Psychological Resistance Level of 1100 Won Broken, Sharp Decline

Small and Medium Export Companies Inevitably Hit

Foreign Exchange Authorities on Alert... Likely to Respond to Sharp Volatility

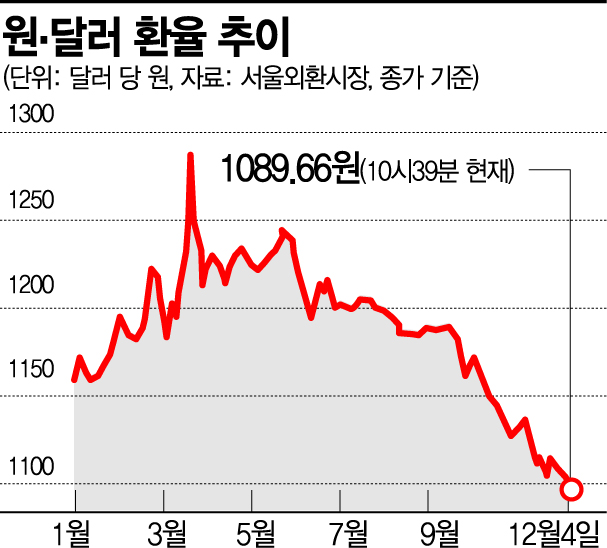

[Asia Economy Reporter Kim Eun-byeol] The won-dollar exchange rate has begun to fall below the psychological resistance level of 1,100 won. After breaking through the 1,100 won mark, the exchange rate dropped further to the 1,080 won range within a day.

Export companies and foreign exchange authorities are on high alert due to the steeper-than-expected decline in the exchange rate. So far, the foreign exchange authorities have taken the stance that they have no choice but to tolerate the won's strength for the time being. Considering ▲the weak dollar ▲preference for risk assets ▲South Korea's favorable economic indicators, the trend of won appreciation is an unavoidable factor. However, they cannot just watch the sharp decline in the exchange rate passively, so they are cautiously monitoring the market. A rapid drop in the exchange rate inevitably impacts export companies, especially small and medium-sized enterprises (SMEs) that find hedging difficult.

The market expects the weak dollar trend to continue for the time being, and with domestic stock prices hitting new highs daily, the won's strength is expected to persist. Although the foreign exchange authorities will take some measures, it seems difficult to change the overall trend. Experts predict that the won-dollar exchange rate will fall to the previous low level of around 1,050 won.

Won-Dollar Exchange Rate Plummets Nearly 15 Won in One Day

On the 4th, the won-dollar exchange rate barely held the 1,080 won level at closing. Following the breach of the 1,100 won level on the 3rd, it plunged nearly 15 won further to close at 1,082.1 won in just one day. This marks the fourth consecutive day of decline. It is also the lowest level in two and a half years since mid-June 2018, when it recorded 1,083.10 won.

In March of this year, when the novel coronavirus infection (COVID-19) was rapidly spreading, the won-dollar exchange rate surged sharply, raising concerns. On March 19, the won-dollar exchange rate peaked at 1,285.73 won, the highest point of the year. There were even forecasts that it would surpass the 1,300 won mark. This was due to increased demand for dollars worldwide amid COVID-19 uncertainties, which raised the dollar's value. At that time, the dollar index, which reflects the dollar's value against six major currencies, rose to 102.82.

However, as the U.S. Federal Reserve (Fed) entered into currency swap agreements with various countries and continued to implement monetary easing measures, the dollar consistently weakened. The Fed lowered the benchmark interest rate to zero (0) percent and pursued economic stimulus policies. In this liquidity-rich environment, news of the development of a COVID-19 vaccine caused global investment funds to rapidly flow into risk assets. With expectations of economic recovery, investment attractiveness in emerging stock markets increased over safe assets like the dollar and government bonds. In particular, South Korea saw foreign capital inflows as its economic growth rate recovered relatively quickly from the COVID-19 shock, and exports performed well.

Export Companies Still Tense Despite Reduced Exchange Rate Impact

Export companies remain on edge as the exchange rate has reached levels they consider a red line. According to the Korea International Trade Association, SMEs consider a won-dollar exchange rate of 1,100 won, and large corporations consider 1,000 won as the threshold for tolerable exchange losses.

There are several reasons why SMEs are more affected by exchange rate fluctuations. First, large corporations have overseas subsidiaries that can produce and sell products abroad directly, and they have the capacity to hold export proceeds in dollars without converting them. As of September, the proportion of duty-free exports (exports from overseas production bases without passing through Korea) was about 14%. Hedging to avoid risks from exchange rate fluctuations is also more active among large corporations. SMEs often urgently need to secure won and must convert export proceeds despite incurring exchange losses.

However, a positive factor is that Korean companies' export items no longer compete solely on price. This means that the era when overseas consumers bought Korean TVs and smartphones because they were cheap is over, so even if the won strengthens, it is unlikely that overseas consumers will reduce purchases of Korean products. Whereas Japan used to be Korea's main competitor, nowadays it is Chinese companies, which is another reason why won appreciation is not necessarily disadvantageous. The yen and won often move inversely, but the won and yuan tend to move in tandem.

Hong Nam-ki, Deputy Prime Minister and Minister of Economy and Finance (left), and Lee Ju-yeol, Governor of the Bank of Korea [Image source=Yonhap News]

Hong Nam-ki, Deputy Prime Minister and Minister of Economy and Finance (left), and Lee Ju-yeol, Governor of the Bank of Korea [Image source=Yonhap News]

Foreign Exchange Authorities Warn of Sharp Fluctuations... Monitoring the Market

The government takes the position that it must tolerate a certain degree of won appreciation against the dollar. However, it is paying close attention to sharp exchange rate volatility. If the exchange rate falls beyond the expected range, corporate hedging could become ineffective.

Foreign exchange authorities have emphasized market stability whenever the exchange rate drops sharply. Since mid-last month, officials have repeatedly engaged in 'verbal intervention.' On the 19th of last month, Deputy Prime Minister and Minister of Strategy and Finance Hong Nam-ki said, "Excessive exchange rate fluctuations are never desirable," and "We will actively respond at any time to stabilize the market." On the 26th of last month, Bank of Korea Governor Lee Ju-yeol stated that he is closely monitoring the recent downward pressure on the exchange rate. Although verbal interventions temporarily defended against short-term exchange rate declines, the rate soon fell again.

The foreign exchange authorities believe that the recent decline in the exchange rate is driven more by external conditions than internal Korean issues, so they have no choice but to tolerate it to some extent. The biggest reason for the recent exchange rate decline is the continued weakness of the dollar. The dollar index, which was above 102 in March, has fallen below 91.0, the lowest level this year.

The market expects the foreign exchange authorities to increase the intensity of verbal interventions and strengthen 'smoothing operations' to slow the exchange rate decline. However, due to concerns about being designated a currency manipulator by the U.S., the authorities find it difficult to intervene indiscriminately in the foreign exchange market. Currently, South Korea is designated as a monitoring country, a step before being labeled a currency manipulator by the U.S. Treasury Department, and designation as a currency manipulator could lead to U.S. sanctions.

Gong Dong-rak, a researcher at Daishin Securities, said, "The fact that South Korean exports turned positive in November, raising expectations for trade normalization, and the anticipation of economic normalization following COVID-19 vaccine development have expanded preference for risk assets," adding, "China's government's push for yuan internationalization and the yuan's value revaluation also support won appreciation." He predicted, "This trend is expected to continue until the first half of next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)