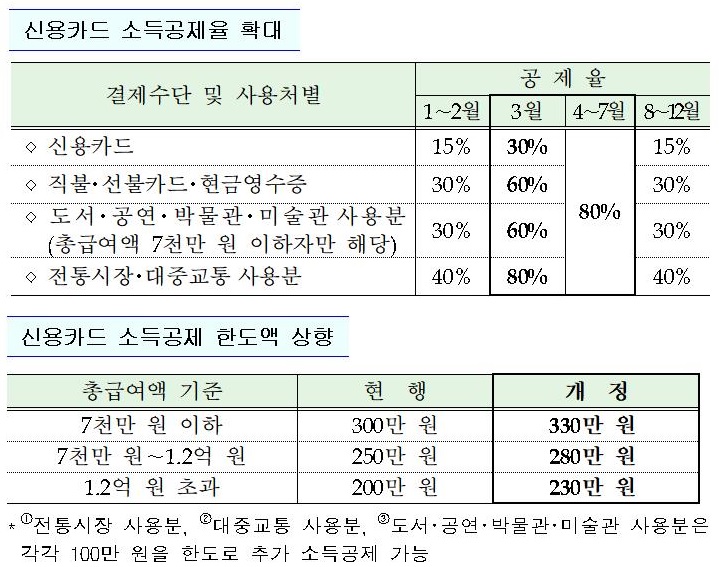

The biggest change in this year's year-end settlement is the significant expansion of income deductions for credit cards and similar payment methods. As part of the government's COVID-19 economic measures to stimulate consumption, the income deduction rates for credit cards, check cards, and cash used from March to July this year were substantially increased. The income deduction for credit cards, etc., is calculated by multiplying the amount exceeding 25% of total salary by the 'deduction rate.' The existing deduction rates were 15% for credit cards, 30% for cash receipts, check cards, books, performances, museums, and art galleries, and 40% for traditional markets and public transportation. For amounts paid in March this year, the deduction rates were doubled. Especially for amounts used from April to July, a uniform deduction rate of 80% is applied regardless of the payment method.

Those aged 50 and over are advised to consider additional contributions to pension savings, taking into account the final tax amount. From this year’s year-end settlement, the deduction limit for pension savings accounts for those aged 50 and above has changed, allowing those with extra funds to maximize year-end settlement deductions through additional contributions. Eligible individuals must be aged 50 or older, have total annual salaries not exceeding 120 million KRW, and interest and dividend income not exceeding 20 million KRW. Pension savings have a deduction limit increased from the existing 4 million KRW to 6 million KRW, and combined with retirement pension (IRP) accounts, the limit has increased from 7 million KRW to 9 million KRW. Pension savings products provide a 16.5% tax credit on the contribution amount. For those with total salaries exceeding 55 million KRW, including local income tax, a 13.2% tax credit applies. Therefore, an additional contribution of 2 million KRW can save 330,000 KRW (264,000 KRW for those earning over 55 million KRW). However, not all workers receive the tax credit; the final tax amount must exceed the tax credit amount to qualify.

Also, workers or their spouses with total annual salaries of 70 million KRW or less who used postpartum care centers can apply medical expense deductions up to 2 million KRW. Since receipts from postpartum care centers are expected to be rarely available through the year-end settlement simplification system, receipts must be obtained directly from the postpartum care center and submitted to the company as proof.

Furthermore, under tax law, persons with disabilities include not only those recognized under the Disability Welfare Act but also patients with severe conditions requiring constant treatment. Severe conditions requiring constant treatment include all cancers such as thyroid cancer, prostate cancer, breast cancer, as well as stroke, dementia, chronic renal failure, Parkinson’s disease, cerebral hemorrhage, and mental illnesses.

In addition, from this year’s year-end settlement, if remarried parents have passed away, stepparents who are actually supporting the family can be considered dependents for deduction purposes. The monthly rent deduction applies to non-homeowners with total salaries of 55 million KRW or less at 12%, and those with total salaries between 55 million KRW and 70 million KRW at 10% of the monthly rent paid. The maximum monthly rent deduction limit is 7.5 million KRW.

Especially, receipts for hearing aids, wheelchairs, disability aids, glasses, and contact lenses must be collected separately. The same applies to school uniforms for middle and high school students, academy fees for preschool children, and overseas education expenses. Donation receipts may also not be available through the year-end settlement simplification system, so verification is necessary.

A National Tax Service official said, "This year, the income and tax deduction report is provided fully pre-filled, reducing the report preparation process from four steps to one step," and added, "While carefully gathering deduction proof documents to avoid missing deductions is important during the year-end settlement, it is also a tax-saving strategy not to bear additional taxes due to improper deductions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)