Near-Distance Travel Recovery Overcomes IPO Failure Fears for Major Success

Marriott, Hilton, Hyatt Market Caps Surpass Expectations

Following DoorDash, Consecutive New IPO Surges... Stock Trading App Robinhood Also Forecasted for Successful Listing

Largest Annual IPO Scale Since 1995

Warnings of Bubble Due to Excessive Surge Emerge

[Asia Economy New York=Correspondent Baek Jong-min] Despite the COVID-19 pandemic, the accommodation sharing company Airbnb surpassed a market capitalization of 100 trillion won on its first day of listing. This was even more than the combined market capitalization of major existing hotel industry leaders such as Hyatt, Marriott, and Hilton. This is interpreted as reflecting investors' expectations for the recovery of the travel industry and startup initial public offerings (IPO) after the COVID-19 crisis.

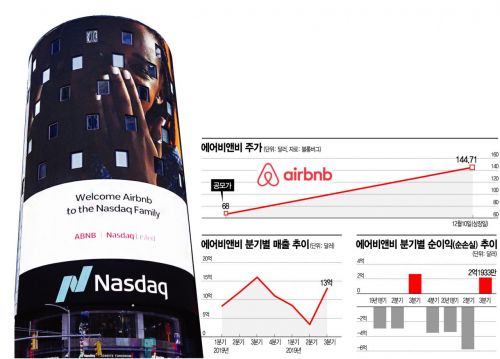

On the 10th (local time), Airbnb's stock price closed at $144.71, up 112.8% on its first day of listing on the Nasdaq market. The company's public offering price was $68, exceeding expectations, and the surge continued in regular trading.

◆ Doubled on the first day of listing = Based on the closing price that day, Airbnb's market capitalization was $100.7 billion. The Wall Street Journal (WSJ) reported that this surpassed not only the combined market capitalization of global hotel chains Marriott, Hilton, and Hyatt but also that of the world's largest online travel agency Expedia and the existing hotel reservation specialist Booking.com. The New York Times evaluated Airbnb as emerging as the largest 'unicorn' company of its time.

Airbnb, founded in 2008, attracted more attention because its listing was achieved amid the unexpected adversity of COVID-19. After the second-quarter earnings announcement, Airbnb, hit hard by COVID-19, laid off nearly a quarter of its total employees, about 1,900 people, to reduce costs. Due to a lack of operating funds, it had to raise $2 billion at an interest rate of about 10%. There were concerns that it might have to give up the listing, but a turning point was made during the summer vacation season.

In the past, Airbnb users were long-distance travelers abroad or within the United States, but focusing on travelers to nearby areas proved effective. Travel demand within 300 miles (483 km) of the residence area increased, and the number of reservations rapidly recovered.

The reservation rate, which had plummeted 91% year-on-year in the first quarter, improved to a 28% decrease in the third quarter. Third-quarter sales exceeded $1.3 billion, and a net profit of $219 million was achieved. Considering the cumulative net loss of $696.87 million from the first to the third quarter, a clear recovery trend can be seen. Brian Chesky, Airbnb's CEO, said, "This crisis was an indiscriminate storm for years," adding, "We focused on areas where we could make a profit amid the crisis."

◆ IPO boom = The investment fever for IPOs based on abundant liquidity during the COVID-19 situation also played a role. Initially, Airbnb announced a public offering price of $44 to $50 per share but later raised it to $56 to $60, eventually issuing new shares at $68.

WSJ reported that the sharp rise in stock prices of Airbnb, food delivery company DoorDash, which was listed a day earlier, and AI company C3.ai would excite the year-end IPO market. On their first day of listing, DoorDash rose 86%, and C3.ai rose 120%. Market research firm Dealogic estimated that funds poured into IPOs in the U.S. stock market this year amounted to $155 billion, surpassing the entire IPO scale of 1999 during the dot-com bubble.

The IPO boom is expected to continue for the time being. Amid the rapid rise of the U.S. stock market this year, individual investors have massively invested, and the stock trading app 'Robinhood,' which has benefited the most, is scheduled to be listed.

However, there are also warnings about excessive IPO investment fever. Some investors were cautious about Airbnb's stock price surge. Tony Ross, Chief Investment Officer of Wilmington Asset Management, told WSJ, "I am also a big fan of Airbnb and wanted to buy the stock today, but I thought the price would go down, so I did not purchase."

The New York Times also quoted James Gallat, CEO of financial analysis firm Rapid Ratings, saying, "Excessive valuation shows a market boom due to unprecedented liquidity," warning, "If the current boom reverses sharply, IPO investors could suffer significant losses within a few months."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)