One-Hour Queue Despite Distancing

Chanel Bag Price Rises from 7 Million to 10.41 Million Won

Hermes Issues Waiting Numbers Only to VIPs

Limited Supply Stimulates Consumer Sentiment

[Asia Economy Reporter Lim Hye-seon] On the afternoon of the 10th at 1 PM, the luxury brand stores on the 2nd floor of Shinsegae Gangnam in Seoul were bustling with people. Despite the daily confirmed cases of COVID-19 exceeding 600 and social distancing measures being continuously strengthened, customers had to wait over an hour to enter the Chanel store, a foreign luxury brand. The situation was similar for other luxury brands such as Hermes and Louis Vuitton. In the case of Chanel and Hermes, people do not hesitate to do an 'open run' to purchase popular products. Since it is unknown when products will be restocked and the quantity is limited to only one or two items, customers have a higher chance of buying their desired products by obtaining a waiting number before the store opens.

The Paradox of Recession: The More Expensive, The Better It Sells

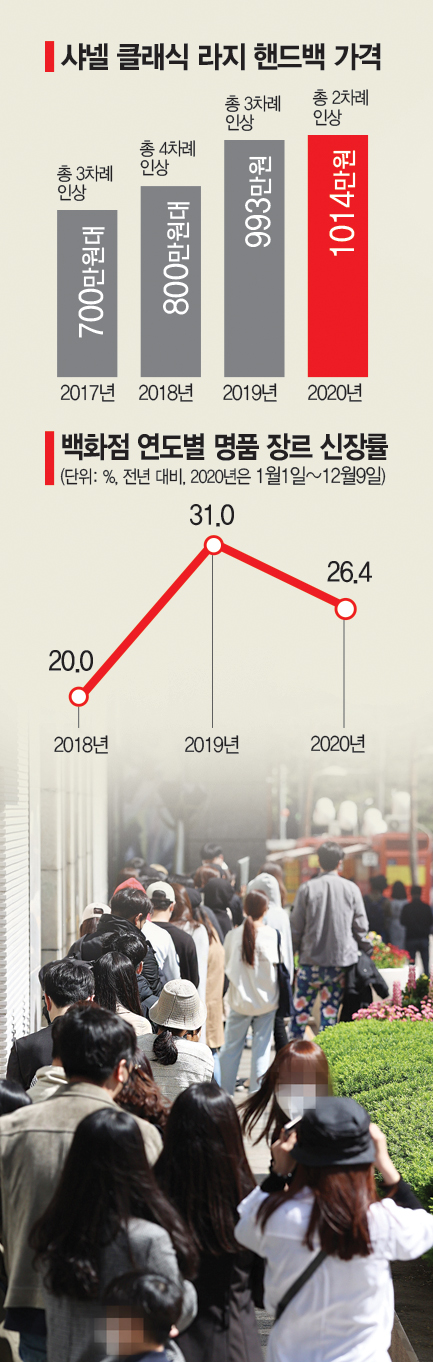

According to the distribution industry on the 11th, Chanel's representative product, the Classic Large Handbag, increased in price from 7 million KRW in 2017 to 10.41 million KRW currently, a 44.8% rise in three years. Despite the same item becoming 3.41 million KRW more expensive over three years, it has become even harder to purchase, and customers still need to get a number ticket just to see the product. This is because the supply remains similar while the number of buyers has increased. On luxury brand cafes on portal sites with over 400,000 members, purchasing proxy part-time jobs have also appeared.

Experts say that Chanel's pricing policy has maximized the 'Veblen effect' by taking advantage of the special situation caused by COVID-19. The Veblen effect refers to the phenomenon where demand increases as the price rises because the product is perceived as more luxurious. The desire to show off, which was previously expressed by sharing photos of overseas trips on social networking services (SNS) like Instagram and Facebook, has shifted to ultra-high-end luxury consumption as international travel was blocked due to COVID-19. The phrase 'I flexed luxury (purchased luxury goods and shared it on SNS)' has become a buzzword. Despite the recession, prices have been raised multiple times, creating anxiety that 'buying late means a loss,' and by limiting supply quantities, the scarcity value is enhanced, targeting consumer psychology persistently with a 'snob effect.' The snob effect refers to consumers' tendency to avoid products perceived as common because many people buy them. For Hermes' Birkin and Kelly bags, customers must achieve VIP status by purchasing other Hermes products to even get a waiting number. This is a representative case targeting the snob effect.

"COVID-19 Raised Consumption Standards"

Experts diagnose that consumption behavior has rapidly changed after COVID-19. Professor Seo Yong-gu of the Department of Business Administration at Sookmyung Women's University said, "As consumption standards have risen, sales of luxury products priced hundreds of times higher than general products, such as luxury goods costing tens of millions of KRW and electronic products worth hundreds of millions, have increased," adding, "This year, especially, revenge consumption tendencies due to COVID-19 have intensified, leading people to flock to luxury goods."

This trend has recently spread to younger generations in their 20s and 30s. According to Lotte Members, the number of luxury purchases by people in their 20s surged from 6,000 in the second quarter of 2017 to 44,000 in the second quarter of this year. On online shopping malls, the purchase share of people in their 20s and 30s has exceeded 50.0% of the total. To capture luxury demand, parallel importers of luxury goods are selling luxury items at convenience stores, and large supermarkets are holding luxury fairs to attract customers. This year, luxury sales at Lotte, Shinsegae, and Hyundai Department Stores increased by more than 20% compared to the previous year. In the case of Shinsegae Department Store, overall sales decreased this year, but luxury sales surged by 26.3%.

According to market research firm Euromonitor, the domestic luxury market size reached approximately 14.8291 trillion KRW last year. It is estimated to exceed 15 trillion KRW this year. This contrasts with the contraction of the largest luxury markets in the world, China and the United States. Management consulting firm Bain & Company forecasts that the global luxury market will decrease by 23.0% compared to the previous year this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.