[Asia Economy Reporter Koh Hyung-kwang] Pension funds, major players in the stock market, have reportedly dumped over 6 trillion KRW worth of stocks in the KOSPI market over the past six months. Analysts suggest that as the domestic stock allocation exceeded the annual target, they engaged in mechanical selling in line with their asset allocation policy. Experts predict that the pension funds' stock selling trend will continue until the end of the year, having already achieved their target returns.

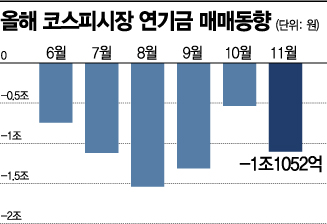

According to the Korea Exchange on the 1st, pension funds including the National Pension Service (NPS) net sold 1.1052 trillion KRW in the KOSPI market last month. Following sales of 743.4 billion KRW in June, they sold 1.1197 trillion KRW in July, 1.541 trillion KRW in August, 1.3153 trillion KRW in September, 534.8 billion KRW in October, and 1.1052 trillion KRW last month, maintaining a selling trend over the recent six months. The total sales volume during this period amounted to 6.3594 trillion KRW, averaging about 1.06 trillion KRW sold monthly. This contrasts with the period from January to May this year, when they continued a net buying streak, purchasing a total of 5.3574 trillion KRW monthly.

Experts believe that pension funds started selling to adjust their domestic stock allocation to the target ratio. According to the fund management plan of the National Pension Service, the "big brother" of pension funds, the target domestic stock ratio for this year is set at 17.3%. However, due to the sharp rise in the stock market, this target was already exceeded in the first half of the year. Song Seung-yeon, a researcher at Korea Investment & Securities, explained, "Since the market bottom in March, the stock market rebounded sharply, causing the domestic stock ratio within pension fund portfolios to exceed the annual target. When the price of a specific asset rises significantly, selling the excess portion during portfolio rebalancing is inevitable."

Over the past six months, the stock most heavily net sold by pension funds was Samsung Electronics. From June to last month, they sold a total of 1.5956 trillion KRW worth of Samsung Electronics shares. During this period, Samsung Electronics' stock price rose 31.5%, from 50,700 KRW to 66,700 KRW. Having earned high returns, they realized gains by selling the shares. Besides Samsung Electronics, pension funds also sold large amounts of BBIG (Bio, Battery, Internet, Game) related stocks that led the domestic market this year and saw significant price increases, including Naver (653.2 billion KRW), LG Chem (566.5 billion KRW), and Kakao (376.1 billion KRW).

It is expected that the pension funds' selling trend will likely continue this month as well. As of the end of September, the National Pension Service's domestic stock holdings amounted to 143.949 trillion KRW, accounting for 18.3% of its total assets of 785.408 trillion KRW. Based on the end of September figures, it is estimated that about 7.85 trillion KRW more needs to be sold to meet the year-end target of 17.3%. Kim Sung-no, a researcher at BNK Investment & Securities, explained, "Due to the recent index rise, the pension funds' stock allocation ratio has become significantly higher than the target, making it highly likely that the selling trend will continue until the end of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.