DRAM Spot Prices Rebound Successfully After One and a Half Months

[Asia Economy Reporter Changhwan Lee] DRAM spot prices have successfully rebounded for the first time in a while, leading to assessments that memory semiconductor prices have hit bottom. It is expected that memory semiconductor prices will bottom out by the end of the year and show a clear upward trend in the first half of next year, which is anticipated to significantly improve the profits of domestic semiconductor companies such as Samsung Electronics and SK Hynix.

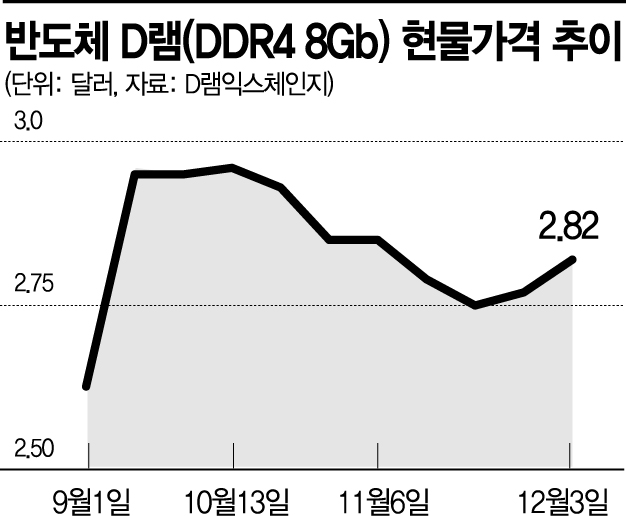

According to market research firm DRAMeXchange on the 4th, the DRAM (DDR4 8Gb) spot price was $2.82, up 1.5% from the previous trading day. DRAM spot prices recorded an increase for two consecutive days, rising 0.14% on the 2nd.

This is the first time DRAM prices have risen in about a month and a half since mid-October. DRAM prices had been weak throughout the second half of the year due to inventory accumulation by major buyers such as server companies. However, in September, semiconductor prices temporarily rose due to concentrated purchases by Huawei, which was stockpiling semiconductors amid U.S. sanctions.

The fixed price of DRAM, which serves as a benchmark for semiconductor transactions by Korean companies, has also stopped declining. The average fixed price of DDR4 8Gb DRAM last month was $2.85, the same as in October. The fixed price had maintained $3.13 for three consecutive months until September after falling 5.44% month-on-month in July, before plunging into the $2 range in October.

With DRAM prices no longer falling and showing signs of rebound, forecasts suggest that the price increase will become more pronounced early next year. DRAMeXchange stated that a full-scale DRAM price increase is expected to begin in the second quarter of next year, with double-digit price increases anticipated each quarter.

Hyunwoo Do, a researcher at NH Investment & Securities, explained, "Considering that spot prices usually lead fixed prices by about three months, expectations for improved DRAM supply and demand are high next year."

Although semiconductor prices remain weak, the clear improvement in demand also supports the outlook for future semiconductor price increases. The World Semiconductor Trade Statistics (WSTS) forecasts that the global semiconductor market sales will increase by 8.4% next year to reach $469.43 billion (approximately 520 trillion KRW).

Memory semiconductors are also predicted to grow by 13.3% compared to this year. Samsung Electronics recently stated at an investor forum that "DRAM demand is expected to grow by 15-20% annually until 2024, and NAND by 30-35%."

Accordingly, there are expectations that the profit improvement of Korean semiconductor companies such as Samsung Electronics and SK Hynix will be significant next year. A semiconductor industry official said, "There are various momentum factors that can boost semiconductor companies' performance next year, such as increased untact demand, DDR5, and NAND high-density development," adding, "Some even believe that a semiconductor supercycle may return."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.