Steady Recovery of the Stock Market Since COVID-19 Pandemic

[Asia Economy Reporter Minji Lee] Asset management companies are showing an increase in net profits amid an unprecedented bull market. By the end of the third quarter, domestic asset management companies earned a net profit of 459 billion KRW, setting a record high. Assets under management reached 1,194.2 trillion KRW, marking a 0.6% (6.7 trillion KRW) increase compared to the end of the previous quarter.

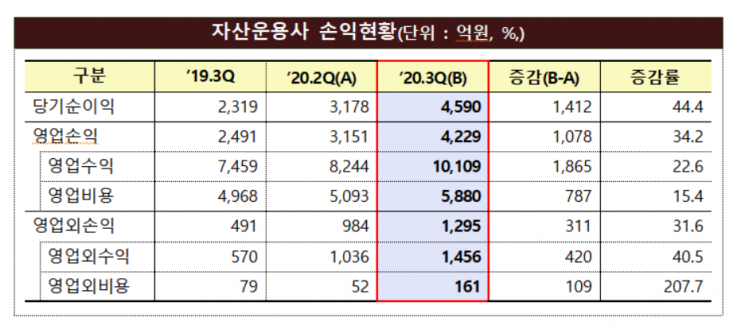

According to the "2020 Q3 Asset Management Company Business Performance (Preliminary)" report released by the Financial Supervisory Service on the 2nd, domestic asset management companies recorded a net profit of 459 billion KRW as of the end of September, achieving an all-time high. This represents a 44.4% (141.2 billion KRW) increase from the previous quarter and a 97.9% (227.1 billion KRW) increase compared to the same period last year.

As of the end of the third quarter, fund custody assets stood at 689.3 trillion KRW, up 1.1% (7.5 trillion KRW) from the end of June. Although public funds decreased by 500 billion KRW compared to the previous quarter, private fund assets increased by a total of 8 trillion KRW, mainly in special assets (4.5 trillion KRW) and bond-type funds (3.1 trillion KRW). Discretionary investment contracts amounted to 503.9 trillion KRW, down 80 billion KRW (0.2%). Approximately 2.3 trillion KRW and 400 billion KRW were withdrawn from equity and derivative funds, respectively.

By sector, fee income totaled 794.2 billion KRW, increasing 16.7% (113.7 billion KRW) from the previous quarter due to growth in assets under management and performance fees, and rose 18.2% compared to one year ago. Selling and administrative expenses were 461.9 billion KRW, up about 8.1% from the previous quarter and 16.1% (64 billion KRW) from the same period last year.

Gains and losses from securities investments, including proprietary asset management, amounted to 156.1 billion KRW, increasing 67.4% (62.8 billion KRW) from the previous quarter. This is attributed to the steady recovery of the stock market since April following the slump caused by the COVID-19 pandemic.

By company, the number of asset management firms totaled 324 as of the end of the third quarter, an increase of 15 companies from the end of June. All of these were specialized private asset management firms. Among the 324 companies, 238 recorded profits while 86 posted losses. The ratio of loss-making companies was 26.5% of the total, down 11.7 percentage points from 38.2% in the previous quarter. The total number of employees was 10,442, a 3.4% (345 persons) increase from the previous quarter.

The Financial Supervisory Service stated, "The asset management industry is generally stable, with a significant decrease in the proportion of loss-making companies due to improved profitability. Considering that a resurgence of COVID-19 and a slowdown in economic recovery could pose risk factors to the domestic stock market, we plan to continue monitoring asset management companies and the fund market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.