Beyond Simple Financial Support

Promotion, Market Development, Global Expansion Support, Discovering New Services Through Collaboration

Pursuing Partnership with Startups

[Asia Economy Reporter Park Sun-mi] Competition among banks to nurture and invest in startups is fierce. The atmosphere is shifting towards accompanying startups not only through simple financial support but also by promoting them, helping them find sales channels, supporting global expansion, and discovering new services through collaboration.

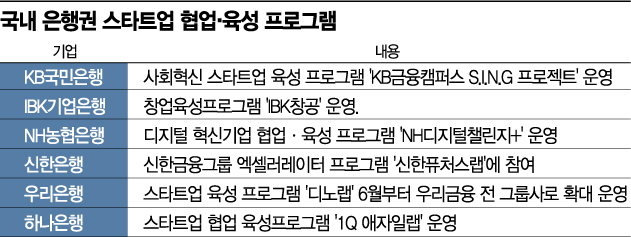

According to the financial sector on the 30th, most major domestic banks operate startup nurturing and investment programs. KB Kookmin Bank runs the social innovation startup nurturing program 'KB Financial Campus S.I.N.G Project,' providing education and coaching programs for social innovation startups in their third year or beyond. Recruitment for the second term has been completed. Outstanding companies are given the opportunity to participate and collaborate in KB Financial's fintech lab (financial technology research institute), the 'KB Innovation Hub.'

IBK Industrial Bank operates the startup nurturing program 'IBK Changgong,' having nurtured a total of 243 innovative startup companies. It has provided over 160 billion KRW in financial support and more than 3,000 instances of non-financial support. On the 3rd of next month, IBK will also hold an online demo day for the startup nurturing program IBK Changgong, which offers financial and non-financial services such as investment, consulting, and office space to startups. The strategy includes attracting overseas venture capital (VC) to support not only startup funding but also promotion and sales channel development.

NH Nonghyup Bank operates the digital innovation company collaboration and nurturing program 'NH Digital Challenge Plus' within its digital innovation campus located in Seocho-gu. The strategy is to provide customized programs and management consulting according to the startup growth stage, having selected 132 companies so far.

Shinhan Bank participates in Shinhan Financial Group's accelerator program 'Shinhan Futures Lab.' It has nurtured 195 companies and invested 31.1 billion KRW. Woori Bank's startup nurturing program 'Dino Lab' has been expanded to all group companies since June. The direction is to create cooperative outcomes between five group companies and Dino Lab resident companies.

Hana Bank operates the startup collaboration nurturing program 'OneQ Agile Lab,' having discovered and nurtured a total of 90 startups and creating various successful collaboration cases. Selected companies can gain opportunities to review business commercialization in collaboration with Hana Bank and can move into a dedicated space for attracting global fintech startups.

A Plus Factor That Can Create Synergy in Digital Transformation

Establishing Collaboration Systems to Launch New Digital Services

Banks have the advantage of many customer touchpoints, enabling direct support for startup promotion and sales channel development. They can also secure overseas expansion routes for domestically nurtured startups through overseas bank branches. Startup nurturing is a plus factor that can create synergy in the banking sector's digital transformation. The background lies in forming collaboration systems with startups discovered by banks to launch new digital services.

Startup support not only aligns with the government's Korean New Deal policy, specifically the Digital New Deal, but also can create synergy in digital transformation movements through collaboration with supported startups. Therefore, the competitive atmosphere in startup support among banks is expected to continue for the time being. The state-run Korea Development Bank also announced plans this month to invest 100 billion KRW by 2025 to foster startups based on science and technology.

A bank official said, "The world's largest super-large startup support and nurturing space 'Front1,' which opened in July this year, is operated by D.CAMP, the Bank Foundation for Youth Entrepreneurship established by financial institutions belonging to the Korea Federation of Banks, receiving full support from the banking sector," adding, "Financial Services Commission Chairman Eun Sung-soo emphasized at the end of last month that 'the government will become a Sherpa to help startups climb and guide their path,' making startup nurturing one of the hot topics in the financial industry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.