Due to COVID-19 Impact, Both Hair Salon Startups and Sales Are Declining

Franchises Are Growing

[Asia Economy Reporter Park Sun-mi] Hair salons are a representative oversupplied industry, with 67% of businesses having annual sales of less than 50 million KRW. Due to the impact of COVID-19, the number of hair salon startups decreased by 15.6% compared to the previous year, and sales are also on a declining trend.

According to the sixth series of the self-employment analysis report "Status and Market Conditions of Hair Salons" published by KB Financial Group on the 29th, there are approximately 110,000 hair salons in South Korea. It was found that about 21.3 hair salons operate per 10,000 people. In the United States, there are 2 hair salons per 10,000 people, whereas in South Korea, the number is 21.3, more than 10 times higher.

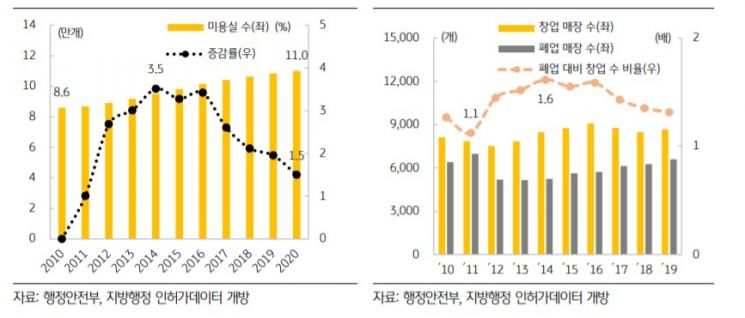

The startup rate of hair salons has decreased by about 1.0 percentage point from 9.2% to 8.2% over the past five years, while the closure rate has increased by 0.3 percentage points from 5.9% to 6.2%, indicating that closures are progressing slightly faster than startups. The hairdressing industry shows a lower startup rate (8.2%) compared to other industries, which is mainly analyzed as being due to severe competition within the industry as a representative oversupplied sector, making it difficult to enter easily.

Hair salons are one of the industries hit hard by COVID-19.

From January to September 2019, 6,610 hair salons were started, but from January to September 2020, the number of startups decreased by 15.6% compared to the previous year, recording 5,577, showing that the number of hair salon startups declined due to the impact of COVID-19.

Sales also decreased. Looking at the monthly sales status over the past year in Ingye-dong, Suwon-si, Gyeonggi-do, where many hair salons are concentrated, sales sharply dropped in March when the first major wave began, and after the increase in confirmed cases originating from Itaewon in May, sales continued to decline. From August, when the second wave started, the sales decline became even more significant. Since delaying a haircut by a month or two does not greatly affect daily life, many people tend to avoid visiting hair salons when COVID-19 cases increase.

The hairdressing industry trend is also rapidly changing. Previously, many opened their own businesses after gaining experience in hairdressing services, but recently, with the development of franchise hair salons, there is a growing trend to gain experience and grow within the company's system instead of starting a business independently.

Hair salons with annual sales of less than 50 million KRW number 78,852, accounting for 67.0% of all hair salons. On the other hand, as franchise hair salons increase, those with annual sales exceeding 500 million KRW number 2,780, accounting for 2.4% of all hair salons, which is a significant increase compared to 1.6% in 2016 and 1.9% in 2017.

Oh Sang-yeop, a researcher at KB Financial Group's Management Research Institute, explained, "Hair salons are a representative oversupplied industry, and competition within the industry is intensifying, leading to a decreasing startup rate," adding, "The short-term impact on hair salons due to the spread of COVID-19 is inevitable." He continued, "However, it is expected that the hairdressing industry will recover to pre-COVID-19 levels as the pandemic subsides. In particular, franchise businesses are expected to continuously expand and grow based on management guidance from franchise headquarters, human and material support, and securing excellent personnel by utilizing brand awareness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.