Partial Amendment to Customs Act Passed

Patent Fees Reduced for Business Losses Due to Disasters

This Year's Duty-Free Shop Patent Fees 75 Billion Won

Industry: "Double Taxation, Revision of Calculation Method Needed"

Incheon Airport Duty-Free Shops Struggle Over Fixed Rent Policy

Individual Brand Exits Continue

Measures Needed Such as Extension of Third-Party Returns

On the 18th, the duty-free shop at Terminal 1 of Incheon International Airport was quiet due to the impact of the novel coronavirus (COVID-19). Photo by Mun Ho-nam munonam@

On the 18th, the duty-free shop at Terminal 1 of Incheon International Airport was quiet due to the impact of the novel coronavirus (COVID-19). Photo by Mun Ho-nam munonam@

[Asia Economy Reporter Seungjin Lee] The National Assembly passed the 'Partial Amendment to the Customs Act' as originally proposed, allowing the duty-free industry, which was hit hard by the COVID-19 pandemic, to receive partial reductions on patent fees amounting to hundreds of billions of won. However, the duty-free industry still maintains that the measures are "insufficient," drawing attention.

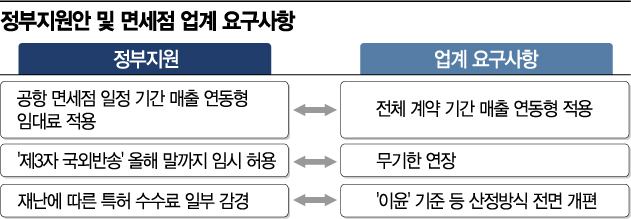

On the 4th, the duty-free industry welcomed the reduction in patent fees. However, since the industry is facing an existential crisis due to the COVID-19 situation, they urged for more proactive measures. They raised their voices for support in practical market development, such as extending the 'third-party return' system, which is set to expire at the end of this month.

Sighs Despite Patent Fee Reduction Approval

The amendment passed by the National Assembly on the 2nd included a clause allowing for a reduction in patent fees for a certain period if significant business losses occur due to a disaster. Patent fees are imposed by the government on duty-free operators in exchange for granting exclusive rights, for purposes such as administrative and management cost collection and social return of reduced taxes.

The patent fee rate was 0.05% of sales in 2016 but was raised to between 0.1% and 1.0% following the revision of the Customs Act Enforcement Rules in 2017. Last year, the duty-free industry paid patent fees amounting to 102.9 billion won. Although the government recently changed the basis for calculating patent fees from 'customs declaration sales' to 'corporate accounting sales,' reducing the scale of patent fee payments, the industry still has to pay about 75 billion won this year. Since April, duty-free sales had been gradually increasing but sharply declined again after October due to tightened regulations by the Chinese government, which reduced the visits of daigou (personal shoppers).

The duty-free industry insists that a review of the calculation method is necessary rather than a temporary reduction in patent fees. They argue that paying patent fees as a means of profit recovery, while already paying corporate tax on duty-free profits, constitutes "double taxation." An industry official said, "In countries like the United States and Japan, duty-free patent fees are considered a kind of 'stamp tax,' often replaced by a fixed deposit. Given the industry's nature of competing globally rather than domestically, spending hundreds of billions of won annually in additional costs could lead to weakened industrial competitiveness."

"Government Support Is Ineffective"

Despite the government presenting several support plans for the duty-free industry, the sector is currently on the brink of collapse. Six duty-free zones at Incheon Airport Terminal 1 (T1) failed to attract bids in three rounds of auctions, and even recent private contracts fell through. The insistence on the existing fixed rent system, despite a 90% drop in arrivals and departures due to COVID-19, has been a stumbling block.

The duty-free industry argues that, given the uncertainty of when the COVID-19 situation will end, the entire contract period should switch from the fixed rent system to a sales-linked rent system, but the gap in positions with the government remains wide.

The industry is gradually withering away. City Duty Free and SM Duty Free have given up their Incheon Airport duty-free stores. Lotte and Shilla Duty Free have temporarily extended their contracts until February next year, but the situation after February is uncertain. Recently, individual brand exits have also been increasing. Following the departure of food and beverage companies, the overseas luxury brand Montblanc also exited the Incheon Airport store on the 30th of last month.

The duty-free industry insists on the need for practical market development measures such as an indefinite extension of the third-party return system, which is temporarily allowed until the end of this year. The third-party return system allows overseas duty-free operators to send duty-free goods, which have completed customs declaration, to desired locations. An industry official said, "This year, third-party returns raised sales from 10 to 50 billion won from a previous 100 billion won, but if this ends next year, we will inevitably be pushed back to the edge of a cliff."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.