5 Million Won Bill Recovery Rate at 25.4% from January to October... Lowest Since 2009 Issuance

Sharp Decline in 5 Million Won Bill Circulation Through Lodging, Food, and Leisure Industries

Increased Demand for Cash Holdings Amid Growing Uncertainty

[Asia Economy Reporter Eunbyeol Kim] # Around last month's Chuseok holiday, a 'shortage' of 50,000 won bills occurred at commercial banks. ATMs displayed notices requesting customers to withdraw 10,000 won bills whenever possible. Customers trying to get new bills had to visit multiple banks to withdraw 50,000 won bills or settle for 10,000 won bills. An employee at a commercial bank went to a nearby branch to borrow 50,000 won bills. Since the customer was a VIP at that branch, they had no choice but to provide 50,000 won bills, but the branch had run out of them. Some bank branches even set limits on the number of 50,000 won bills that could be withdrawn per person.

The most valuable currency in South Korea, the 50,000 won bill, is disappearing more and more. Many people want 50,000 won bills, but once issued, they are not returning. This year, the redemption rate of 50,000 won bills (the ratio of redeemed amount to issued amount) has dropped to the lowest level since their issuance.

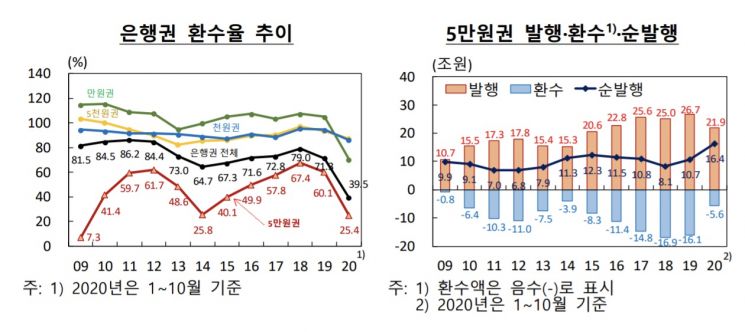

According to the Bank of Korea on the 30th, the redemption rate of 50,000 won bills from January to October this year was 25.4%, the lowest since the first issuance of the 50,000 won bill in June 2009. Although 21.9 trillion won was issued, only 5.6 trillion won worth of 50,000 won bills returned to the Bank of Korea. While it is natural for cash demand to increase during crises, this time the drop in redemption rate was particularly large. In the past, both issuance and redemption of high-denomination bills decreased, but after the COVID-19 pandemic, issuance increased while redemption sharply declined. During the 1998 foreign exchange crisis, the redemption rate of the high-denomination 10,000 won bill was 107.1%, up 6.5 percentage points from the previous year, and during the 2008 financial crisis, it was 95.1%, down only 0.8 percentage points from the previous year.

The Bank of Korea cited ▲a sharp decline in face-to-face transactions and ▲cash demand for uncertainty as main reasons. Above all, due to the nature of the infectious disease COVID-19, face-to-face commercial activities in sectors with a high proportion of self-employed workers such as food service, accommodation, and leisure services greatly decreased. The Bank of Korea estimated the circulation channels of 50,000 won bills and found that the cash acquisition ratio in sales of food and accommodation businesses was 18.6%, higher than manufacturing (2.2%) and construction (0.9%). Although credit card payments increased, self-employed people in food and accommodation still earn a large portion of their income in cash, which was hit hard. Deposits of 50,000 won bills at duty-free shops, casinos, tourist area stores, currency exchange operators, and ATMs also significantly decreased. On the other hand, the proportion of cash spending by workers in these industries (food and accommodation 11%, leisure services 7.8%) was lower than their sales proportion. Ultimately, the 50,000 won bills earned through self-employed workers also sharply declined, and those self-employed people saved or stored the cash in banks.

Increased precautionary demand due to uncertainty was also a cause of the sharp drop in the 50,000 won bill redemption rate. The Bank of Korea reported that before and after COVID-19, issuance of 50,000 won bills through financial institutions decreased by 8.8% at the top three banks where issuance was usually frequent, while issuance at other commercial banks increased by 25%. Demand for 50,000 won bills used for transactions in rural and local industrial complexes decreased, while precautionary demand to hold cash increased. Ok Ji-hoon, head of the Bank of Korea's Currency Issuance Planning Team, said, "The redemption rate of 50,000 won bills has decreased due to the negative economic shock, but it is expected to rise again once COVID-19 subsides," adding, "We plan to significantly increase the order volume from the Korea Minting and Security Printing Corporation in 2021 compared to 2020."

The phenomenon of a sharp decline in high-denomination bill redemption rates has also been common in other countries. From January to October, the redemption rate of high-denomination bills of 100 euros or more in the Eurozone (19 countries using the euro) was 76.7%, down from 96.0% during the same period last year. The problem is that compared to major countries, South Korea's 50,000 won bill redemption rate is even lower, but the Bank of Korea cited that the 50,000 won bill is still in its 'growth phase.' The Bank of Korea assessed that the possibility of the missing 50,000 won bills flowing into the underground economy is low. Ok said, "It is more due to the economic shock rather than a structural problem." The Bank of Korea stated that if the economic situation does not improve significantly, it will print more bills to meet the increasing demand for 50,000 won bills for the time being and monitor to prevent supply instability.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.