Last Year's Operating Loss of 11.9 Billion Won... Increased Fivefold

Due to Sharp Rise in Cost of Sales and SG&A Expenses

Unable to Pay Remaining Landfill Fees, Sales Plummet

The waste disposal industry has emerged as a "goose that lays golden eggs." As landfill sites gradually decrease and waste increases, disposal costs are rising daily. Waste increases as industry develops and population grows. The speed of waste increase accelerated due to the surge in single-use products caused by the COVID-19 pandemic. On the other hand, securing landfill sites is difficult. As illegal waste disposal issues worsened, the government strengthened environmental regulations last May. It decided to reinforce the responsibilities of waste generators and transport companies and to thoroughly conduct compliance inspections of waste disposal businesses at regular intervals. With new waste disposal companies finding it difficult to enter the market, existing companies are expected to continue stable growth. Asia Economy analyzes the business capabilities, remaining waste disposal capacity, and financial structures of domestic waste disposal companies Inseon ENT and Zenen Bio to gauge their growth potential.

[Asia Economy Reporter Jang Hyowon] Waste disposal company Zenen Bio is struggling. The atmosphere is quite different from other waste companies that are thriving. Although it is conducting a paid-in capital increase worth 50 billion KRW, this has been delayed as the Financial Supervisory Service rejected the securities registration statement twice.

Waste Disposal Business Sales Decline

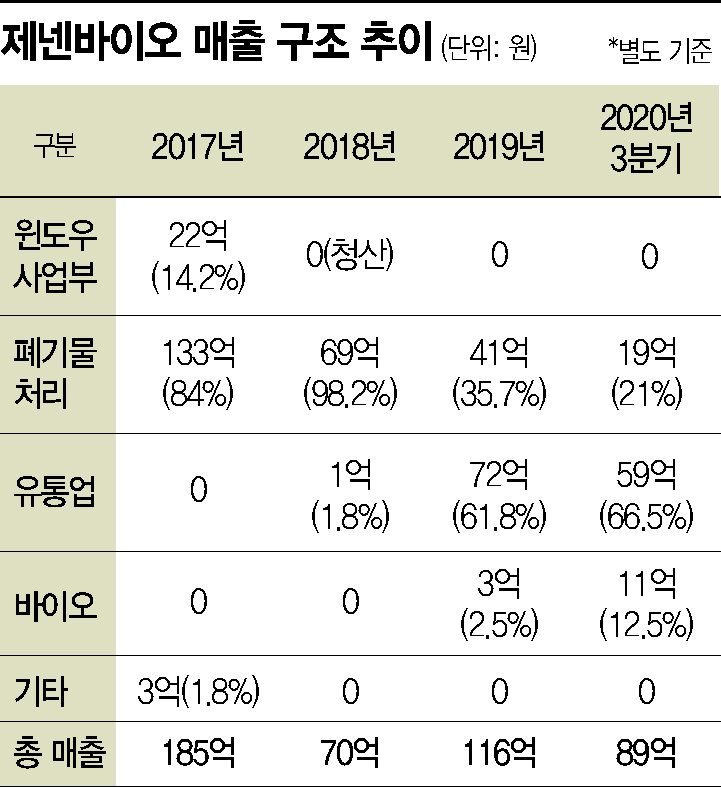

Zenen Bio operates in pharmaceutical and medical device distribution, waste disposal, and xenotransplantation product development. As of last year, the sales composition by sector was 61.8% distribution, 35.7% waste disposal, and 2.5% bio business for xenotransplantation product development.

Except for an operating profit of 700 million KRW in 2017, Zenen Bio has continuously posted losses since 2012. The deficit has been increasing again over the past two years. Last year, operating loss was 11.9 billion KRW, about five times the 2.4 billion KRW in 2018. Net loss also surged more than eightfold to 43 billion KRW.

The large losses recorded by Zenen Bio are analyzed to be due to a sharp increase in cost of sales and selling and administrative expenses. Last year, Zenen Bio’s sales amounted to 11.6 billion KRW, with cost of sales accounting for 10.9 billion KRW. While sales increased by 65% compared to the previous year, cost of sales surged by 195%.

