Banks Mobilize All Available Means to Curb Loans

Potential Impact on Small Business Loan Handling

[Asia Economy Reporter Kim Hyo-jin] As financial authorities intensify pressure, commercial banks are consecutively tightening loan regulations, raising concerns about cash shortages among small business owners. This is because banks may treat general individual business loans more conservatively to manage total loan volumes.

With the spread of the novel coronavirus infection (COVID-19) intensifying to the point where discussions about raising social distancing to level 3 are underway, any tightening of loan access could significantly increase the impact on small business owners.

According to the financial sector on the 14th, banks are focusing on curbing the overall increase in household loans by employing all available methods such as suspending loan issuance, reducing limits, and raising interest rates, following guidelines from financial authorities. The authorities aim to prevent excessive capital inflow into real estate and stock markets through 'targeted regulations' on high-income earners' loans and non-living expense loans.

However, concerns are being raised inside and outside the banking sector that if this trend continues, overall loan tightening could worsen. A representative from a commercial bank pointed out, "Strengthening regulations on loans for specific groups like high-income earners or specific types of loans may have temporary effects, but for long-term management, it is inevitable to adjust general loans that constitute a significant portion of the total volume."

Another bank official expressed concern, saying, "If meaningful changes in figures do not occur despite targeted regulations, we may need to explore various other measures."

Stopping issuance, removing preferential interest rates, and lowering limits

Meanwhile, banks continue to introduce 'unprecedented' measures to suppress loan growth.

Woori Bank has reduced preferential interest rates on credit loan products such as 'Woori Main Workplace Loan' and 'Woori Financial Club' since the 3rd. For example, the preferential interest rate given for salary transfers to Woori Bank accounts was lowered from 0.2% to 0.1%, or preferential rates provided under conditions like subscription and maintenance of installment savings products were eliminated. Additionally, from the 11th, Woori Bank stopped issuing the 'Woori WON Workplace Loan.'

KB Kookmin Bank has effectively suspended household credit loans exceeding 100 million KRW from this day until the end of the year. New applications or requests for increases that would cause the total credit loan amount to exceed 100 million KRW will not be approved. KB Kookmin Bank has already decided not to handle mortgage loans and jeonse (long-term deposit) loans through loan counselors until the end of the year.

Shinhan Bank also lowered the credit loan limit for professionals such as doctors and lawyers to 200 million KRW starting today. Shinhan Bank plans to soon introduce measures to curb credit loans for general office workers. Hana Bank is also reportedly preparing to implement measures such as reducing loan limits soon. NH Nonghyup Bank is responding with measures including reducing limits on major loan products and suspending preferential interest rates on credit loans.

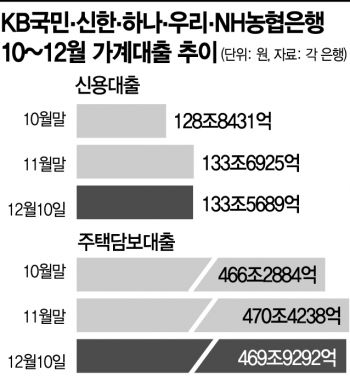

As banks accelerate their loan tightening efforts, the surge in household loans appears to be slowing down for now. The outstanding balance of credit loans at the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?stood at 133.5689 trillion KRW as of the 10th of this month, down by 123.5 billion KRW from the end of last month (133.6925 trillion KRW). During the same period, the outstanding balance of mortgage loans also decreased by 494.6 billion KRW, from 470.4238 trillion KRW to 469.9292 trillion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)