Gu Bon-jun, LG Advisor, Plans Independence from LG Group

Advisor Gu Expected to Take LG Sangsa, Silicon Works, LG Hausys, LG MMA, Pantos, and Others

[Asia Economy Reporter Changhwan Lee] As LG Group moves forward with the independence of Honorary Chairman Koo Bon-joon, interest is growing regarding the method and schedule of the upcoming affiliate split. It is expected that Honorary Chairman Koo will pursue independence by swapping his shares of LG Corporation for shares in the newly established company.

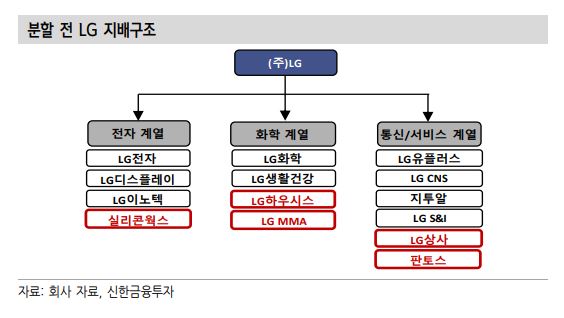

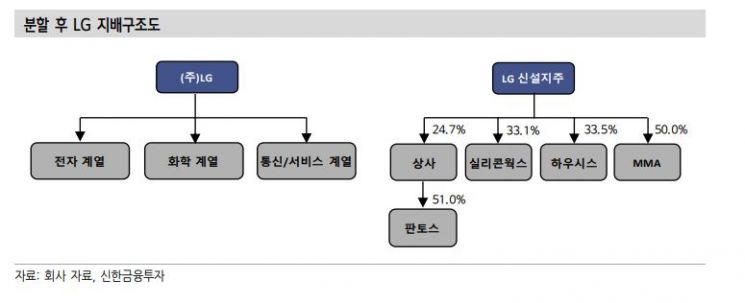

According to LG Group on the 29th, LG Corporation, the holding company, held a board meeting on the 26th and resolved a split plan to separate the investment divisions of four subsidiaries?LG International, Silicon Works, LG Hausys, and LG MMA?from the 13 subsidiaries under LG Corporation, and establish a new holding company tentatively named ‘LG New Holding Corporation.’

The plan is for ‘LG New Holding Corporation (tentative)’ to incorporate these four companies as subsidiaries and include Pantos, under LG International, as a wholly owned subsidiary. ‘LG New Holding Corporation (tentative)’ will operate under an independent management system led by Honorary Chairman Koo Bon-joon and a new board of directors.

LG Corporation plans to reorganize into two holding companies?the existing LG Corporation and the newly established ‘LG New Holding Corporation (tentative)’?effective May 1, following approval of the company split at the regular shareholders' meeting on March 26, 2021. Honorary Chairman Koo is expected to separate ownership by exchanging his LG Corporation shares for shares in LG New Holding Corporation (tentative).

Kim Su-hyun, a researcher at Shinhan Financial Investment, said, "Similar to the past affiliate split with GS Group, this personnel split can be interpreted as a separation between LG Corporation, led by Chairman Koo Kwang-mo, which is based on electronics, chemicals, and telecommunications, and the affiliate led by current Honorary Chairman Koo Bon-joon, which includes trading (Pantos), Hausys, Silicon Works, and MMA." He added, "Therefore, after the split date on May 1 next year, a share swap between the surviving company led by Chairman Koo Kwang-mo and the newly established company led by Honorary Chairman Koo Bon-joon is expected."

Split ratio: LG Corporation 0.915, New holding company 0.088

This split will be carried out as a personnel split of the investment divisions of LG Corporation’s subsidiaries, including listed subsidiaries LG International, Silicon Works, LG Hausys, and unlisted subsidiary LG MMA, so that both the surviving and newly established holding companies can maintain the current holding and listed company structure.

The split ratio is based on the net asset book value on the separate financial statements of the surviving and new holding companies: LG Corporation 0.9115879, new holding company 0.0884121.

Accordingly, upon completion of the split procedure on May 1 next year, shareholders holding 100 shares of LG Corporation will receive 91 shares of LG Corporation and 44 shares of the new holding company, which has set its par value at 1,000 KRW to meet the re-listing stock number requirements. Fractional shares will be converted to cash based on the closing price on the first day of re-listing. The shareholder composition of the surviving and new companies will remain the same before and after the split.

After the split, the surviving company LG Corporation will have a total of 160,322,613 shares issued, assets of 9.7798 trillion KRW, capital of 9.3889 trillion KRW, liabilities of 390.9 billion KRW, and a debt ratio of 4.2%. The new holding company will maintain a financial structure with 77,745,975 shares issued, assets of 913.3 billion KRW, capital of 910.8 billion KRW, liabilities of 2.5 billion KRW, and a debt ratio of 0.3%.

While the split event itself is not expected to have a significant impact on LG Corporation’s corporate value, if the two holding companies enhance efficiency and business competitiveness through independent and responsible management after the split, it could lead to an increase in corporate value.

Yang Ji-hwan, a researcher at Daishin Securities, said, "After the split, Chairman Koo Kwang-mo will hold approximately 26,096,700 shares of LG Corporation and 12,170,000 shares of LG New Holding Corporation, while Honorary Chairman Koo Bon-joon will hold 12,140,000 shares of LG Corporation and 5,887,100 shares of LG New Holding Corporation, with no change in shareholding ratios." He added, "Following the split re-listing and new listing, the affiliate separation process for independent and responsible management will be completed soon through a share swap."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)