[Asia Economy Reporter Suyeon Woo] Hyundai Motor Group is interpreted to have entered the countdown for a governance restructuring as it pushes for the merger of three IT software companies. The business structure changes, which began centered on software affiliates, are expanding across the entire group, naturally leading to governance restructuring.

According to Hyundai Motor Group on the 14th, Hyundai AutoEver, Hyundai MnSoft, and Hyundai Autron each held board meetings on the 11th and resolved to merge the three companies. Hyundai AutoEver will absorb Hyundai MnSoft and Hyundai Autron, with the merger ratio set at 1 to 0.96 to 0.12, respectively.

Merger of Three Software Companies Signals Governance Restructuring

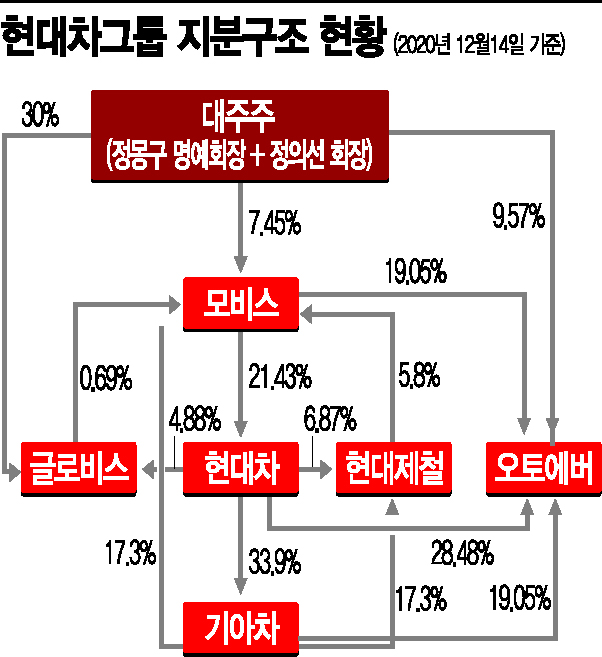

Following the merger resolution of the three Hyundai Motor Group software companies, industry attention is focused on governance restructuring. This is because empowering Hyundai AutoEver, which has the second-highest major shareholder stake (9.57%) among listed affiliates after Hyundai Glovis, is interpreted as a blueprint for governance restructuring.

Hyundai AutoEver, which was listed on the KOSPI market last year, has seen its stock price surge 43% in the past month (as of the closing price on December 11). Compared to the IPO price, it has risen by a whopping 112%. The recent stock price increase is largely due to the growing demand for IT solutions within the group, such as Hyundai Motor's plan to establish a global innovation center in Singapore, but the high major shareholder stake also played a role. It is expected that regardless of the direction of governance restructuring, the major shareholder is likely to utilize their stake in AutoEver. Chairman Chung Euisun already sold half of his shares, 2.01 million shares, during Hyundai AutoEver's IPO last year, cashing out 96.5 billion KRW.

After the merger of the three companies, Chairman Chung's stake will decrease from 9.57% to 7.44%, but the asset value held by the major shareholder is expected to increase significantly due to the rise in corporate value from the merger. The securities industry forecasts that AutoEver's current market capitalization of about 2.4 trillion KRW could rise to 3 trillion KRW after the merger. However, challenges remain, such as opposition from minority shareholders during the merger process. Hyundai Autron, which will be absorbed, is wholly owned by Hyundai Motor affiliates, but Hyundai MnSoft has 42.5% held by other shareholders and a high proportion of minority shareholders at 34.7%.

Researcher Kwon Soon-woo of SK Securities said, "As roles and responsibilities among affiliates strengthen and new investments continue, announcements of affiliate restructuring similar to this are expected to continue," adding, "At the same time, attention should be paid to major shareholder equity investments and changes."

Effects of Hyundai Motor Group’s Merger of Three Software Companies

This affiliate restructuring is meaningful in itself as a merger. It unified the software development entities, created synergies, and laid the foundation for a mobility software specialized company.

As 'MECA (Mobility, Electrification, Connectivity, Autonomous driving)' is expected to be the main axis in the future car industry, software development capabilities have emerged as a crucial core factor. Until the early 2000s, the number of software-based electronic control components required for one car was only about 20, but now about 100, five times more, are applied.

Hyundai AutoEver has been engaged in IT solutions and cloud business, Hyundai Autron in vehicle software development, and Hyundai MnSoft in navigation and high-definition map development. The merged entity plans to first widely apply vehicle wireless software update (OTA) technology and further pursue new businesses such as establishing vehicle software standards, integrating cloud-based service infrastructure, and integrated operation of mobility data.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)