[Asia Economy Reporter Jo Gang-wook] Concerns over a wave of bad loans triggered by the COVID-19 pandemic are spreading across the entire financial sector. The government's tightening of commercial banks has sharply increased loan demand at savings banks, credit card companies, and insurance companies, raising fears that this could act as a balloon effect, ultimately fueling bad loans in the secondary financial sector.

Although the government limited regulations to high-income and high-credit borrowers, it has simultaneously strongly ordered 'total household loan volume management,' forcing banks not just to raise the bar but to close their loan doors one by one. As a result, the increased loan demand caused by the resurgence of COVID-19 is being pushed into the secondary financial sector, and tightening supply has led to voices suggesting that the failure of real estate policies, which increased demand despite supply restrictions, might be repeating itself in the loan market.

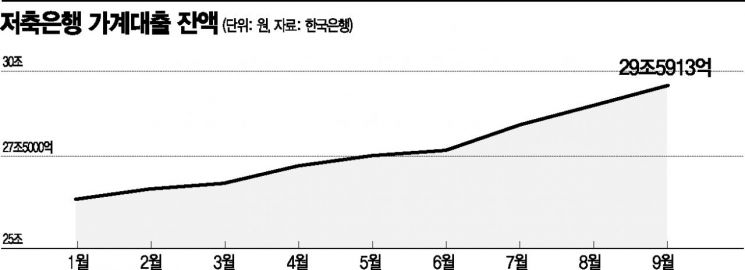

According to financial authorities and the financial sector on the 11th, household loans in the financial sector increased by 103 trillion won from the beginning of this year to November, showing an unprecedented surge despite the government's repeated loan regulations. Compared to the increase of 48.4 trillion won during the same period last year, this is more than double. During this period, bank household loans increased by 94 trillion won, and household loans in the secondary financial sector, including savings banks, rose by 9 trillion won. Notably, in the secondary financial sector, loans surged by 4.7 trillion won in the past month alone, exceeding half of the annual increase. This is interpreted as a strong movement to secure loans in advance following the government's tightening of credit loan regulations, causing not only banks but also the secondary financial sector to stir due to the balloon effect.

In fact, according to the Bank of Korea, bank household loans in November reached 982.1 trillion won, increasing by 13.6 trillion won from the previous month, marking the largest increase since related statistics began in 2004. The record increase in bank household loans last month was largely due to a rush of last-minute demand ahead of the tightened credit loan regulations implemented on the 30th of last month, causing a sharp rise in credit loans and overdraft accounts. In particular, other loans increased by 7.4 trillion won last month, unusually surpassing the increase in mortgage loans (6.2 trillion won). The increase in other loans was also the largest since 2004.

◆As banks raise the bar, high-interest secondary financial sector loans rise... Will it become a bad loan bomb? = The rapid increase in loans other than those for home purchases and credit loans continues. The balance of housing subscription savings secured loans at the four major commercial banks?KB Kookmin, Shinhan, Hana, and Woori?stood at 1.8318 trillion won in November, a 32.6% surge compared to 1.3806 trillion won in January. Housing subscription savings secured loans, which allow borrowing 90-95% of the saved amount, fall under deposit-secured loans. Since only the principal is used as collateral, taking out a loan does not affect the subscription function, making it a means to circumvent loan regulations. Both movable property-secured loans and technology finance loans are also steadily increasing.

Given this situation, financial authorities, concerned about loan defaults, pressured commercial banks to 'manage total household loans more strictly,' leading banks to eliminate preferential interest rates on loan products or even stop selling certain products altogether, raising the bar further. Consequently, there are growing concerns within the financial sector that as commercial bank loans become restricted, loan demand will shift to the secondary financial sector, causing a chain reaction that increases the loan burden on financial consumers.

The main customers of the secondary financial sector are mostly vulnerable borrowers such as those with medium to low credit and low income, and the average interest rate in the secondary financial sector is in the mid-to-high teens percentage-wise, imposing a heavier interest burden compared to commercial banks. Therefore, household loan default issues may arise, especially among vulnerable borrowers with lower repayment capacity. Moreover, with the third wave of COVID-19 expected to worsen the economic situation, there is a higher possibility of loan defaults in the small and medium-sized enterprises and small business sectors.

A financial sector official said, "Recently, financial authorities decided to strengthen loan inspections in the secondary financial sector to prevent the balloon effect, but borrowers who must secure funds by any means sometimes take out loans at high interest rates through peer-to-peer (P2P) lending platforms," adding, "The currently low delinquency rate is a visual illusion due to policy effects, and there are concerns that unforeseen balloon effects could collapse the financial market structure."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)