Delinquency and Non-Performing Loan Ratios Remain Stable

Insurance Company Loans Increase by 4.9 Trillion in Q3... Rise in Mortgage and SME Loans

[Asia Economy Reporter Oh Hyung-gil] The balance of insurance companies' loan receivables in the third quarter increased at the largest rate since the outbreak of the novel coronavirus disease (COVID-19). This appears to be due to a significant rise in loans to small and medium-sized enterprises (SMEs) and household mortgage loans.

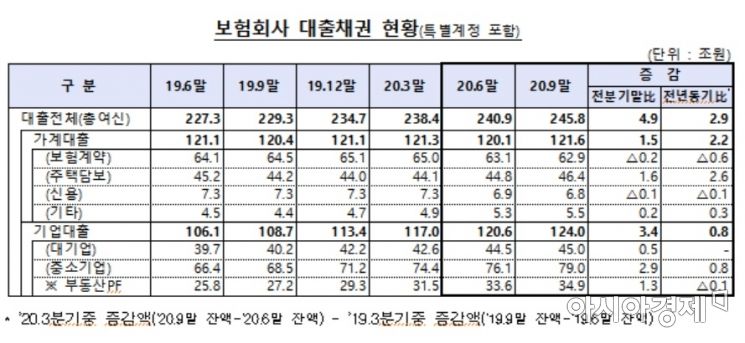

According to the "Status of Insurance Company Loan Receivables as of the End of September 2020" released by the Financial Supervisory Service on the 22nd, the balance of insurance company loan receivables during this period was 245.8 trillion won, an increase of 4.9 trillion won (2.0%) compared to the previous quarter.

This is the largest increase in loan receivables balance so far this year. Looking at the quarterly increase in loan receivables balance, after recording 5.4 trillion won in the fourth quarter of last year, the growth slowed down to 3.7 trillion won and 2.5 trillion won in the first and second quarters of this year, respectively.

Corporate loans, which surpassed household loans in the second quarter, continued their steep growth in the third quarter. Corporate loans reached 124 trillion won, up 3.4 trillion won (2.8%) from the previous quarter, while household loans increased by 1.5 trillion won (1.2%) to 121.6 trillion won.

Among corporate loans, loans to large corporations increased by only 500 billion won to 45 trillion won compared to the previous quarter, whereas loans to SMEs surged by 2.9 trillion won to 79 trillion won. Among these, real estate project financing (PF) rose by 1.3 trillion won to 34.9 trillion won.

In household loans, mortgage loans increased by 1.6 trillion won to 46.4 trillion won. Insurance companies' mortgage loans, which had been declining last year, have been on the rise since the first quarter. This is interpreted as some loan demand shifting to insurance companies amid the low interest rate environment. Additionally, insurance company mortgage loans are subject to a debt service ratio (DSR) of 60%, which is 20 percentage points higher than that of banks.

On the other hand, insurance policy loans and unsecured loans decreased by 200 billion won and 100 billion won, respectively, to 62.9 trillion won and 6.8 trillion won compared to the previous quarter.

"Provision for loan losses to induce strengthened loss absorption capacity"

The delinquency rates and non-performing loan ratios for both household and corporate loans maintained stable levels compared to the previous quarter, showing sound credit quality. Loans are classified according to the degree of delinquency into normal, precautionary, substandard, doubtful, and estimated loss categories, with the proportion of loans classified as substandard or below representing the non-performing loan ratio.

The delinquency rate, which is the proportion of loans overdue by more than one month among insurance company loans, was recorded at 0.2%, down 0.02 percentage points from the previous quarter. The delinquency rate for household loans was 0.42%, down 0.06 percentage points from the previous quarter, while corporate loans remained unchanged at 0.1%.

The non-performing loan ratio also decreased by 0.01 percentage points from the end of June to 0.15%. The non-performing loan ratio for household loans fell by 0.01 percentage points to 0.18%, while that for corporate loans remained unchanged at 0.12%.

An official from the Financial Supervisory Service stated, "We plan to encourage insurance companies to sufficiently provision for loan losses in response to the COVID-19 situation and strengthen their loss absorption capacity," adding, "We will continue to monitor the credit quality of insurance company loans, including delinquency rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.