The reason cost of sales increased more than sales is that most of the sales increase came from merchandise distribution sales. Zenen Bio started distributing prescription drugs and medical devices last year. This business generated 7.2 billion KRW in sales last year, with merchandise cost of sales at 7.1 billion KRW. Including labor costs and commissions, this resulted in a loss.

Selling and administrative expenses also rose 125% year-on-year to 12.6 billion KRW. As the number of employees increased, salaries rose from 1.7 billion KRW to 4.9 billion KRW, and other items including commissions related to distribution sales surged about tenfold from 300 million KRW to 3.1 billion KRW.

Performance through the third quarter of this year is similar to last year. As of the end of Q3, on a separate basis, cumulative sales were 8.9 billion KRW, operating loss 8.6 billion KRW, and net loss 14.7 billion KRW. Merchandise cost of sales accounts for nearly 70%, and selling and administrative expenses reach 10 billion KRW.

The waste disposal business, which Zenen Bio chose for turnaround, is also gradually declining. At the end of 2016, Zenen Bio acquired 99.78% of shares in waste disposal company Gonggam ENT for 7.685 billion KRW. Additionally, a loan of 2.3 billion KRW was converted into equity. Subsequently, Zenen Bio merged Gonggam ENT.

At that time, Gonggam ENT was valued at 12.6 billion KRW, based on estimates that it would generate over 14 billion KRW in sales annually from 2017 to 2019. However, actual sales were 18.2 billion KRW in 2017, 6.9 billion KRW in 2018, 4.2 billion KRW last year, and 1.8 billion KRW through Q3 this year, showing a large gap from expectations.

Delays in Capital Increase and Issues with CB Disclosure Highlighted

As the core waste disposal business shrinks, the financial condition is deteriorating. Zenen Bio’s net borrowings have been increasing since 2018. Net borrowings rose from 8.7 billion KRW in 2018 to 15.1 billion KRW last year and reached 18.6 billion KRW as of the end of Q3 this year. The debt ratio stands at 151.1%.

Most of the debt consists of convertible bonds (CB). As of the end of Q3, Zenen Bio’s outstanding CBs amount to 44.1 billion KRW. The CB conversion price ranges from 1,195 to 1,920 KRW. The conversion request dates will come sequentially starting on the 27th, and if the stock price remains above 3,000 KRW, bondholders are expected to convert. While conversion will reduce debt, 27,753,585 new shares (28.7%) will be issued, diluting existing shareholders’ stock value.

Additionally, Zenen Bio faces potential sanctions from the Financial Supervisory Service related to CB issuance. When issuing the 13th series CB, Zenen Bio entered into a transfer collateral agreement with bondholders but failed to disclose this in public filings.

Moreover, since 2017, Zenen Bio has issued CBs more than 50 times on three occasions. If these CBs are sold to more than 50 people within six months after issuance, it is considered a public offering, requiring submission of a securities registration statement. However, Zenen Bio did not submit such a statement.

Putting these issues aside, Zenen Bio is conducting a paid-in capital increase through a rights offering and general public offering worth 51.5 billion KRW. Of this, 11.7 billion KRW will be used to pay the remaining balance for a new landfill site purchase.

However, Zenen Bio’s capital increase continues to be delayed. The securities registration statement was rejected twice by financial authorities. The authorities reportedly requested more detailed explanations regarding investment risks. The second amended registration statement included a note that sanctions from the Financial Supervisory Service might occur due to CB disclosure issues. As the capital increase is delayed, payment for the landfill site is uncertain, and all new investments are on hold.

Regarding this, Zenen Bio stated, “The payment date for the balance of the Gyeongsan landfill site is the 30th, but as the capital increase is delayed, we are negotiating the payment date with the counterparty. Even if the capital increase succeeds as planned and we acquire the Gyeongsan landfill, it will take about 18 months to build the facilities, so actual sales will begin in 2022.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.