Real Estate Assets Up 14%, Financial Assets Up 24%

Increasing 'Aggressive Investment' Tendency Amid Low Interest Rates

Surge in Non-Face-to-Face Asset Management Experience Due to COVID-19 Impact

Anticipated Future Digital Financial Service: Kakaobank

[Asia Economy Reporter Kim Hyo-jin] A survey revealed that the net assets of households in the top 10-30% income bracket increased by approximately 213 million KRW compared to the previous year, influenced by the rise in asset prices such as real estate.

Woori Financial Management Research Institute announced a report titled "Asset Management and Digital Financial Usage Behavior of the Middle-Class Wealthy in Korea" on the 6th. The report was based on a survey conducted from September to October targeting 4,000 individuals nationwide belonging to the top 10-30% income bracket.

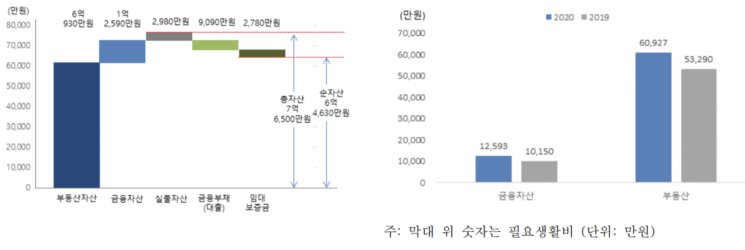

According to the report, the net assets of this group this year were surveyed at 646 million KRW. This is the result after deducting liabilities of 119 million KRW from total assets of 765 million KRW.

Among these, real estate assets amounted to 609 million KRW, an increase of 76 million KRW (14.3%) compared to the previous year, and financial assets increased by 24 million KRW (24.1%) to 126 million KRW. The proportions of financial assets and real estate assets within total assets were 18.9% and 76.6%, respectively, showing a continued concentration in real estate as in the previous year.

Within financial assets, the share of deposits and savings decreased by 5.0 percentage points compared to last year, while stocks increased by 3.0 percentage points, accounting for 15.4% of the financial asset portfolio.

Respondents expressed a desire to increase the proportion of stocks and further reduce deposits and savings in the future. In last year's survey, they responded that they would reduce the stock proportion by about 1 percentage point, but this year they answered that they would expand it by 1.7 percentage points from the current level to 17.1% of the portfolio.

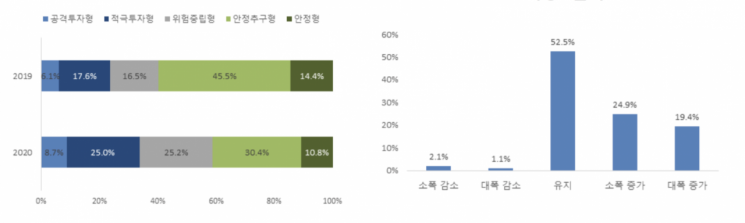

The report also stated that the middle-class wealthy showed a tendency toward more risk-oriented investment compared to last year.

Last year, low-risk seeking types such as stability-seeking and stable types accounted for about 60%, but this year it shrank to 41.2%, while active and aggressive investors increased by 10 percentage points to 33.7%.

The report analyzed that this is due to the financial environment where low market interest rates make risk-taking inevitable to achieve previous levels of profit.

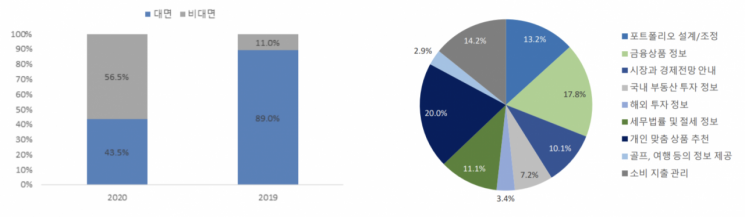

Digital financial usage among the middle-class wealthy has become more active since the outbreak of COVID-19.

44.3% of survey participants answered that their use of digital finance increased after the COVID-19 outbreak. The proportion of users experienced in non-face-to-face asset management channels such as internet and mobile applications rose sharply from 11.0% last year to 56.5% this year.

More than 9 out of 10 respondents, 95.1%, use financial apps, and 73.8% use online channels for financial transactions. Additionally, the most needed mobile asset management feature for the middle-class wealthy was found to be "personalized product recommendations."

Open banking users accounted for 35.0%, and banks (86.6%) were mainly used rather than fintech companies. Furthermore, 88.6% of respondents said they intend to use personal credit information management services (MyData) once they start.

Regarding the most anticipated digital financial services in the future, 27.8% of respondents chose KakaoBank, and 13.4% chose Naver.

The factors that most significantly affect trust in financial companies' asset management services were identified as staff expertise and the sale of high-quality financial products.

The report advised, "The trend of increasing financial assets among the middle-class wealthy and their high digital financial utilization are opportunities for asset management business," adding, "Financial companies should strive to enhance the quality of digital-based customized asset management services and improve trust through highly professional personnel and excellent financial products to capitalize on this opportunity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.