More Transactions in Townhouses and Multi-family Homes than Seoul Apartments

Unusual Reversal Phenomenon... As Apartments Rise, Buyers Turn to Villas

Townhouse Price Increase Rate Hits Highest in 14 Years

[Asia Economy Reporter Moon Jiwon] Despite the government's successive regulations, apartment sale and jeonse prices continue to rise, leading to a surge in transaction volumes and soaring sale prices even in row houses and multi-family housing, which had previously shown stability. Concerns are emerging that government policies aimed at stabilizing the real estate market have only raised the barriers for ordinary citizens to own their own homes.

According to the Seoul Real Estate Information Plaza on the 30th, the number of multi-family and row house sales in Seoul last month totaled 4,591 transactions, a 14.4% increase compared to 4,012 transactions in the previous month. While the transaction volume for multi-family and row houses remained below 5,000 from January to May, it surged to 7,287 in July, marking the highest level in 12 years and 3 months since April 2008 (7,686 transactions). Even amid a deepening 'transaction cliff' thereafter, the volume has remained relatively high.

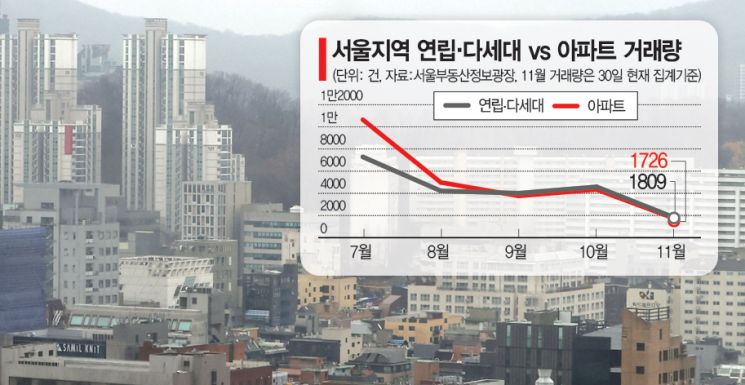

The phenomenon of multi-family and row house transaction volumes surpassing apartment transactions is also becoming entrenched. This year, from January to August, apartment transaction volumes were higher than those of row houses and multi-family homes except in April. However, in September, multi-family and row house transactions reached 4,012, surpassing apartment transactions at 3,767, and last month, they again exceeded apartments with 4,591 versus 4,339. Although this month's data is not yet complete, as of this date, multi-family and row houses have 1,809 transactions compared to apartments' 1,726.

Along with the increase in transaction volume, sale prices are also rising. According to KB Kookmin Bank's Real Estate Live On November Housing Price Trend Survey, the sale price of row houses in Seoul rose 2.13% compared to the previous month. This is the largest monthly increase in about 14 years since December 2006 (2.27%).

Row houses typically have less demand for sales compared to apartments, which usually see larger price increases. However, after the new lease laws, including the rent ceiling system and the right to request contract renewal, were implemented at the end of July, excessive rises in apartment jeonse and sale prices have led many buyers to turn their attention to villas.

In fact, the sale price increase rate for row houses dropped to 0.05% in May but rose to 0.67% in July, then continued to grow monthly, reaching 1.10% last month and surpassing 2% this month.

The reason the villa sales market is gaining momentum is due to 'panic buying' among tenants exhausted by rising jeonse prices. With apartment sale and jeonse prices soaring even in outer districts of Seoul such as Geumcheon, Nowon, and Dobong-gu, some low-income residents with nowhere else to turn are purchasing villas, according to analyses.

Unlike apartments, villas face fewer regulations, making investment easier and contributing to price increases. The government previously restricted jeonse loan financing for apartments priced over 300 million KRW in regulated areas through the June 17 measures, but villas were not subject to these restrictions, allowing 'gap investment' using jeonse loans to continue. Additionally, non-apartment properties such as villas and multi-family houses maintain the housing rental business registration system, making it easier to invest with tax benefits and other incentives.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.