Fourth-Generation Real-Expense Insurance Launch Scheduled for July Next Year with Up to 70% Premium Reduction

Premium Differentiation Applied to Non-Covered Items like Manual Therapy

Exceptions for Severe Diseases and Elderly in Differentiation System

[Asia Economy Reporter Ki Ha-young] Starting from July next year, the 4th generation indemnity health insurance, which charges premiums based on hospital usage, will be introduced. The structure involves paying higher premiums when receiving non-reimbursed treatments such as manual therapy and vitamin injections, and lower premiums when not receiving such treatments. However, exceptions to the premium differentiation system have been made for the elderly and patients with severe illnesses.

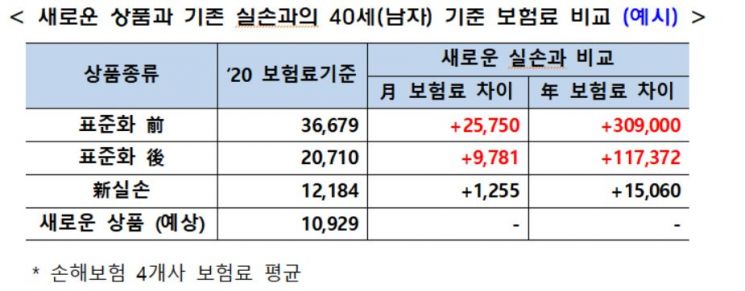

According to the industry on the 12th, the Financial Services Commission recently announced the 'Indemnity Health Insurance Product Structure Reform Plan' and revealed the launch of the 4th generation indemnity insurance. While coverage and limits are similar to existing indemnity insurance, the main point is to reduce premium burdens by up to 70% compared to the current system through non-reimbursed premium differentiation and adjustment of the deductible rate.

Premium Differentiation Applies Only to 'Non-Reimbursed' Treatments

The premium differentiation introduced in the 4th generation indemnity insurance applies only to 'non-reimbursed' treatments, which are elective medical services, not to 'reimbursed' treatments that are essential for medical care. The non-reimbursed premium is determined based on the amount of non-reimbursed insurance claims paid during the 12 months prior to premium renewal. However, the history of insurance claims (accidents) is reset every year. For example, if an insured person had many claims paid in 2018, the premium in 2019 will be surcharged, but if there are no claims paid in 2019 due to no accidents, the premium in 2020 can be discounted.

Exceptions to Premium Differentiation for Severe Illness Patients, Elderly, and Group Indemnity

The financial authorities have included exceptions to the premium differentiation system to minimize disadvantages to insured persons in hospital treatment. The basic principle is that premium differentiation does not apply to reimbursed treatments essential for disease treatment, and patients with severe illnesses such as cancer, who are designated as special cases under the National Health Insurance Act, are excluded from premium differentiation.

Additionally, to accommodate the elderly who may frequently use hospital services, long-term care benefit recipients under the Long-Term Care Insurance Act for the Elderly are also excluded from premium differentiation. As of last year, recipients of long-term care benefits rated at levels 1 to 2 under the Long-Term Care Insurance Act for the Elderly accounted for about 1.5% of the population aged 65 and over. Specialized products for those with pre-existing conditions or the elderly, such as the Old-age Indemnity (available for ages 50 to 75), also do not apply premium differentiation.

Premium differentiation does not apply to group indemnity insurance either. This is because group indemnity insurance has a one-year policy period and the policyholder (group) can change insurance companies annually, making it structurally difficult to apply premium differentiation.

10% Premium Discount for Two Consecutive Years Without Claims Maintained

The premium differentiation system will not apply to existing products but only to new subscriptions of the 4th generation indemnity insurance launched in July next year. If existing policyholders wish to join, they must 'convert their contract' to the new product. Currently, the Financial Services Commission is reviewing a plan to allow contract conversion without underwriting in all cases except for a limited list of cases requiring separate negative underwriting.

Furthermore, even with the implementation of premium differentiation, the current '10% premium discount for two consecutive years without claims' system will be maintained. This is because premium differentiation is based on risk premiums for discounts and surcharges, while the 10% discount for two consecutive years without claims is based on additional premiums. Therefore, insured persons with two consecutive years without claims can receive both a 10% discount on additional premiums and an additional discount on risk premiums due to premium differentiation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.