Entering Recovery Phase in Orders in Q4

Since Last Month, Shipbuilding 'Big 4' Outperform KOSPI Returns

[Asia Economy Reporter Gu Eun-mo] Shipbuilding stocks, which had suffered poor performance and stock prices due to the impact of COVID-19 and other factors, are showing growing expectations for order recovery entering the fourth quarter.

According to the Korea Exchange on the 15th, the stock price of Korea Shipbuilding & Offshore Engineering closed at 111,000 won, up 1.37% (1,500 won) from the previous trading day, continuing a four-day consecutive rise. Hyundai Mipo Dockyard also maintained a positive trend by closing higher for three consecutive days, hitting a 52-week high.

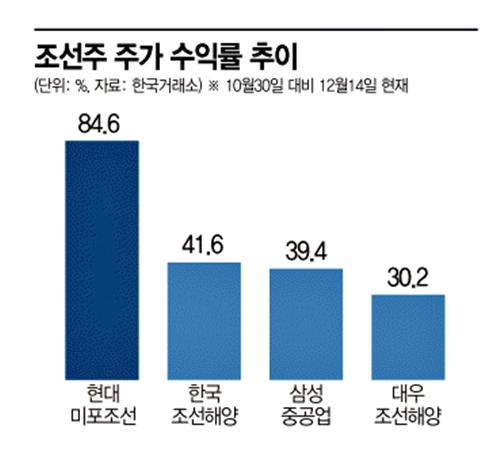

Recently, shipbuilding stocks have sharply rebounded as they entered a recovery phase for orders. Since last month, Hyundai Mipo Dockyard surged 84.6% up to the previous day, and during the same period, Korea Shipbuilding & Offshore Engineering (41.6%), Samsung Heavy Industries (39.4%), and Daewoo Shipbuilding & Marine Engineering (30.2%) ? the 'Big 4' domestic shipbuilders ? all outperformed the KOSPI return of 21.8%.

Domestic shipbuilders, which had been repeatedly experiencing extreme sluggishness, are now showing a clear recovery in orders. After the positive news in June about Qatar's reservation of 100 LNG carrier slots, orders and stock prices both stalled due to the resurgence of COVID-19. However, from the end of October, news of vaccine development expanded expectations for economic recovery, and combined with rising oil prices and falling exchange rates, an optimal timing for new orders was formed.

This year, the total new orders for merchant ships by the four domestic shipbuilders reached $15.1 billion as of last week, achieving 56% of the target of $26.7 billion. Lee Dong-heon, a researcher at Daishin Securities, said, "During the order recovery period, the main variable is the increase in orders rather than ship prices," adding, "Since $5.4 billion worth of orders have been secured since October 30 alone, it is expected that by the end of the year, total orders will reach around $18.5 billion, achieving about 70% of the target."

The expansion of orders for domestic shipbuilders is expected to continue through the fourth quarter and into next year. First, the supply and demand conditions for ships are evaluated as positive. Han Young-soo, a researcher at Samsung Securities, analyzed, "The fundamental reason for the strong shipping indicators this year is the decrease in ship supply," and added, "With solid freight rates improving shipping companies' capacity to place orders, and considering that the order backlog determining future ship supply is at its lowest, shipowners have sufficient incentives to invest in vessels."

Stronger-than-expected demand is also a factor boosting expectations for continued orders. Global maritime cargo volume has rapidly rebounded since hitting bottom in May, and the volume of secondhand ship transactions, which precede new ship orders, is at a level similar to last year. Another demand factor, vessel operating speed, has declined compared to the beginning of the year. The researcher explained, "Despite the drop in oil prices, the implementation of sulfur oxide emission regulations has prevented a reduction in the actual fuel cost burden for shipowners."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)